The local financial markets sent mixed signals to investors as the new year began, with the Philippine Stock Exchange index (PSEi) climbing slightly higher while the peso slipped against the US dollar, setting the stage for a potentially volatile 2025. The peso began the year with a slight...

Entering the new trading year 2025, stock market investors are faced with a lot of uncertainties as both risks and positive factors mingle to present a hazy picture in analysts’ crystal balls. For Chinabank Capital Corporation Managing Director Juan Paolo Colet, “Next year [2025] presents a...

For the local capital market, 2024 was a year of unmet expectations as global economic and geopolitical tensions took bourses worldwide, including the Philippines, on a roller-coaster ride. The year began with optimism. The Philippine Stock Exchange was projected to end the year at the 7,000 to...

The Philippine Stock Exchange, Inc. index (PSEi) closed higher year-on-year for the first time since 2019, up by 78.75 points or 1.2 percent to 2024 at 6,528.79 points from its close of 6,450.04 in 2023. In a statement, the PSE said that, year-on-year, the PSE MidCap and PSE DivY indices...

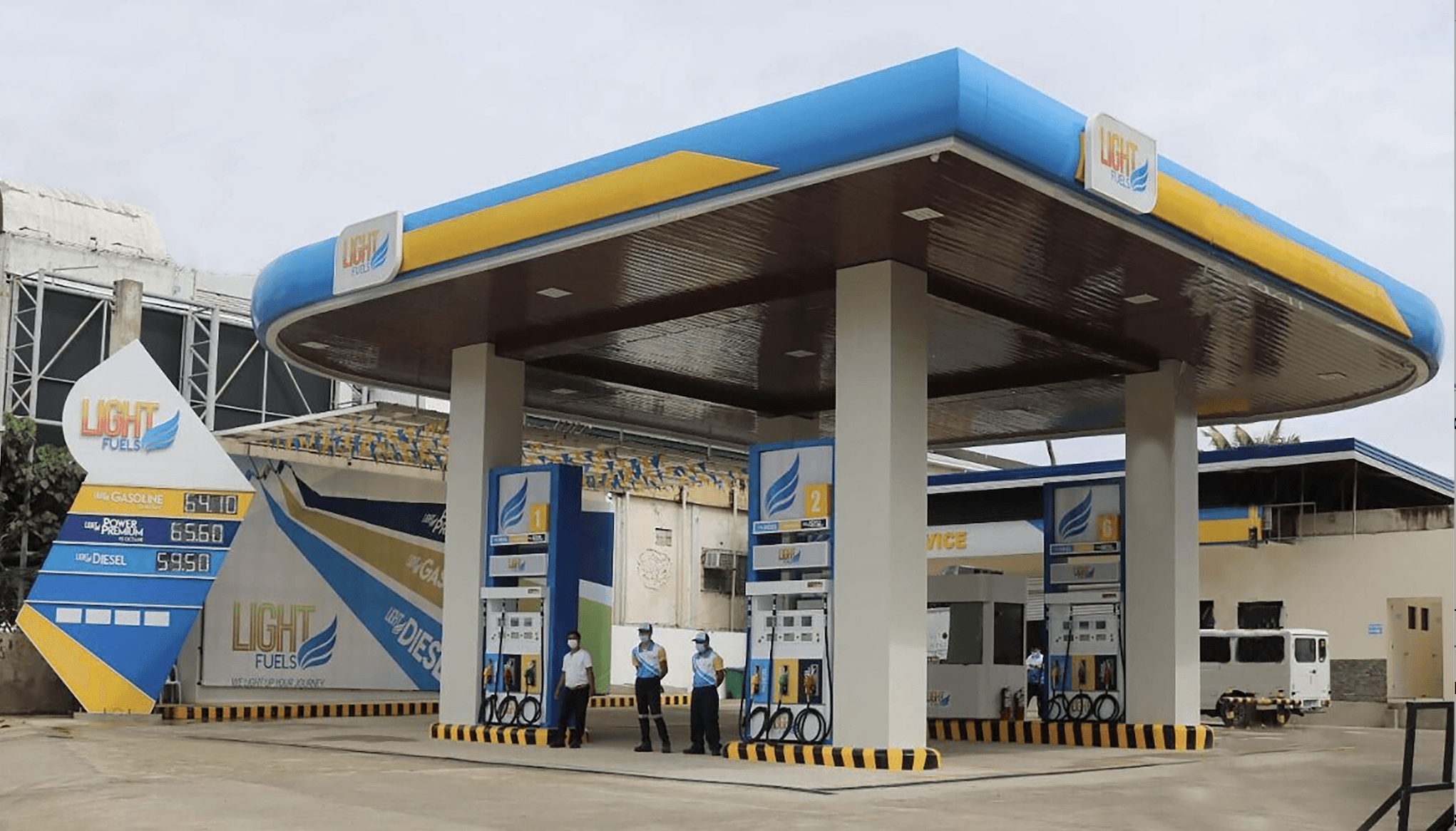

Cebu-based fuel retailer Top Line Business Development Corp. (Topline) is launching its P3.16 billion initial public offering before the year ends to be the last maiden offering at the Philippine Stock Exchange for 2024. The PSE said it has approved the firm’s IPO tentatively slated for Nov. 27...

The Philippine Stock Exchange (PSE) is planning to launch two new product offerings in the next two years, the Global Philippine Depository Receipts (GPDRs) and derivatives such as index futures. PSE President Ramon S. Monzon said GPDRs are peso-denominated instruments that represent an economic...

The Philippine Stock Exchange (PSE) will hold this year’s edition of the Road to IPO on Oct. 22, 2024 for companies planning to raise capital through the equities market. In a statement, the PSE said the event will feature presentations and discussions on what going public entails. The PSE is...

The number of initial public offerings is expected to surge next year as the expected decline in interest rates increases the attractiveness of equities versus fixed-income securities. In an interview at the sidelines of the EJAP-AboitizPower Renewable Energy Forum, BDO Capital and Investment...

The Philippine Stock Exchange, Inc. (PSE) announced that it has entered into a Memorandum of Understanding (MOU) with Taiwan Stock Exchange (TWSE) that will formalize and strengthen the relationship between the two bourses. TWSE Chairman Sherman Lin and PSE President and CEO Ramon S. Monzon...

The Philippine Stock Exchange, Inc. (PSE) is looking forward to seven public stock offerings worth a total of P48.36 billion that will be launched in September and in the last quarter this year. “In terms of listing, our fund raising pipeline at this time includes five FOOs (follow-on...

The Philippine Stock Exchange announced that the mid-year edition of its PSE STAR: Investor Day will see the participation of 14 publicly listed companies (PLCs) in a live briefing scheduled from August 14 to 16, 2024. As in previous runs, the virtual event will showcase...

Investors of SM Prime Holdings Inc. (SMPH) who bought shares during its initial public offering (IPO) in 1994 and held on to them for the next 30 years have now seen their investments balloon by 972.6 percent. (from left): SMPH Executive Committee Chairman Hans T. Sy, SMPH Vice Chairperson...