Apple Pay and Google Pay are exploring the possibility of entering the Philippine market, but must first register with the Bangko Sentral ng Pilipinas (BSP) as operators of payment systems (OPS), a central bank official said. BSP Deputy Governor Mamerto Tangonan confirmed that both tech giants have...

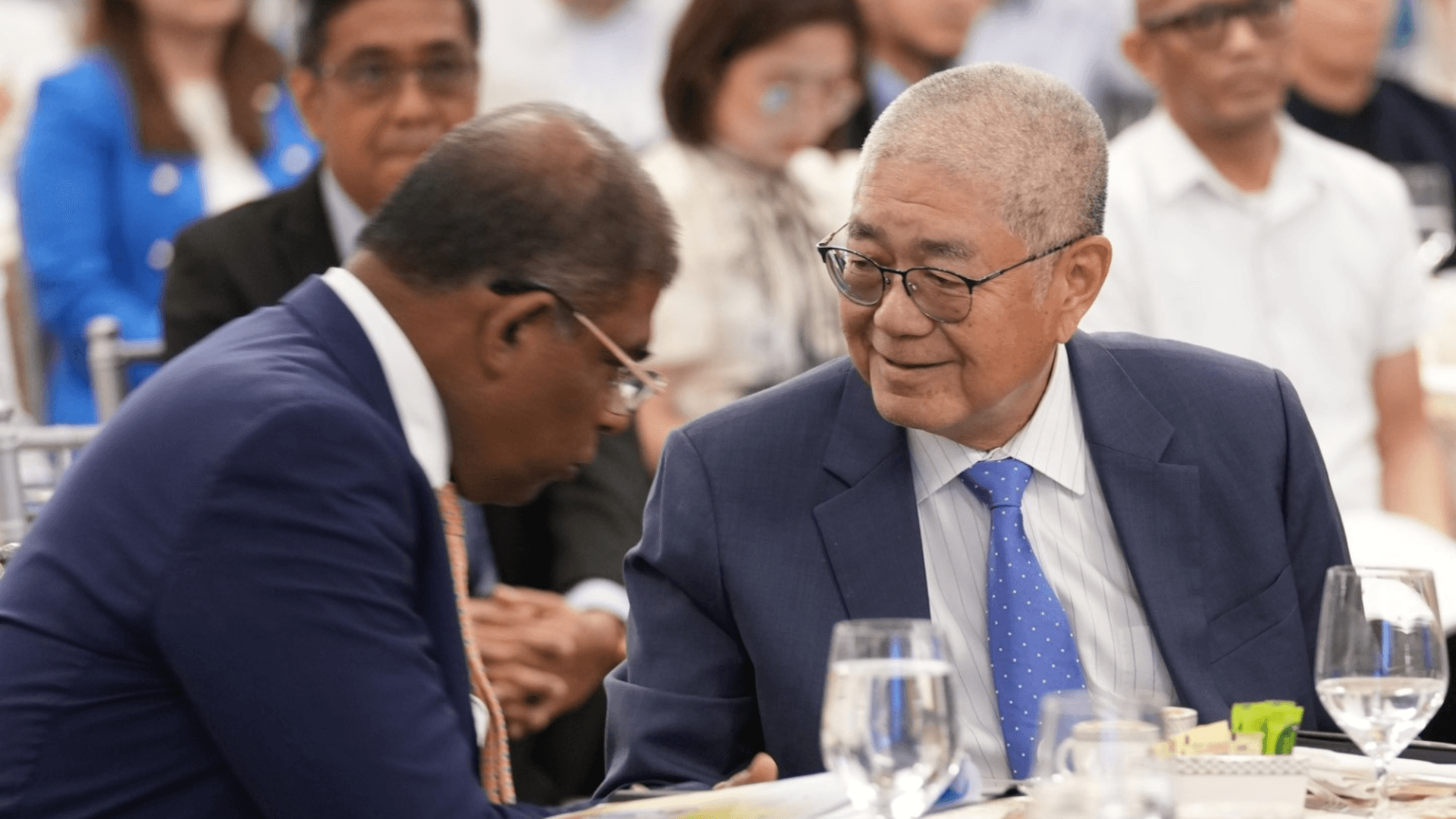

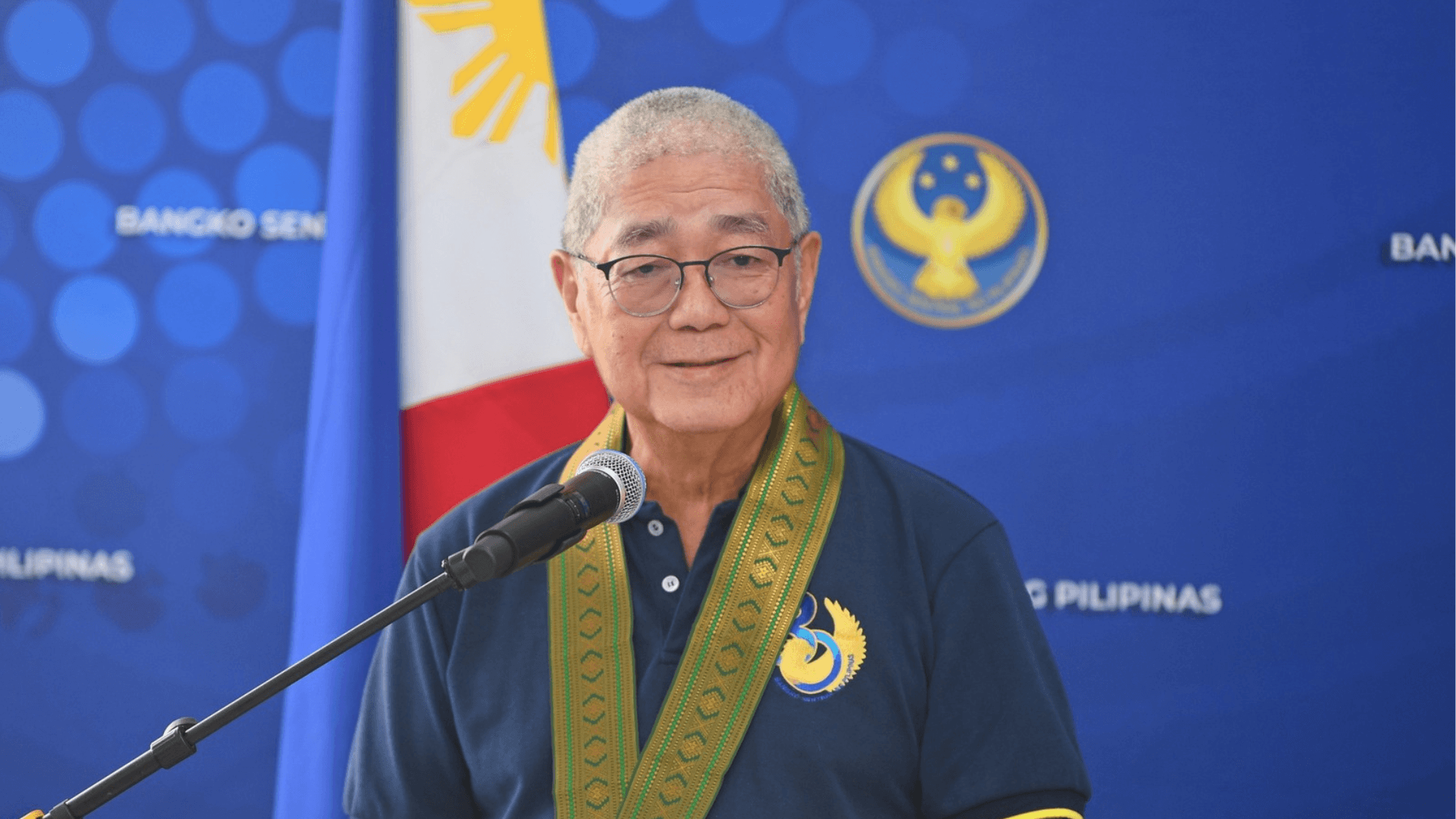

The Bangko Sentral ng Pilipinas (BSP) highlighted the Philippines’ potential as an investment destination for Islamic finance, citing the country's growing economy and the government’s push for financial inclusion. In a statement on Monday, Dec. 2, BSP Governor Eli M. Remolona, Jr. said that...

The repercussions of US President-elect Donald J. Trump's protectionist trade and expansionary fiscal policies would slow the pace of interest rate cuts in emerging markets like the Philippines, according to Oxford Economics. In a report, Oxford Economics emerging markets economist Callee Davis...

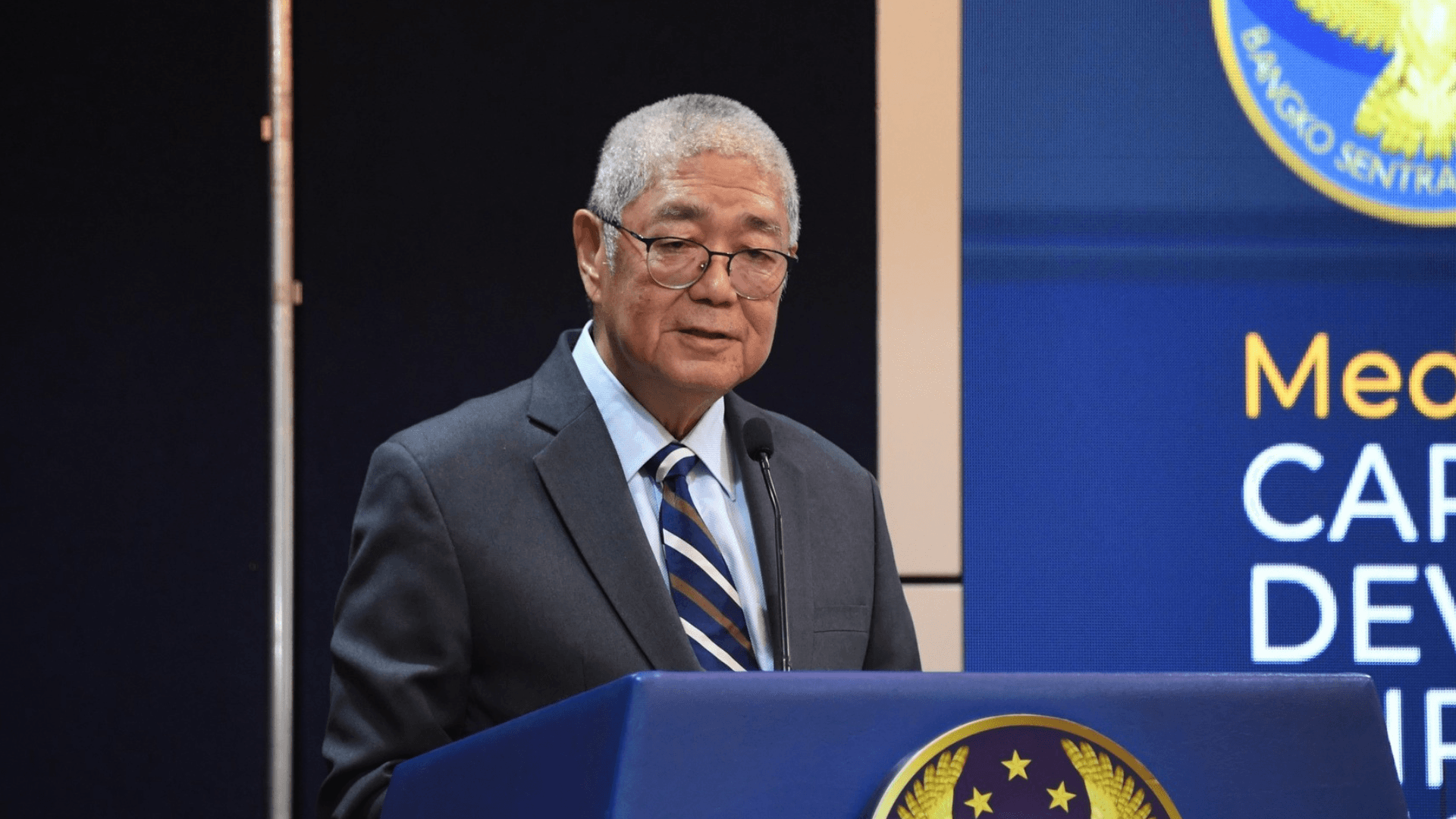

Mactan, Cebu — Digicentric financial institutions operating like digital banks should be regulated the same way to address market arbitrage, a Bangko Sentral ng Pilipinas (BSP) official said. "If you're already behaving like a digital bank, you should be regulated like a digital bank, not like a...

Mactan, Cebu — The Bangko Sentral ng Pilipinas (BSP) may keep borrowing costs steady if inflationary pressures continue and economic growth remains sluggish in the final quarter of the year, the central bank chief said. "Our readings indicate that there’s still some inflationary pressure, and...

Mactan, Cebu — Following the GCash incident, a Bangko Sentral ng Pilipinas (BSP) official stated that the central bank would strengthen its policies if the investigation revealed that the e-wallet platform was at fault for the unauthorized account deductions. On the sidelines of the...

Mactan, Cebu — Amid Trump's comeback, the Bangko Sentral ng Pilipinas (BSP) is considering a 25 basis points (bps) reduction in borrowing costs, either in December or at the next Monetary Board (MB) meeting, as the central bank continues its easing cycle, according to an official. During the...

The country’s external debt service burden dipped 3.8 percent to $8.68 billion as of end-August compared to $9.023 billion in the same period last year, based on Bangko Sentral ng Pilipinas (BSP) data. During the period, external debt service principal payments totaled $3.461 billion, lower by...

The Bangko Sentral ng Pilipinas (BSP) reported a higher net income of P105.6 billion in the first eight months of 2024, a significant 361 percent increase compared to P22.9 billion the same time last year due to more revenues but less expenses. Based on the latest BSP data, revenues totaled P220.2...

The Bangko Sentral ng Pilipinas (BSP) said it is investigating a system error at GCash, the leading e-wallet platform in the country, which resulted in unauthorized deductions from user accounts over the weekend. In a statement late Monday, Nov. 11, the BSP said that it had instructed...

With economic growth slowing to its lowest pace since the second quarter of 2023, economists pointed to lower inflation and eased monetary policy as potential catalysts for boosting consumption, although trade barriers and peso volatility could hinder this progress. "Admittedly, a continued boost...

Big banks’ outstanding loans grew by 11 percent year-on-year in September, an improvement from the 10.4 percent reported in August, according to the Bangko Sentral ng Pilipinas (BSP). Bank lending in peso terms amounted to P12.402 trillion in September, net of reverse repurchase (RRP) placements...