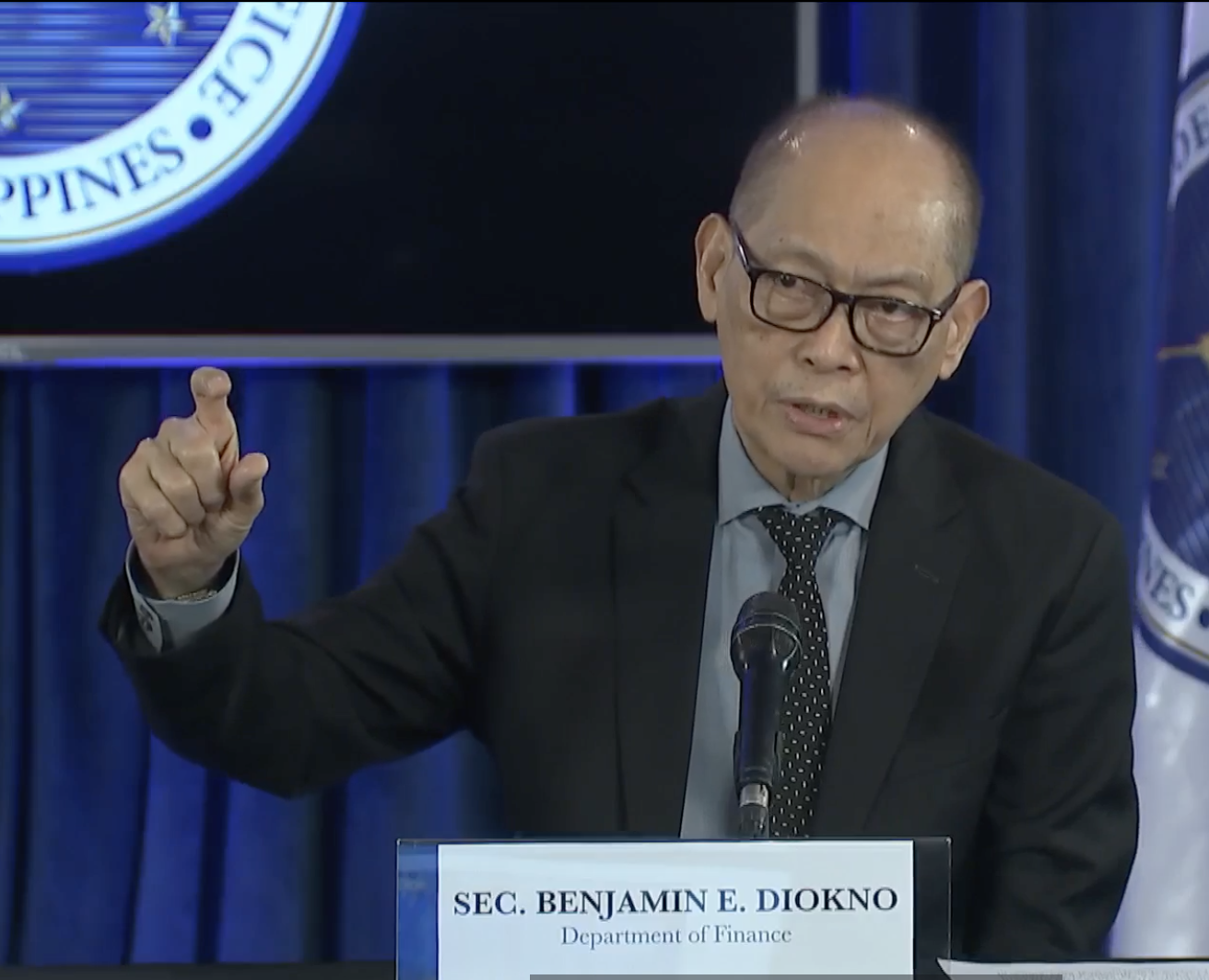

The Department of Finance (DOF) said the government’s first-ever sukuk bond offering will be settled by the middle of December this year. In a briefing on Tuesday, Nov. 28, Finance Secretary Benjamin E. Diokno said the Bureau of the Treasury has just announced the sukuk bond issuance, noting that...

The Marcos administration has mandated banks to oversee the Philippines’ first Islamic bond sale, aiming to raise at least half a billion dollars to aid in funding the government's budget shortfall. Based a document released by the Department of Finance (DOF), the national government is preparing...

The Philippines will benefit from the new credit line approved by the World Bank that aims to minimize the impact of major natural disasters and health crises on the domestic economy, the Department of Finance (DOF) said. Finance Secretary Benjamin E. Diokno said the $500-million standby credit...

The Bureau of the Treasury has surpassed its borrowing target with the sale of the government's first tokenized bonds. Deputy National Treasurer Erwin D. Sta. Ana reported that the government's sale of one-year tokenized Treasury bonds reached P15 billion, surpassing the initially planned amount of...

The Bureau of the Treasury has decided to cancel its short-term borrowing plan for next week to give way for the government's maiden offering of blockchain-backed debt instruments. In a notice signed by Deputy National Treasurer Erwin D. Sta. Ana, the bureau has announced the cancellation of...

In a move towards embracing digitalization, the Bureau of the Treasury is set to launch its maiden tokenized bond issuance, aiming to raise at least P10 billion. In a statement, the Treasury said these digital peso-denominated IOUs will be offered with a minimum denomination of P10 million, which...

The national government successfully sold its short-term debt papers as benchmark yields decreased after a seven-week rise. On Monday, Nov. 13, the Bureau of the Treasury executed its auction by fully awarding P15 billion worth of Treasury bills, with a total demand of P46.441 billion, three times...

The national government failed to sell all its short-term debt papers after banks demanded for higher returns following the Israel-Hamas war that led investors to favor safer investment options. At Monday's auction of Treasury bills on Oct. 9, the national government raised a total of P12.518...

The Bureau of the Treasury said the Marcos administration has recorded a slight decrease in its foreign and local borrowings in the first nine months of the year. From January to September 2023, gross financing totaled P1.782 trillion, a two percent drop compared to the same period last year when...

The national government's debt stock had decreased in September compared to the previous month due to repayments made to both local and foreign creditors, the Bureau of the Treasury reported on Tuesday, Oct. 31. The government's outstanding debt as of September stood at P14.269 trillion, a decline...

Government borrowing declined in August with fewer loans borrowed from local lenders, data from the Bureau of the Treasury showed. According to the Bureau of the Treasury, government borrowing in August amounted to P124.06 billion, lower by 7 percent than the P133.34 billion recorded in the same...

The national government's debt rose by double digits last August, driven by higher borrowings from both local and foreign lenders, the Bureau of the Treasury reported. The government's outstanding debt reached P14.349 trillion as of August 2023, a 10 percent increase from P13.021 trillion in the...