New pension plan for military, uniformed personnel must be based on good governance principles

Establishing a new pension plan for military and other uniformed personnel has triggered extensive debates since the administration’s economic team proposed that henceforth, the intended beneficiaries will be made to contribute to a retirement fund.

The Armed Forces of the Philippines – Retirement and Separation Benefits System (AFP-RSBS) was established through Presidential Decree No. 361 in 1973 “to provide a self-reliant funding scheme and continuous financial support to the AFP retirement system.” In 2003, the Feliciano Commission tasked to analyze the root causes of the Oakwood mutiny, cited the apparent mismanagement of the AFP-RSBS was a major cause of disgruntlement.

Then President Gloria Macapagal-Arroyo issued Executive Order (EO) No. 590 (series of 2006) and EO No. 590-A (series of 2007) mandating the deactivation of AFP-RSBS, including its winding down and liquidation, “but the same were not fully implemented.” Before the end of his term in 2016, President Benigno S. Aquino III issued Executive Order No. 90 on the AFP-RSBS’ abolition and specified the steps for ensuring its complete phaseout.

Since its inception, the AFP-RSBS did not require the beneficiaries, namely, soldiers and other uniformed personnel, to contribute their individual shares through salary deductions. Retirement payouts were funded from annual appropriations in the national budget.

The Marcos economic team, headed by Finance Secretary Benjamin E. Diokno, has proposed a new system in which both new entrants and active-duty officers prospective beneficiaries would be required to contribute 9 percent of their base and longevity pay upon entering the service, while the government will contribute an additional 12 percent to fulfill the proposed 21 percent monthly premium.

Based on latest available data, there are 134,735 military pensioners from the AFP’s major services, namely, army, air force, and navy; and 75,244 other uniformed personnel pensioners, from the Philippine National Police (PNP), Philippine Coast Guard (PCG), Bureau of Fire Protection (BFP), and Bureau of Jail Management and Penology (BJMP).

What has emerged as the primary bone of contention is whether or not the proposed system will be contributory on the part of the covered beneficiaries. Another contentious point is the automatic indexation of retirees’ pension. In the present system, when the salaries of those in the active service increase, there is a corresponding increase on base salaries used in computing for retirees’ pension benefits.

Evidently, the administration’s economic team has premised its position on the all-important issue of affordability. Given the ever-increasing budgetary outlay for social services, as well as for overall government operations, the team is proposing that the burden be shared by the prospective beneficiaries, similar to those made by members of the Government Service Insurance System (GSIS) and the Social Security System (SSS).

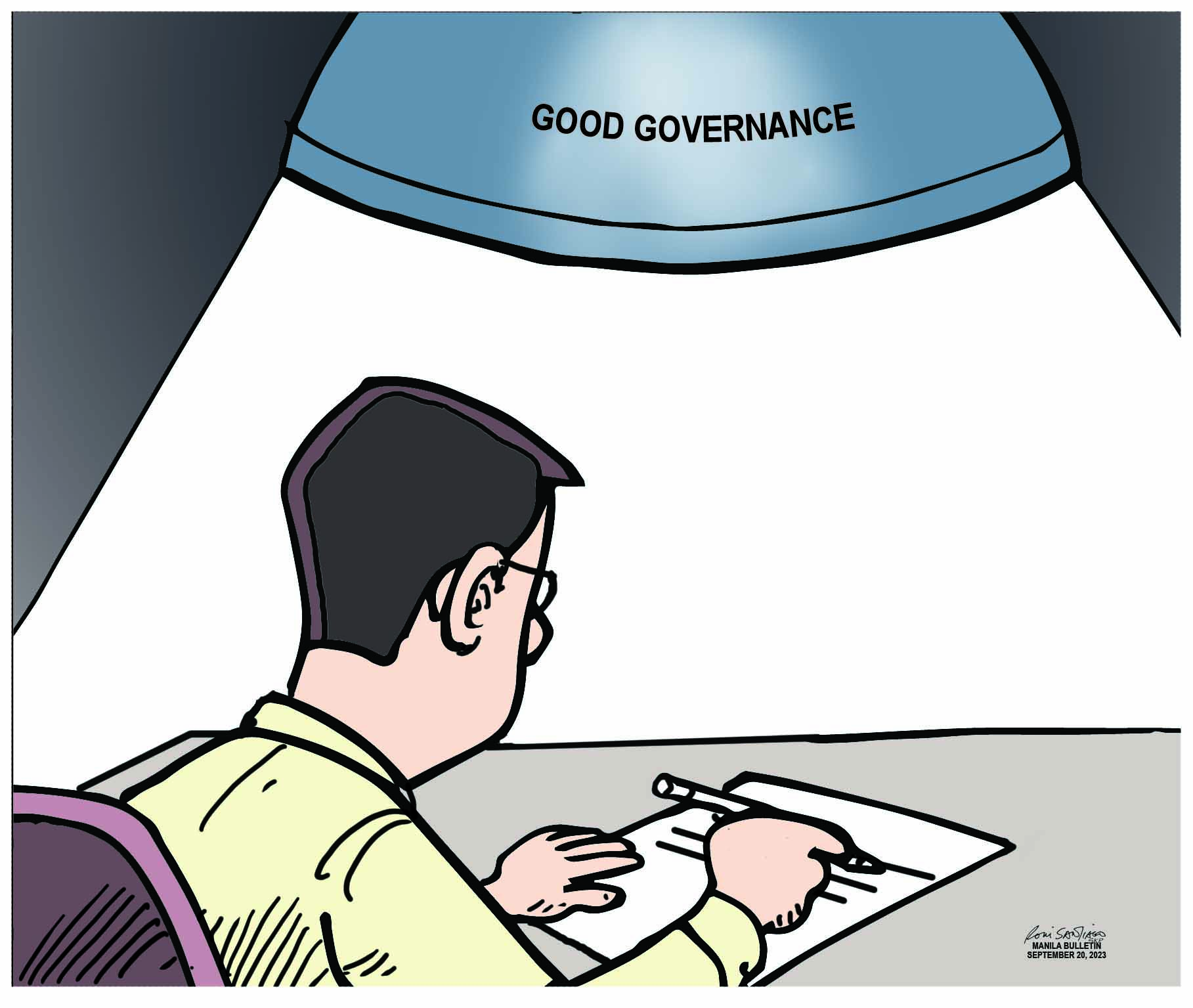

Good governance is at the heart of this dilemma. It must be emphasized that mismanagement caused the abolition of the erstwhile AFP-RSBS. In the ultimate analysis, it is the tax-paying citizenry that bears the burden of government expenditures. An abundance of prudence must be exercised to ensure that there will be no similar lapse in governance.