By DERCO ROSAL Finance Secretary Ralph G. Recto said that the Department of Finance (DOF) will abide by the Supreme Court’s (SC) temporary restraining order (TRO) that halts the utilization of Philippine Health Insurance Corp.’s (PhilHealth) idle, unused, and excess funds. On Tuesday, Oct. 29,...

By DERCO ROSAL The Philippines is poised for potential credit rating upgrade given the country’s resilient economy and positive growth outlook, global banking giant Citi executives stated. “Citi executives expressed confidence that the country is well-positioned for a credit...

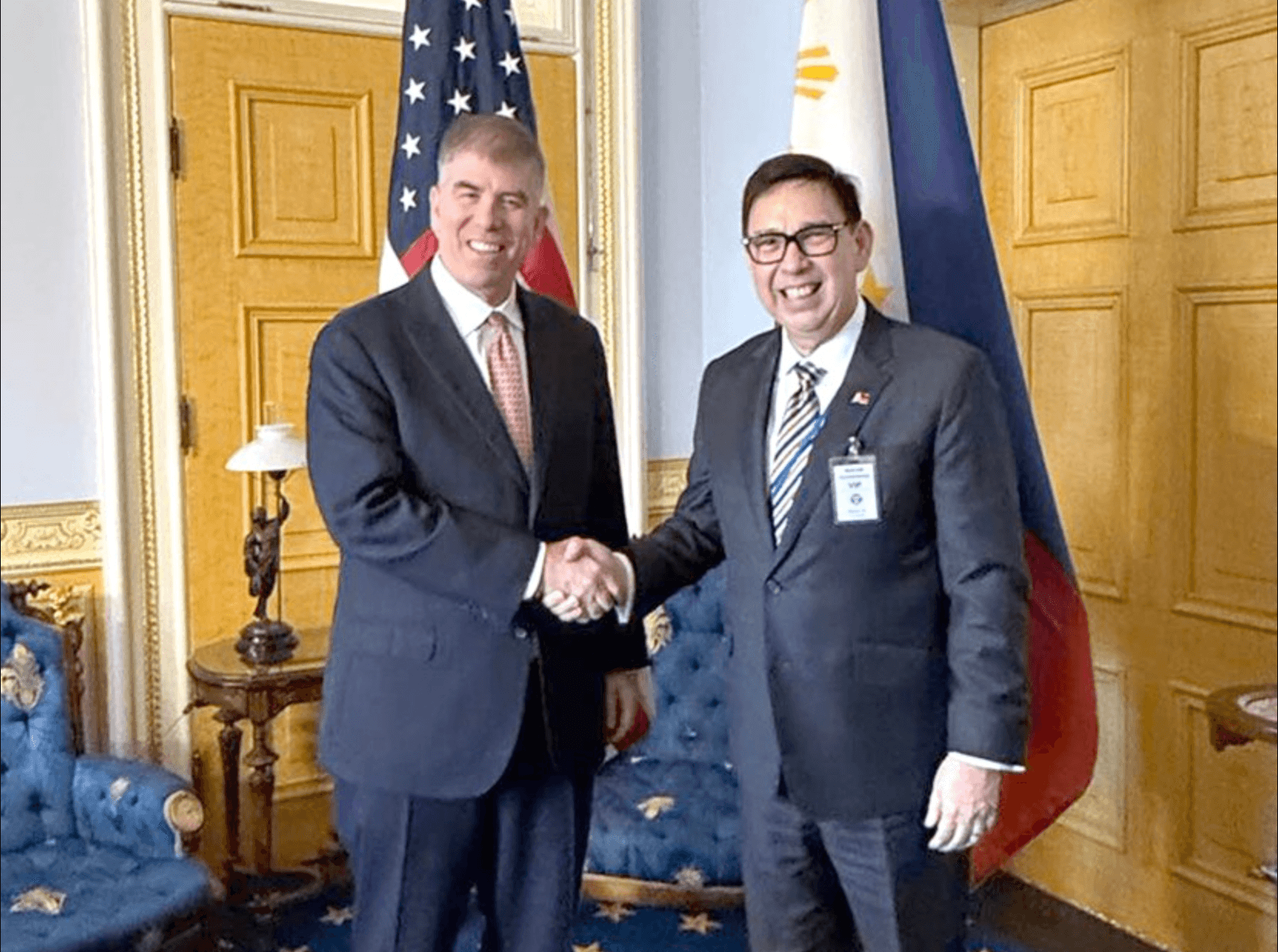

The Department of Finance (DOF) said that the US Department of the Treasury has vowed to support the country’s efforts to strengthen its tax and customs administration system. The DOF said the commitment was made by US Treasury Undersecretary Jay C. Shambaugh and other senior officials during a...

The Department of Finance (DOF) has assured the public that the national government is fully prepared financially to support relief and rehabilitation efforts in areas impacted by the devastation of Typhoon Kristine. Finance Secretary Ralph G. Recto said the government has adequate funds available...

By DERCO ROSAL Amid concerns about a potential Donald Trump victory and its impact on global trade, President Marcos’ chief economic manager expressed optimism about the Philippines' strong relationship with Washington and projected a surge in investment from US companies. In a briefing in...

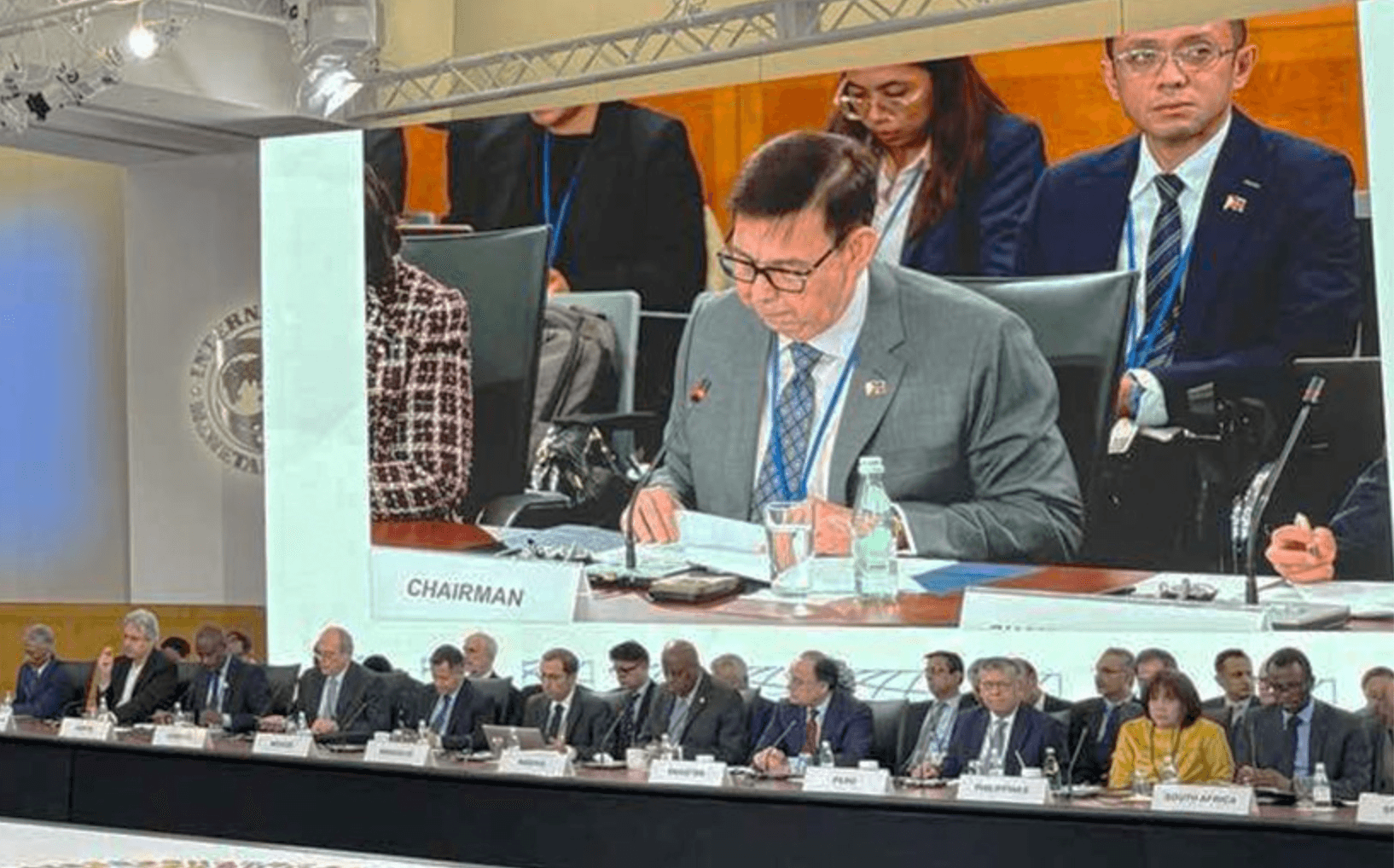

By DERCO ROSAL The Department of Finance (DOF) is urging swift action to finalize a new climate financing framework by next year, aiming to help developing countries balance growth and tackle climate challenges. As a major element of the Paris Agreement, the country is calling for the completion of...

The Department of Finance (DOF) reported that collections from the government’s two main tax agencies showed strong double-digit growth in the first nine months of the year. The Bureau of Internal Revenue (BIR) and the Bureau of Customs collectively gathered P2.771 trillion from January to...

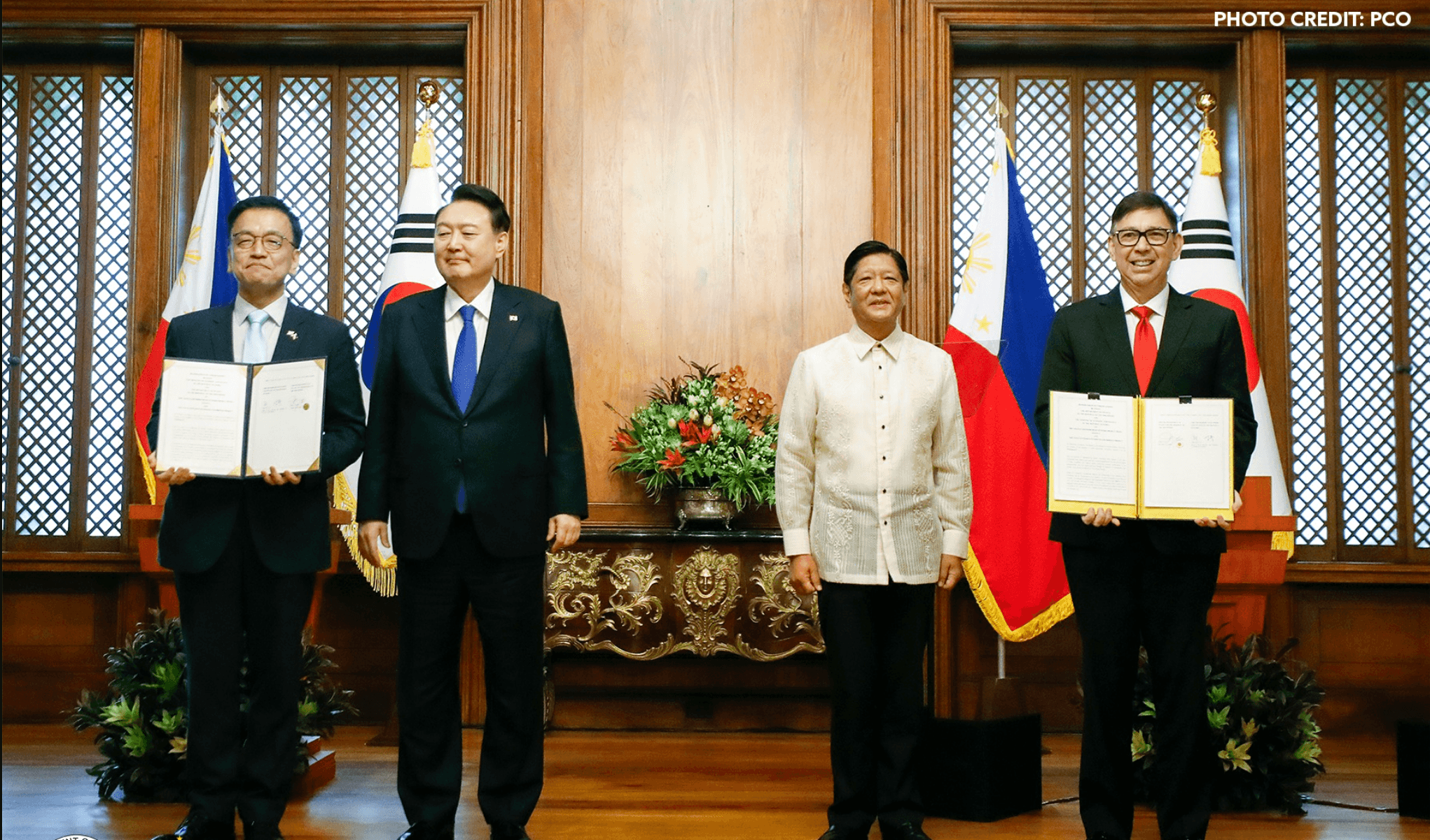

By DERCO ROSAL After securing the deal, President Marcos’ chief economic manager stated that South Korea’s funding for three major infrastructure projects will create more jobs and expand businesses in the country. “Beyond enhancing mobility, they will create jobs, spur businesses, boost...

The proposed Capital Market Efficiency Promotion Act (CMEPA) being pushed by the Legislative-Executive Development Advisory Council (LEDAC) has removed the planned reimposition of excise tax on pick-up trucks such that the bill, if passed into law, would result in foregone revenues for the...

The Philippine Chamber of Commerce and Industry (PCCI) said that the imposition of value-added tax (VAT) on non-resident digital service providers creates a fairer competitive landscape for local businesses. In a statement, Enunina Mangio, PCCI president, said the recent signing of the VAT on...

The Philippine government is seeking a one-year extension and partial reallocation of a World Bank loan that has been partly funding the Pantawid Pamilyang Pilipino Program (4Ps) since 2021. A World Bank restructuring paper showed that the Department of Finance (DOF) on Sept. 17 requested the...

The Department of Finance (DOF) expects to generate P102.12 billion over the next five years from a new law that imposes a 12-percent value-added tax (VAT) on both local and foreign digital service providers (DSPs). According to the DOF, the estimated revenues to be collected from 2025 to 2029 will...