The Bureau of Internal Revenue (BIR) has started implementing the withholding tax requirement for online sellers who conduct business on electronic marketplaces like Lazada and Shopee. In a statement, BIR Commissioner Romeo D. Lumagui Jr. said there will be no further extensions for online...

The Bureau of Customs (BOC), the government's second-largest tax agency, is poised to surpass its revenue target this year, potentially hitting a record of nearly P1 trillion. Assistant Commissioner and Spokesperson Vincent Philip Maronilla said the BOC’s internal target is to exceed its 2024...

The Bureau of Internal Revenue (BIR), the government’s main tax agency, fell short of its tax collection target for the first half of the year, data released by the Department of Finance (DOF) revealed. A report on the DOF’s official Facebook page showed that the BIR, responsible for generating...

Department of Finance Secretary Ralph G. Recto called on the government’s two main tax agencies to expedite their digitalization efforts to reach the P4.27 trillion target for this year. During a meeting on Wednesday, July 11, Recto discussed with the Bureau of Internal Revenue (BIR) and the...

The Department of Finance (DOF) announced that government revenues have already achieved half of the target for the year in the first semester, indicating a promising outlook for meeting the full-year goal. Finance Secretary Ralph G. Recto said that a total of P2.13 trillion in revenues was...

The Bureau of Internal Revenue (BIR) announced that the agency has removed the five-year validity period for electronic certificate authorizing registration (eCAR). In a Facebook post on Monday, June 24, BIR Commissioner Romeo D. Lumagui Jr. said that eCAR is now valid until its presentation...

The Bureau of Internal Revenue (BIR) has issued additional guidelines regarding registration procedures and invoicing requirements following the passage of the Ease of Paying Taxes (EOPT) Act. These new guidelines aim to provide relief to taxpayers in meeting the new invoicing requirements....

The Bureau of Internal Revenue (BIR) has instructed its employees to refrain from connecting government-issued laptops to public Wi-Fi networks. Under Revenue Memorandum Order (RMO) 22-2024, dated June 14, 2024, and signed by BIR Commissioner Romeo D. Lumagui Jr., the bureau said the directive is...

In a move aimed at easing administrative burdens for taxpayers, the Bureau of Internal Revenue (BIR) has removed the time limit for utilizing converted official receipts (ORs) as invoices. Under the newly released BIR Revenue Regulation (RR) No. 11-2024 , taxpayers are now allowed to convert any...

Senators commended the Bureau of Internal Revenue's (BIR) initiative to investigate Bamban, Tarlac Mayor Alice Guo. BIR Commissioner Romeo D. Lumagui Jr. initiated a tax fraud investigation against Guo, who is currently under Senate scrutiny for various issues, including her citizenship. Sen. Risa...

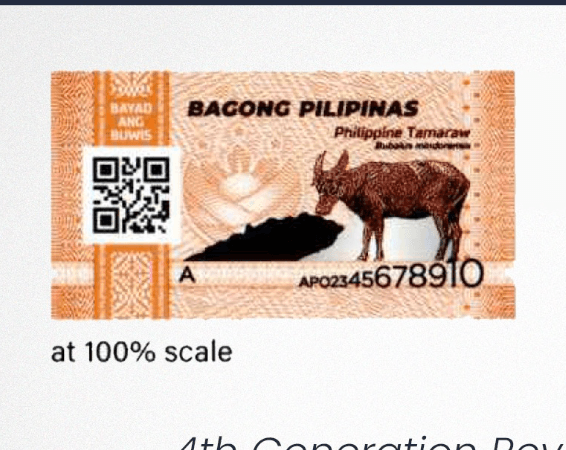

The Bureau of Internal Revenue (BIR) is urging consumers to verify the presence of a specific "Tamaraw" tax stamp on vape products before making a purchase. In a recent social media post, BIR Commissioner Romeo D. Lumagui Jr. detailed the importance of distinguishing between tax-paid and...

State coffers from the Bureau of Customs (BOC) continued to improve in May as it grew by 4.9 percent compared to last year. The BOC reported that it collected over P81.75 billion in revenues last month, surpassing the target of P79.62 billion by 2.6 percent and the P77.92 billion collected in May...