The Court of Tax Appeals (CTA) has dismissed the petition for P6 million tax refund sought by a firm that recruits qualified Filipino seafarers for employment by foreign shipping companies. Dismissed was the petition filed by BW Shipping Philippines, Inc. against the Bureau of Internal Revenue...

The Court of Tax Appeals (CTA) has ordered the Valenzuela City government to refund North Luzon Expressway Corporation (NLEX) P3.8 million in erronously collected taxes for taxable years 2012 to 2019. In a 34-page decision penned by Associate Justice Corazon G. Ferrer-Flores and promulgated last...

Senator Juan Miguel “Migz” Zubiri lauded the signing of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act on Monday, Nov. 11, as it is expected to cut the bureaucratic red tape that has hampered the growth of the...

Senate President Francis “Chiz” Escudero on Sunday, November 10 said he expects the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act to generate new jobs domestically and attract more foreign investments in the...

The Philippines needs to keep pursuing tax reform measures pending in Congress en route to its plan to narrow its yawning budget deficit, according to the World Bank. In its Philippines Monthly Economic Developments report for October 2024, the World Bank noted that the fiscal deficit as a share of...

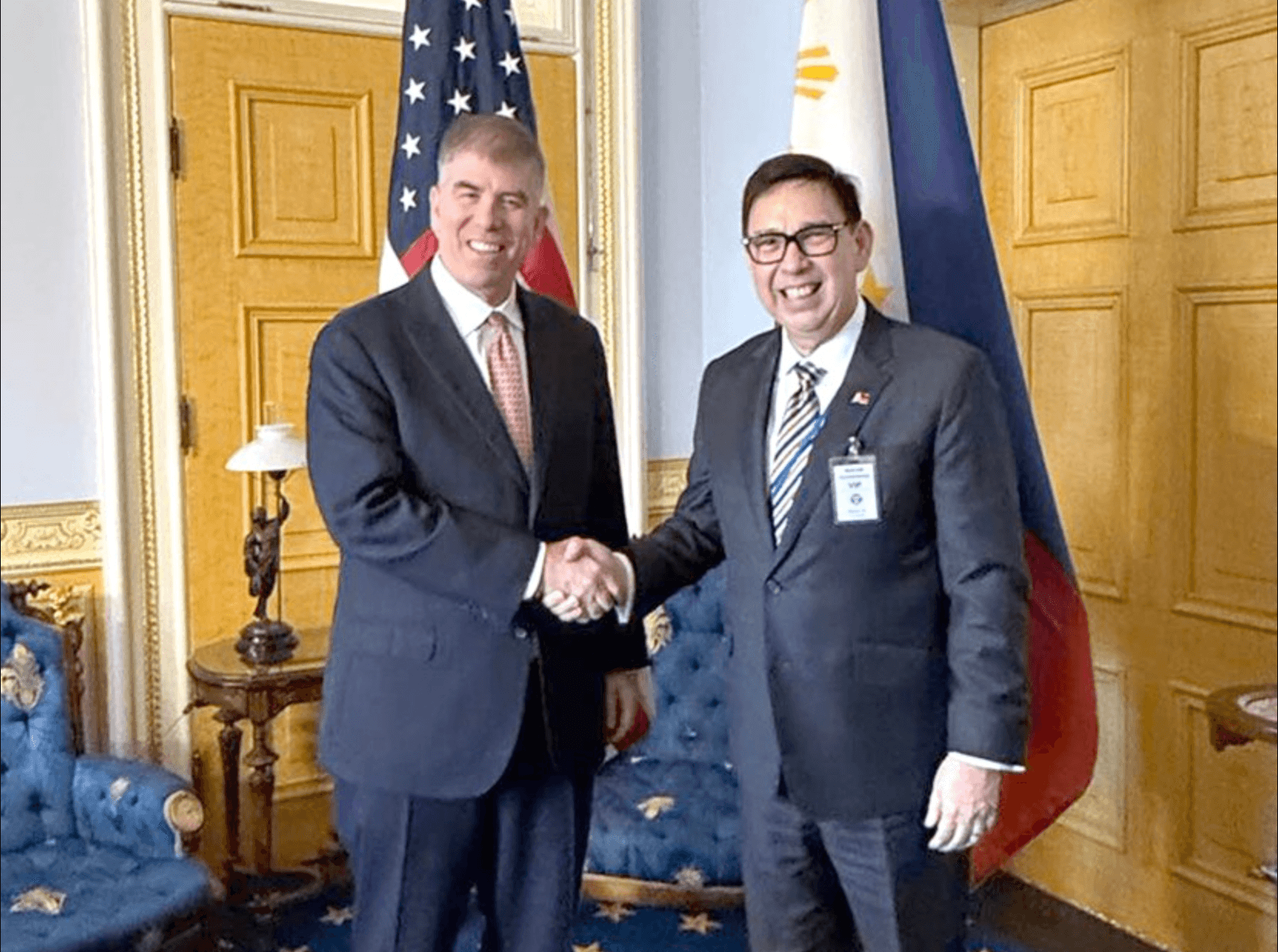

The Department of Finance (DOF) said that the US Department of the Treasury has vowed to support the country’s efforts to strengthen its tax and customs administration system. The DOF said the commitment was made by US Treasury Undersecretary Jay C. Shambaugh and other senior officials during a...

Taxes to protect and fund universal health care (UHC)—such as those slapped on so-called "sin" products like cigarettes, alcoholic drinks, and sweets—still have room for further increases, according to a global task force. "Health taxes continue to be underutilized despite the...

The proposed Capital Market Efficiency Promotion Act (CMEPA) being pushed by the Legislative-Executive Development Advisory Council (LEDAC) has removed the planned reimposition of excise tax on pick-up trucks such that the bill, if passed into law, would result in foregone revenues for the...

Senate President Francis “Chiz” Escudero expressed confidence that the bill imposing a 12-percent value-added tax (VAT) on digital transactions would shore up government coffers by at least P80 billion in revenues. Escudero said that this would level the playing field for local and foreign...

(Unsplash) Hommittee on Ways and Means chairperson and Albay 2nd district Rep. Joey Salceda said he will push the House of Representatives to adopt the proposed Senate measure that seeks to implement a value added tax (VAT) refund mechanism for tourists to...

The Court of Tax Appeals (CTA) has denied the petition of Air Drilling Associates Pte. Ltd. which sought a tax refund of P951,459.67 for its zero-rated sales for the fourth quarter of 2018. Air Drilling is a foreign company from Singapore engaged in aerated drilling services. It was licensed to...

The Court of Tax Appeals (CTA) has denied the petition of Bohol Light Company, Inc. (BLCI) to reverse a regional trial court (RTC) ruling that the firm has "no clear and categorical exemption from other local taxes." Assailed by the BLCI was the March 31, 2016 decision issued by the Tagbilaran...