Debt payments made by the government decreased in February due to lower principal payments made to domestic creditors, data from the Bureau of the Treasury showed. The national government's debt servicing reached P293.61 billion last February, 22 percent lower than the P375.71 billion paid out in...

The Bureau of the Treasury reported that the Marcos administration significantly increased its borrowing in February this year, primarily from the domestic market. In the second month of 2024, the national government's gross borrowings totaled P419.97 billion, higher by 22 percent compared to...

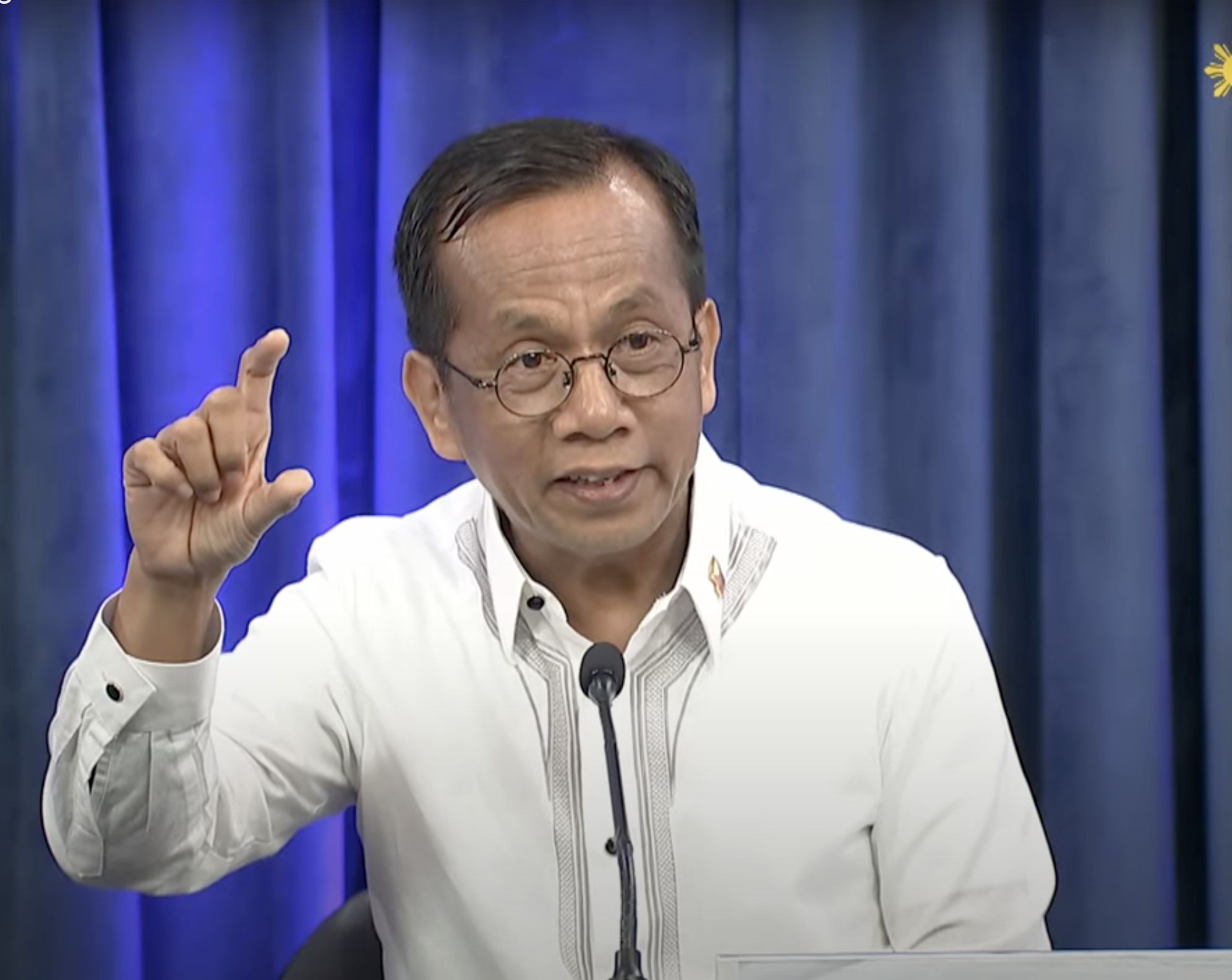

The government’s revenue collections will be impacted by the downward revision of the gross domestic product (GDP) but should be offset by improvement in their tax administration, according to National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan. During a Malacañang...

The national government's debt surpassed the P15-trillion mark in February. According to the Bureau of the Treasury's report on Wednesday, April 3, government debt load soared by P388 billion in February alone on the back of borrowing spree from domestic lenders. The borrowing during the month...

The Bureau of the Treasury reported that the national government has spent over three times on debt payments in the first month of the year due to significant amortization obligations. In January 2024, the government's debt servicing expenses totaled P158.9 billion, a substantial 232 percent...

The Philippines’ total external debt (EDT) rose by $14.1 billion or by 12.7 percent to $125.4 billion in 2023 from the end-2022 level of $111.3 billion, driven by net availments of $9.2 billion, bulk of which were net borrowings by the national government. The Bangko Sentral ng...

The national government increased its debt service by almost a quarter last year as payments for interest and amortization soared. Data from the Bureau of the Treasury showed that the Marcos administration’s debt payments reached P1.6 trillion from January to December 2023, higher 24 percent than...

The Bureau of the Treasury borrowed P15 billion from the local debt market through its successful auction of Treasury bills (T-bills) on Monday, March 4. Averages rates continued to move up during the auction, with all the tenors fetching slightly higher rates. Robust investor demand also marked...

President Marcos took out slightly more loans last year to finance the government's operations and projects. Based on the Bureau of the Treasury's data, the national government's gross borrowings increased by 1.4 percent to P2.193 trillion between January and December 2023 from P2.163 trillion in...

The national government's debt is edging closer to the P15 trillion mark, fueled by increased borrowing to cover the budget deficit, data from the Bureau of the Treasury showed. In January 2024, the government's total debt rose by eight percent to P14.79 trillion from P13.698 trillion in the same...

Filipino families tend to be more cautious and conservative in their approach to debt when compared to their neighbors in Southeast Asia. With a debt ratio of only 12.6 percent, Philippine households recorded the lowest debt burden compared to those in Indonesia, Vietnam, Singapore, Malaysia, and...

The news of the country's debt nearing P15 trillion is undoubtedly alarming. It raises the question of why the government continues to borrow extensively, despite its significant indebtedness. While many Filipinos tend to avoid borrowing, viewing debt as inherently negative and a sign of poor...