Amid heightened uncertainties wrought by US President Donald Trump’s tariffs, a cautious Bangko Sentral ng Pilipinas (BSP) is seen to resume policy easing by April at the earliest after last week’s pause. Think tank Capital Economics said in a Feb. 18 report that rising interest rates in...

President Marcos’ chief economic manager stated that low and steady inflation in January gives the central bank room to cut key borrowing costs further to spur economic growth. “This is a strong indicator of the government’s commitment to keeping prices stable and signals that the BSP...

BAGUIO CITY — Another policy rate cut could be possible at the next Monetary Board (MB) meeting as the Philippine economy grows below capacity, according to the central bank’s governor. During a media information session, Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. told...

While the Philippine economy has likely accelerated further in the last three months of 2024, majority of the private-sector economists polled by Manila Bulletin doubt its degree was enough to reach the government’s growth target. Following the lower-than-expected quarter-three gross...

President Marcos expressed his gratitude to the Philippines' international partners as he highlighted the country's strides in diplomacy and economic growth. President Ferdinand 'Bongbong' Marcos Jr. (Manila Bulletin file photo) Marcos said this as he hosted a New Year Vin D'Honneur for members of...

The Philippine central bank’s third consecutive interest rate cut this year has prompted private sector economists to anticipate continued easing, citing sluggish economic growth and subdued inflation. On Dec. 19, the Monetary Board (MB) reduced the key borrowing cost by 25 basis points (bps),...

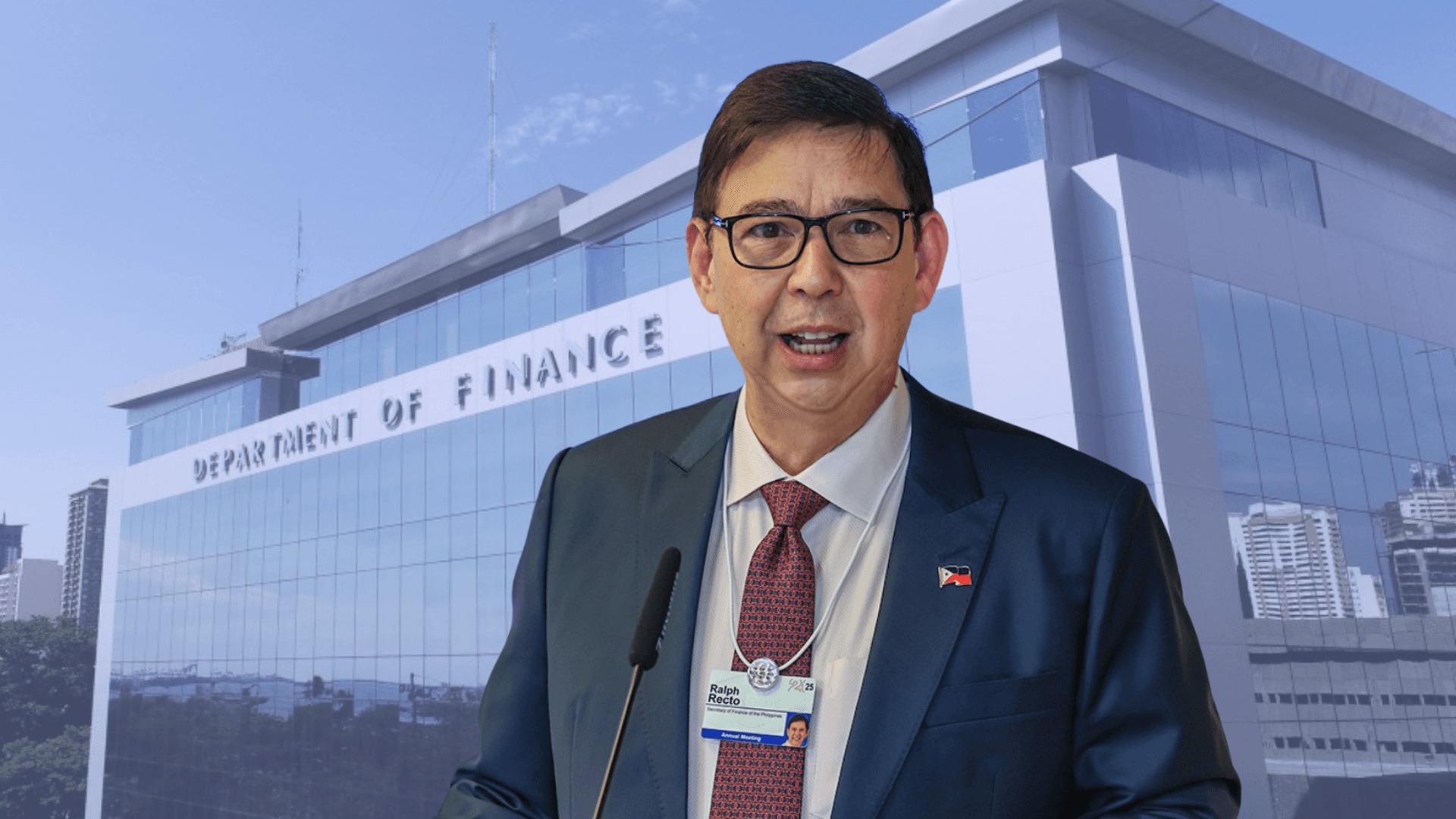

Monetary Board (MB) member and Department of Finance (DOF) Secretary Ralph G. Recto aligned with market consensus, expecting that the central bank will likely reduce its key borrowing cost by 25 basis points during its final policy meeting on Thursday, Dec. 19. "I agree with the market consensus of...

With inflation remaining within the government's target range and economic growth slowing, private sector economists expect that the Bangko Sentral ng Pilipinas (BSP) will further reduce its borrowing cost at its Dec. 19 meeting. According to the Bank of the Philippine Islands (BPI) and think tanks...

Singapore-based United Overseas Bank (UOB) anticipates the Philippine central bank will lower borrowing costs in December, citing manageable inflation and rising risks to economic growth. “Monetary policy is well-positioned for what lies ahead,” said Julia Goh, senior economist at executive...

With consensus expectations that inflation modestly accelerated in November, most economists polled by Manila Bulletin anticipate the Bangko Sentral ng Pilipinas (BSP) will proceed with cutting borrowing costs during its Dec. 19 policy meeting. Private-sector economists who are monitoring the...

By DERCO ROSAL The International Monetary Fund (IMF) expects a wave of interest rate cuts among Asian central banks, driven by strong economic performance, even as it cautions that trade fragmentation could hinder global growth. Domestic demand in advanced Asia is set to strengthen, while emerging...

Moody’s Analytics is projecting that the Bangko Sentral ng Pilipinas (BSP) will further reduce its key interest rate by another 25 basis points (bps) in December. According to Moody’s Analytics, this forecast is based on the country's continued low inflation rates and stable price...