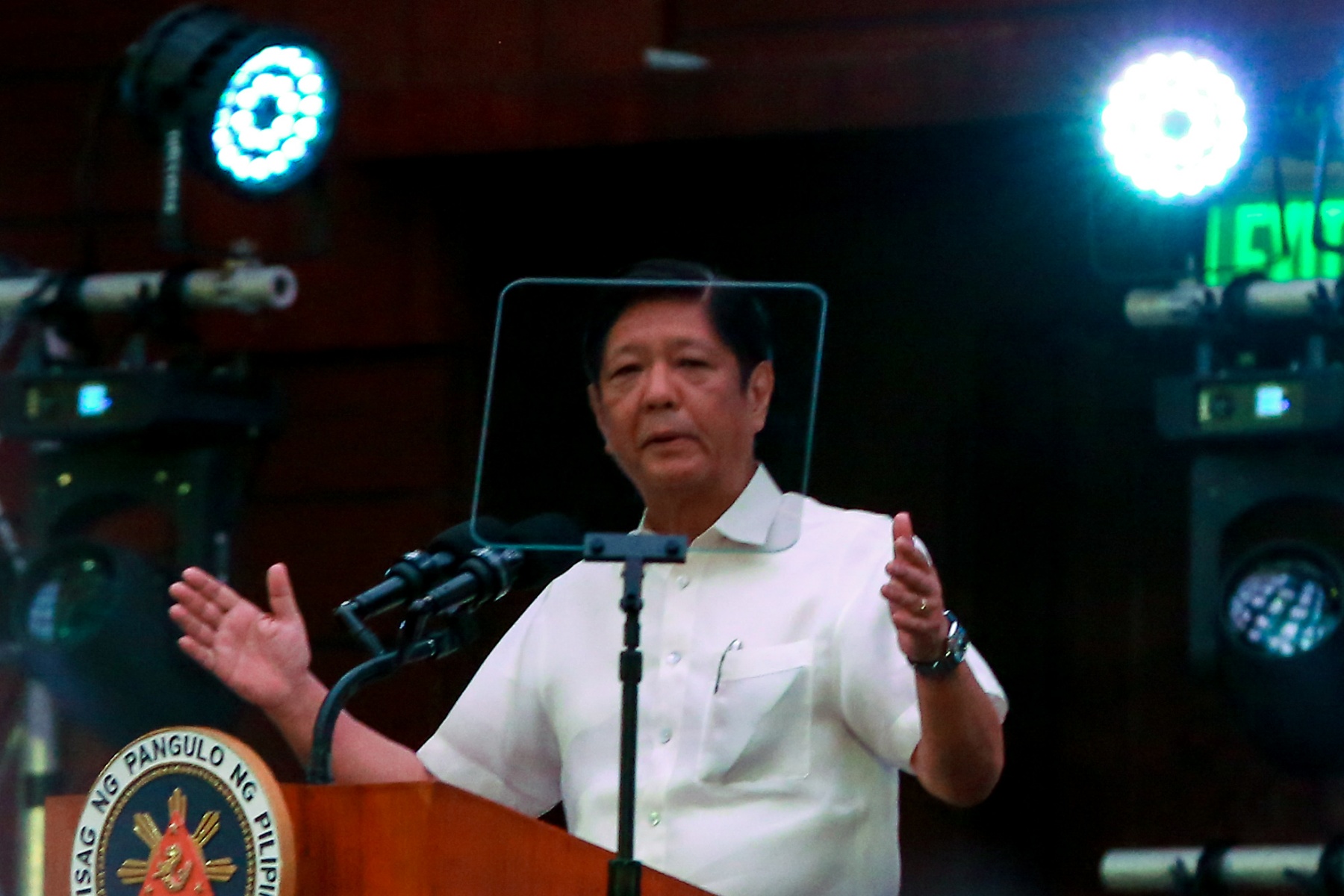

President Marcos took out slightly more loans last year to finance the government's operations and projects. Based on the Bureau of the Treasury's data, the national government's gross borrowings increased by 1.4 percent to P2.193 trillion between January and December 2023 from P2.163 trillion in...

PPA General Manager Jay Daniel Santiago The Philippine Ports Authority (PPA) made a great rebound following the adverse effects of the Covid-19 pandemic to the shipping industry by remitting more than P5 billion cash...

The national government's debt is edging closer to the P15 trillion mark, fueled by increased borrowing to cover the budget deficit, data from the Bureau of the Treasury showed. In January 2024, the government's total debt rose by eight percent to P14.79 trillion from P13.698 trillion in the same...

The Marcos administration registered a reduction in the budget deficit last year, with revenues growing significantly faster than expenditures, data from the Bureau of the Treasury showed. In 2023, the national government's fiscal deficit stood at P1.512 trillion, a 6.3 percent decrease from the...

The national government fell short anew in making a full award of the short-term debt papers following the record-high P585 billion retail treasury bond issuance. The Bureau of the Treasury during an auction on Monday, February 26, partially borrowed P14.8 billion through the sale of Treasury bills...

The Department of Finance (DOF) said the Marcos administration is on track to meet its borrowing requirements for the year, which will provide the necessary funding for government programs and projects. With a total financing goal of P2.46 trillion for 2024, the government plans to secure 75...

Small Filipino investors swarmed the government's retail treasury bond (RTB) sale, reaching another record driven by the attractive interest rate being offered. The Bureau of the Treasury announced that the national government raised a total of P584.86 billion through the sale of five-year RTBs,...

The government sold some short-term loans to Filipino investors, even though interest rates were up and there were fewer takers. During the auction on Monday, Feb. 19, the Bureau of the Treasury raised P14.5 billion through the sale of Treasury bills (T-bills), below the P15 billion program. ...

Investing in the government’s retail bonds is as effortless as ordering a loved one's favorite meal for delivery! Finance Secretary Ralph G. Recto said that retail treasury bonds (RTBs) are readily accessible through a few taps on mobile phones, offering Filipinos both here and abroad secure,...

Finance Secretary Ralph G. Recto emphasized the need to promote a culture of saving and investing in the country, while encouraging Filipinos to consider investing in retail treasury bonds (RTB). “We should instill in our people a mindset that embraces and normalizes a culture of saving and...

Filipino investors seeking to invest their savings with the government can expect a guaranteed return that surpasses the 2023 average inflation rate, data from the Bureau of the Treasury showed. During an auction on Tuesday, Feb. 13, the five-year retail treasury bond (RTB) secured a coupon rate of...

The Marcos administration is set to offer Filipinos the opportunity to grow their hard-earned savings by investing at least P5,000 in the government’s upcoming retail Treasury (RTB) bond sale. The Bureau of the Treasury has announced that the government intends to raise more than P30 billion...