The local stock market rose further as investors picked up cheaper stocks ahead of Wednesday’s announcement of the inflation rate for February. The main index added 26.92 points or 0.45 percent to close at 6,064.11, led by the strength of the mining and banking sectors, while the conglomerate and...

The Philippine Stock Exchange index (PSEi) recovered some ground but settled below the day’s high as investors bet on a lower inflation rate to be announced on Wednesday. The main index added 39.22 points or 0.65 percent to close at 6,037.19 as conglomerates led the advance while the services and...

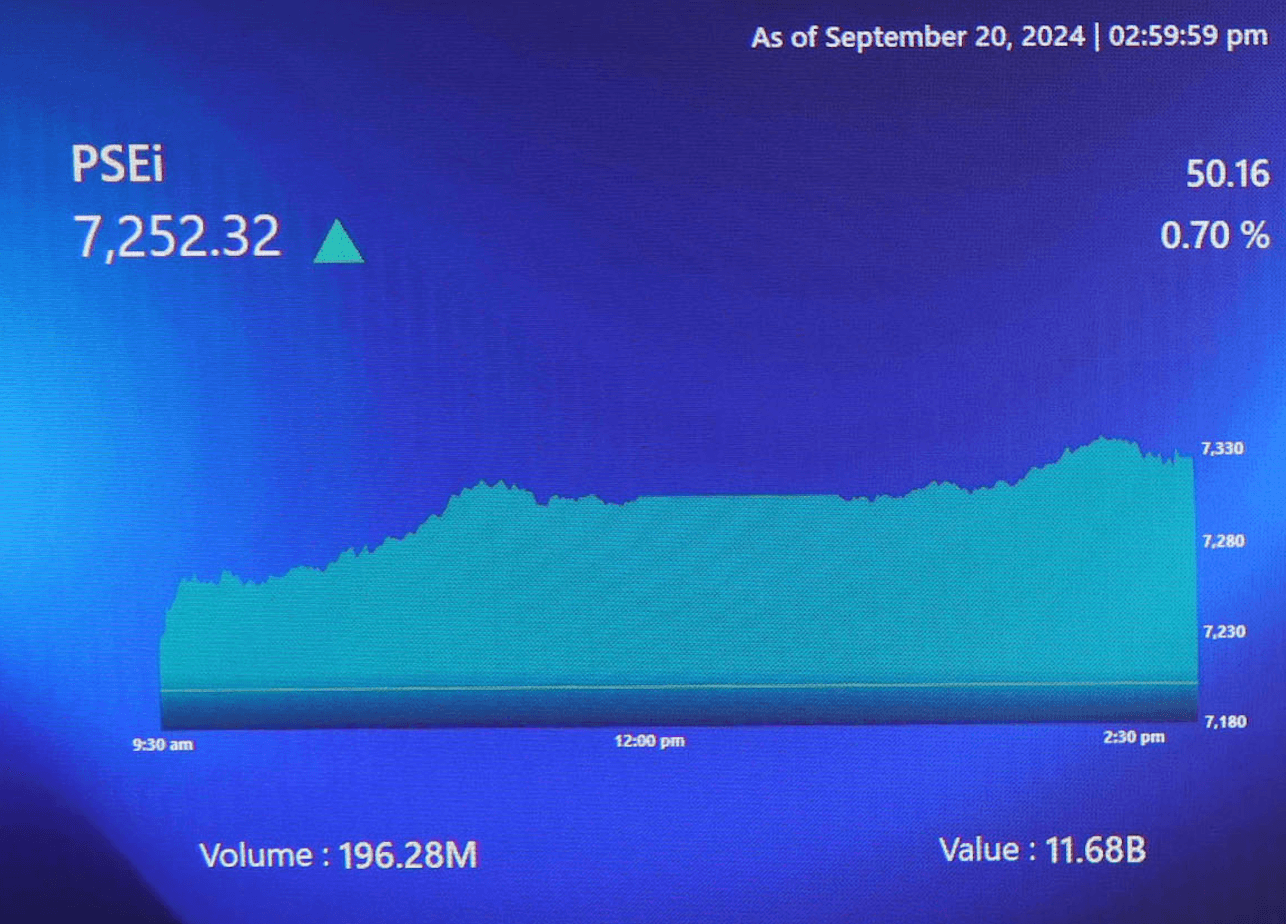

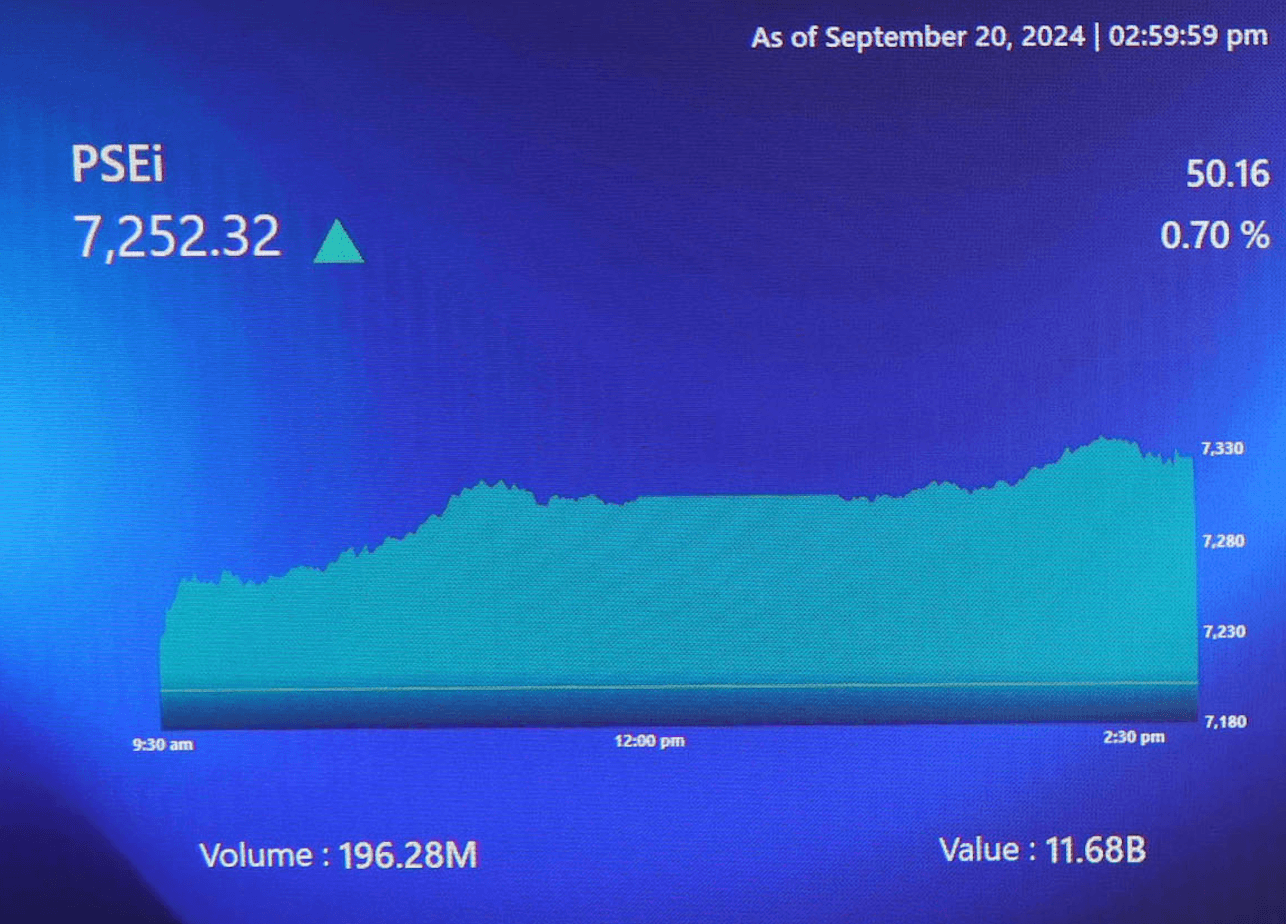

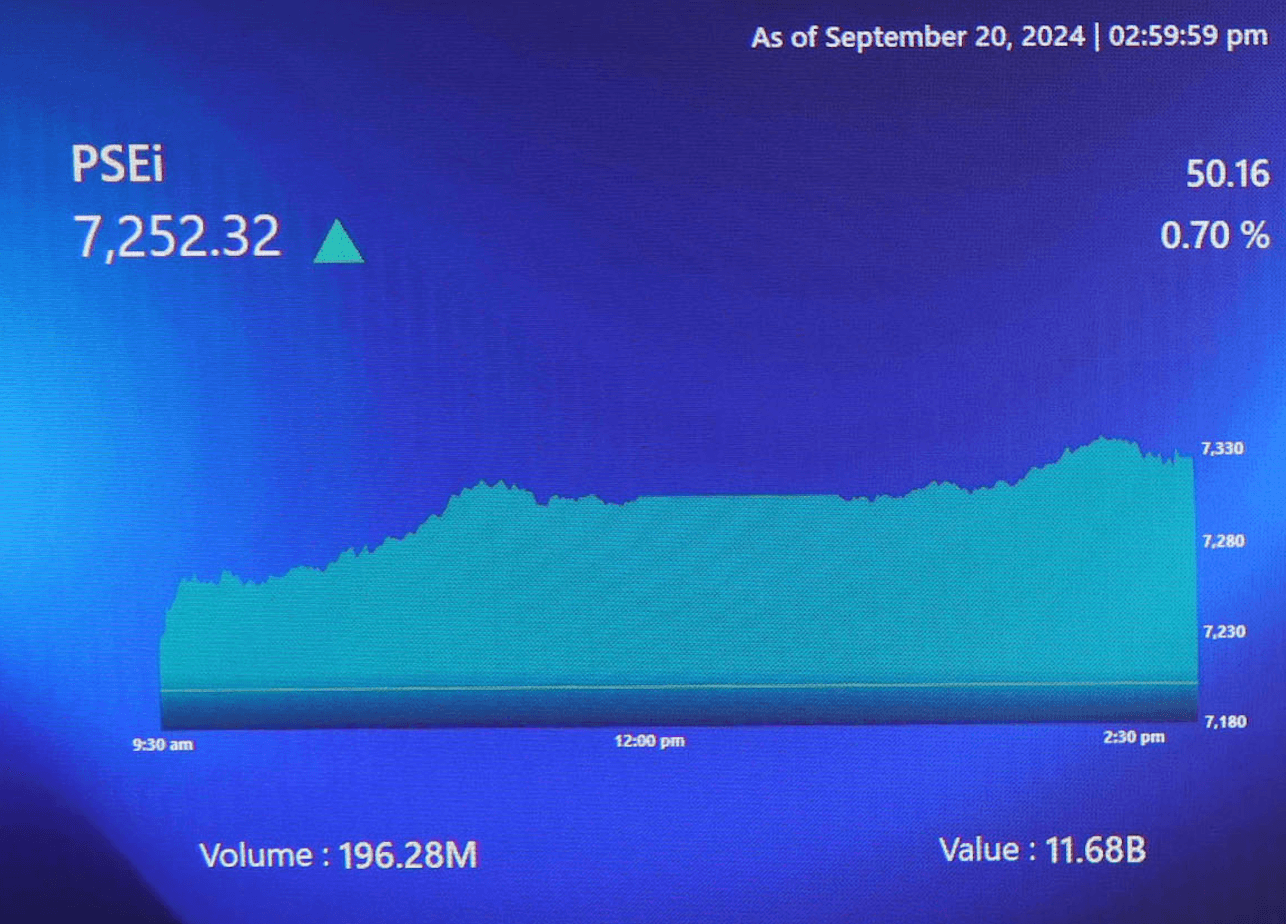

Despite the turmoil the local stock market is currently going through, stock brokerage Philstocks Financial still expects the Philippine Stock Exchange’s benchmark index (PSEi) to rise to over 1,200 points to the 7,274.49 to 7,620 range by the end of 2025. “We maintain a bullish yet cautious...

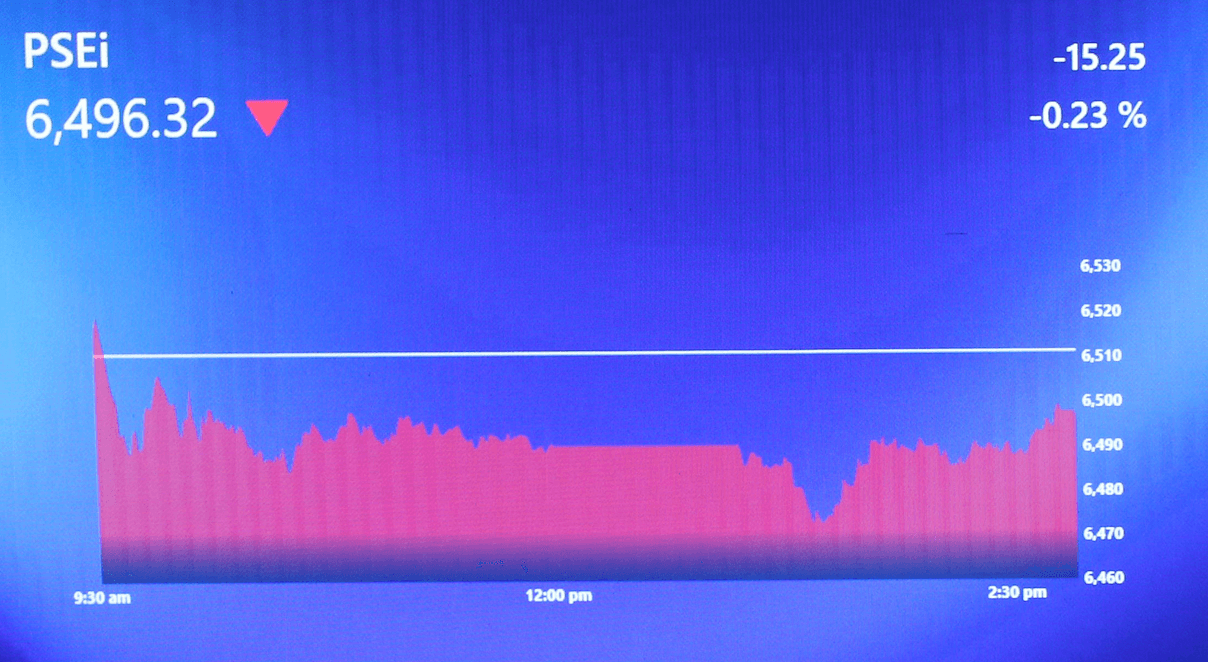

The local stock market weakened as investor sentiment remains dampened by geopolitical concerns such as US tariffs and discouraging economic and inflation numbers. The main index dropped on Tuesday, Feb. 25, by 31.81 points or 0.52 percent to close at 6,064.16, as conglomerates led the retreat...

The Philippine Stock Exchange index (PSEi) ended almost flat on Monday, Feb. 24, as gains of banks and conglomerates managed to balance losses of other sectors. The main index shed 2.07 points or 0.03 percent to close at 6,095.97 with the industrial and services counters leading decliners. Volume...

The local stock market recovered some lost ground to close the week on a higher level than in the previous Friday. The main index added 31.41 points or 0.52 percent to close at 6,098.04 as the Property sector bounced back to lead the advance while Banks dipped. Volume declined to 1.65 billion...

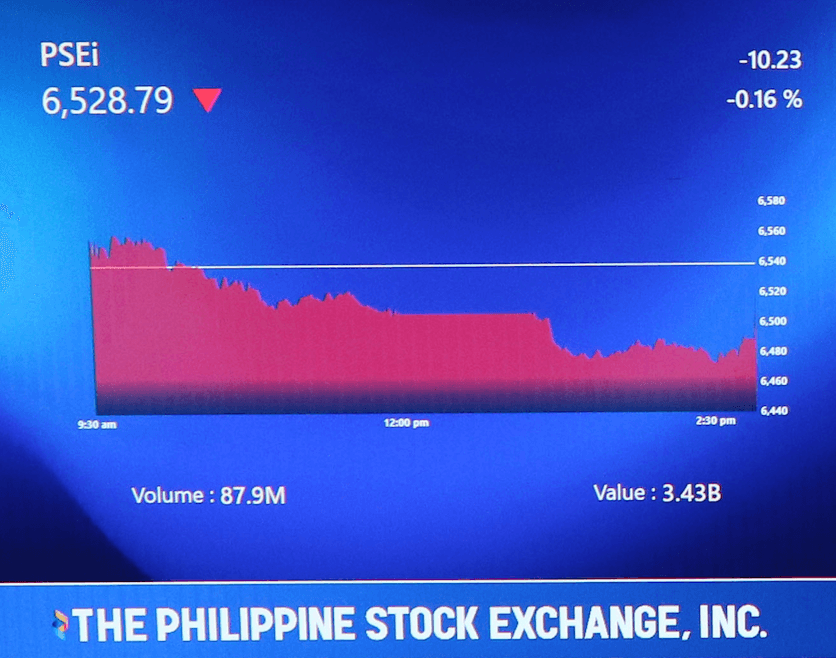

The Philippine stock market weakened as investors grew concerned about potential delays in U.S. interest rate cuts and increased tariff threats by President Trump. The main index fell 53.25 points, or 0.87 percent, to close at 6,066.63 on Thursday, Feb. 20. The property sector led the...

The Philippine Stock Exchange index (PSEi) gained more ground as investors continued to pick up cheaper stocks on the back of gains in US bourses. The main index added 24.92 points or 0.41 percent to close at 6,119.88 with the mining and oil surging by 4.73 percent while banks and services...

The local stock market strengthened as investors picked up bargains amid stronger remittances and corporate tax cuts. The main index surged by 101.48 points or 1.69 percent to close at 6,094.96 as the property counter made a strong bounce while miners saw some profit-taking. Volume grew to...

The Philippine Stock Exchange index (PSEi) fell following the decline in US bourses last Friday as investors are jittery about factors that may further delay interest rate cuts. The main index lost 67.85 points or 1.12 percent to close at 5,993.48 on Monday, Feb. 17, as the property sector plunged,...

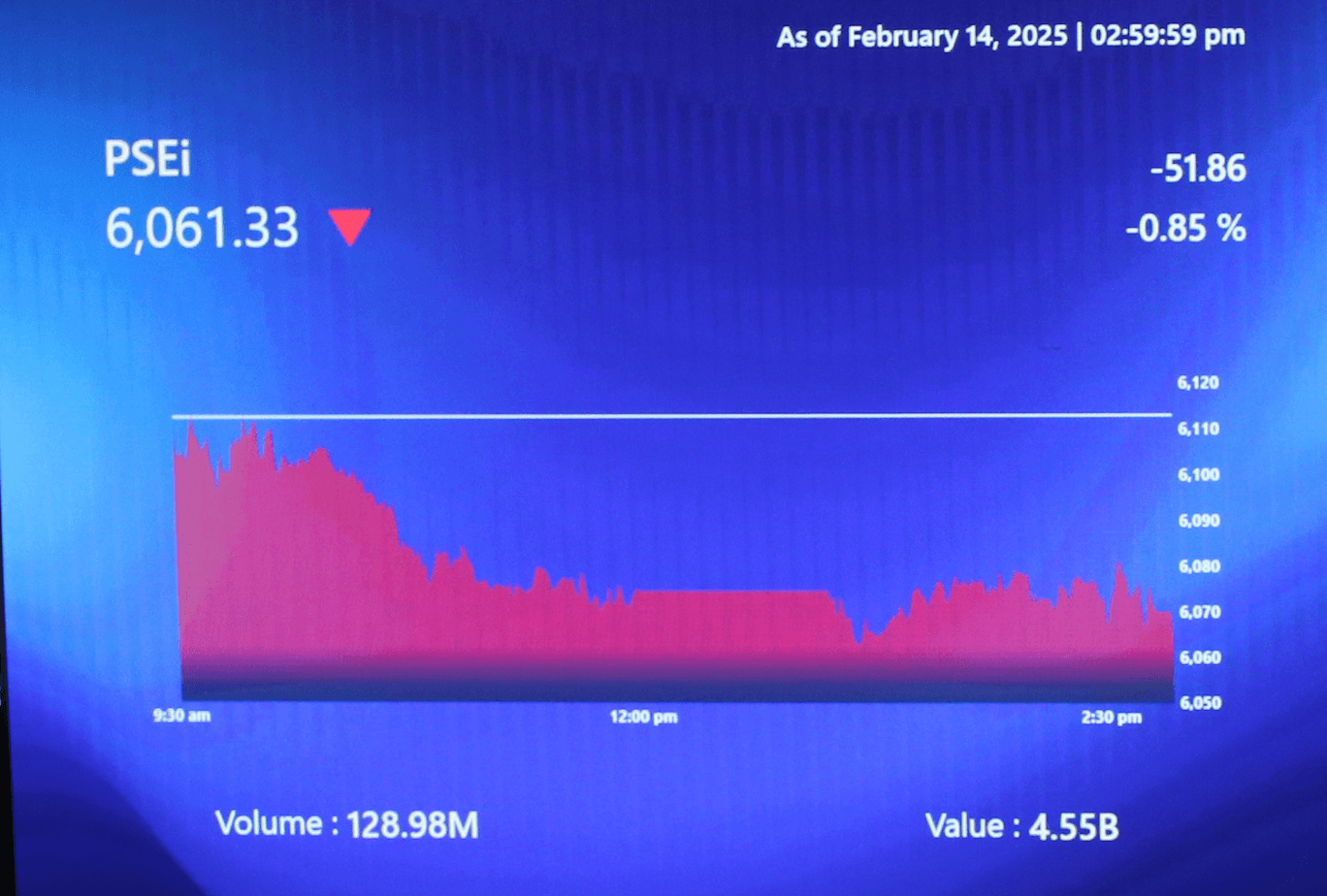

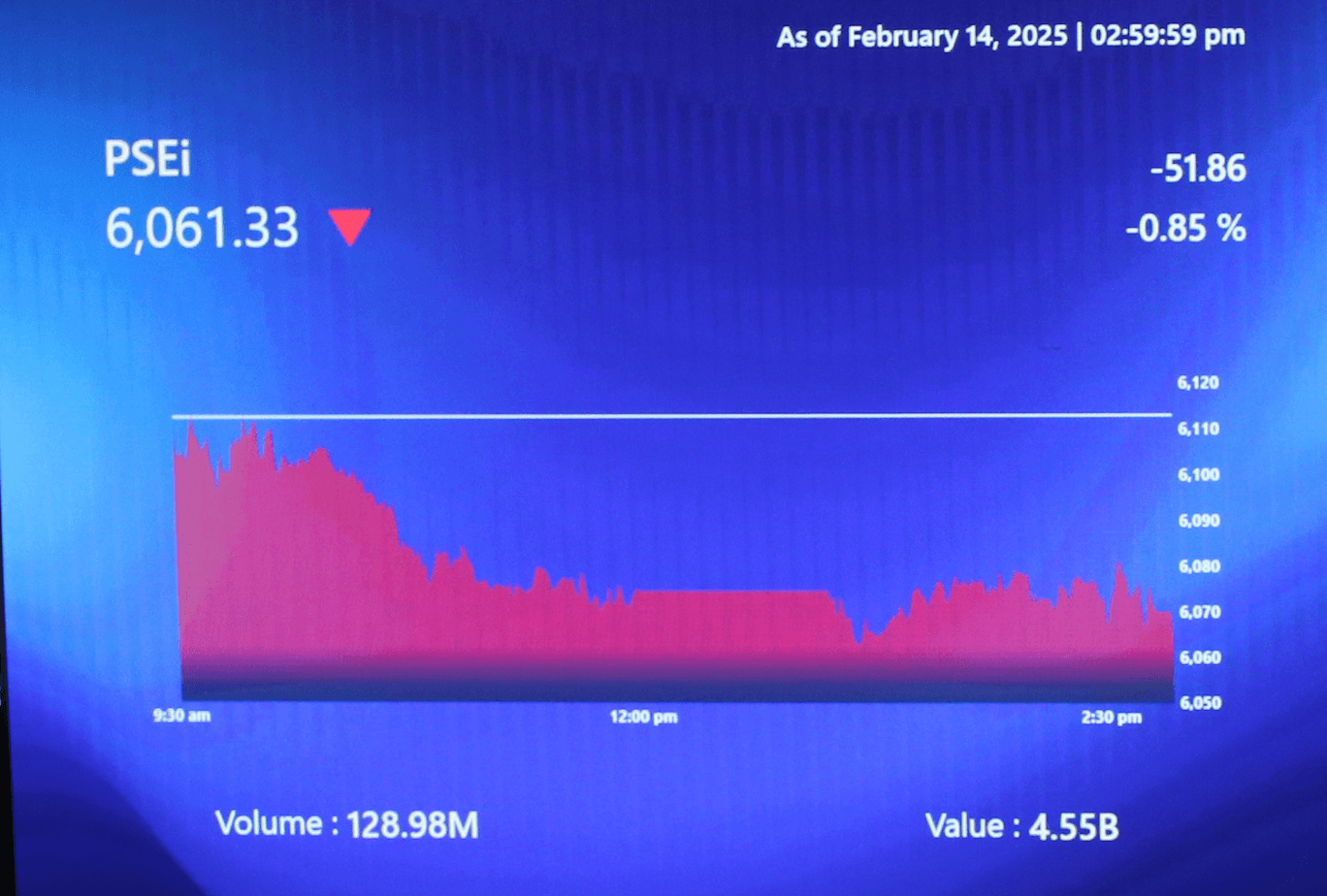

The local stock market turned red on Valentine’s Day as investors cashed out after the Bangko Sentral Pilipinas' surprise move to hold back an expected rate cut. The main index lost 51.86 points or 0.85 percent to close at 6,061.33 as the rate-sensitive property sector led the retreat while...

The local stock market managed to rise despite higher US inflation as investors were expecting the Bangko Sentral ng Pilipinas (BSP) to cut its policy rate. The main index jumped 69.06 points or 1.14 percent to close at 6,113.19 with the mining and services sectors leading all sub-indices up....