Senator Jinggoy Ejercito Estrada is now pushing for a bill seeking to lower the individual income tax rates to increase the take-home pay of workers, particularly for low and middle-income earners. In filing Senate Bill No. 1685, Estrada proposes to adjust tax brackets starting in 2027 by amending...

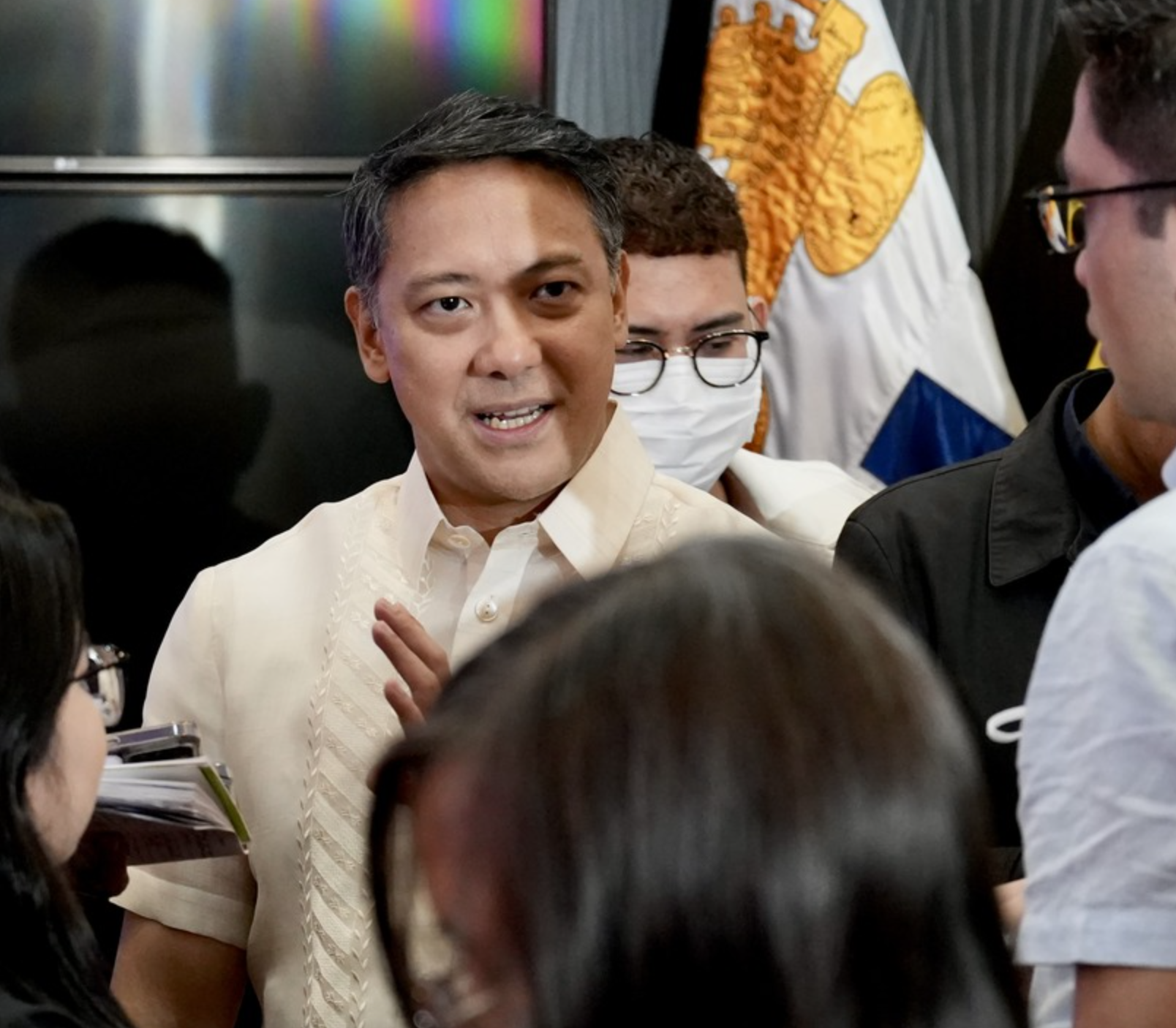

(MANILA BULLETIN) On Labor Day, Alyansa para sa Bagong Pilipinas senatorial candidate Benhur Abalos batted for higher income tax exemption levels, as he reckoned that workers deserve greater financial relief amid continuing inflation...

BIR Commissioner Romeo D. Lumagui Jr. Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui Jr. is confident that the government’s main tax agency will meet its ₱3.23 trillion collection goal this year after it exceeded its first quarter targets. “Based on the progress of...

The Court of Tax Appeals (CTA) has ordered a businessman to pay the Bureau of Internal Revenue (BIR) P6.6 million in deficiency income and value-added taxes of his company for calendar year 2016. Redentor Agpuldo Tagala, proprietor of 7th Concept Trading and 7C Construction, filed a petition for...

President Marcos’ chief economic manager stated that he expects an additional P300 billion to be injected into the government’s treasury over the next five years following the planned revision of existing passive income tax law. Department of Finance (DOF) Secretary Ralph G. Recto, during...

Online marketplaces like Facebook and Shopee may be shut down if unregistered online sellers are still able to sell on their platforms, Bureau of Internal Revenue (BIR) Commissioner Romeo D. Lumagui Jr. said. Lumagui told reporters on Wednesday, July 17, that online sellers whose businesses are not...

By CZARINA NICOLE ONG KI The Court of Tax Appeals (CTA) has denied the P262 million tax refund claimed by Ford Group Philippines, Inc. for the firm's alleged excess and unutilized creditable withholding taxes (CWT) for 2018. Ford filed its Application for Tax Credits/Refunds before the Bureau of...

For lack of jurisdiction, the Court of Tax Appeals (CTA) has dismissed the petition filed by Friendlycare Foundation, Inc. which challenged the P10.3 million deficiency income tax and value-added tax assessed by the Bureau of Internal Revenue (BIR) for taxable year 2014. The petition was filed by...

The Court of Tax Appeals (CTA) has granted the petition of former Chief Justice Maria Lourdes P.A. Sereno against her alleged P6.9 million deficiency income taxes, surcharges, and interests for taxable years 2011 to 2016. In a decision promulgated last May 14 by its special second division, the CTA...

Most taxpayers have already fulfilled their annual tax filing obligations ahead of the deadline, the Bureau of Internal Revenue (BIR) reported. BIR Commissioner Romeo D. Lumagui Jr. said that 95 percent of registered taxpayers have filed and paid their 2023 income tax returns (ITR) prior to the...

The Bureau of Internal Revenue (BIR) has clarified that not all online sellers are obligated to follow the government’s withholding tax regulations. In a statement, the BIR said that electronic marketplace operators and digital financial service providers, such as Lazada and Shopee, are required...

(Noel Pabalate/ MANILA BULLETIN) The House of Representatives and the Senate have approved in the bicameral conference committee meeting an amendment to the National Internal Revenue Code exempting overseas Filipino workers (OFWs) who derive their income...