The Court of Tax Appeals (CTA) has denied for lack of jurisdiction the petition of Suburbia Automotive Ventures, Inc. against the P46.05 million tax assessments issued by the Bureau of Internal Revenue (BIR). The BIR issued a preliminary assessment notice (PAN) dated Sept. 6, 2010 assessing...

The Court of Tax Appeals (CTA) has denied the petition of Nippon Express Philippines Corporation for a tax refund of P18.7 million from the Bureau of Internal Revenue (BIR). Nippon Express filed an application for tax credits or refunds before the BIR on July 13, 2020 in the amount of...

Senator Sherwin Gatchalian has called on the Department of Finance (DOF) and the Bureau of Internal Revenue (BIR) to immediately suspend a rule requiring members of cooperatives to obtain their respective tax identification numbers (TINs) before they are granted tax exemption privileges. ...

While businesses involved in ghost selling have paid over ₱4.3 billion as of December 2024, the Bureau of Internal Revenue (BIR) chief expects this amount to double to at least ₱8 billion once ongoing assessments are completed. Earlier this month, the BIR reported that the Run After Fake...

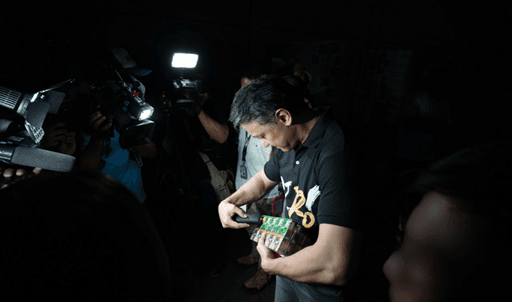

The Bureau of Internal Revenue (BIR) has commenced the nationwide destruction of confiscated untaxed cigarettes valued at ₱2.1 billion. The operation, which runs from today until the end of the month, aims to eliminate illicit tobacco products and prevent them from re-entering the market. BIR...

The Bureau of Internal Revenue (BIR) has filed tax evasion cases against individuals involved in a large-scale illicit cigarette operation in Bulacan and Valenzuela, following a raid last November. In a statement on Monday, Feb. 17, BIR Commissioner Romeo D. Lumagui Jr. said the bureau filed an...

BIR officers are providing clear explanations and step-by-step guidance to help taxpayers navigate the system. The TCVD emphasizes education and support, fostering a collaborative approach to fiscal responsibility. A friendlier, more sustainable approach to tax compliance is gaining traction...

The Bureau of Internal Revenue (BIR) will aggressively continue its campaign against ghost receipts, illicit vape products, and illegal cigarettes throughout 2025, Commissioner Romeo D. Lumagui Jr. announced. Lumagui's statement follows President Ferdinand Marcos Jr.'s recent warning during the...

Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui Jr. expressed optimism that the agency can achieve its ₱3.2 trillion revenue target for this year, provided major tax measures are passed. If achieved, this would mark a second consecutive year of the BIR, the government’s main tax...

Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui Jr. expressed openness to a proposed moratorium on the annual increase in excise taxes on tobacco products, provided that the agency's tax collection targets are revised accordingly. "One issue that we will be [facing] moving forward if...

Senator Sherwin Gatchalian has called for a congressional inquiry into a Bureau of Internal Revenue (BIR) requirement that allegedly threatens the tax exemption privileges of cooperatives. Gatchalian is referring to the requirement for cooperative members to present a Tax...

While the Bureau of Internal Revenue (BIR) expressed optimism about repeating its historic beyond-target collection in 2025, achieving the double-digit growth target this year will be challenging for the Bureau of Customs (BOC), President Marcos’ chief economic manager said. Department of Finance...