The Marcos administration is planning to borrow P200 billion from domestic creditors in the first month of next year to finance the government’s budget deficit, data from the Bureau of the Treasury showed. Based on a Treasury memorandum posted on its website, the national government has raised...

The Bureau of the Treasury cancelled its last borrowing plan for the year given the government’s better than expected revenue collection performance, resulting in lower borrowing than originally planned. National Treasurer Rosalia V. De Leon said on Monday, Dec. 12, that the bureau already...

Debt payments of the national government dropped by more than half in October this year due to lower amortization, data from the Bureau of the Treasury showed. Marcos administration’s debt servicing reached P39.82 billion in October, down 55 percent more O89.06 billion paid out in the same month...

Government debt stock rose anew in October this year due to new loans and weakening peso, data from the Bureau of the Treasury revealed. As of October 2022, the national government’s outstanding debt stood at P13.641 trillion, up 14 percent compared with P11.971 trillion in the same period last...

The Bureau of the Treasury made a full-award on Tuesday, Dec. 6, after the benchmark interest rate on debt falling due in almost 12-years settled within the secondary market levels. The interest rate of the reissued 25-year IOUs, with a remaining life of 11-years and 11-months, fetched 7.189...

Benchmark yields for short-term loans moved sideways, prompting the Bureau of the Treasury to reject bids for one-year notes. At Monday's auction of Treasury bills on Dec. 5, the bellwether 91-day Treasury bill rate dropped to 4.089 percent from 4.205 percent last week. This is also lower than the...

Borrowings of the national government rose last October due to President Marcos’ maiden issuance of offshore commercial bonds, data from the Bureau of the Treasury revealed. Gross financing of the Marcos administration stood at P182.42 billion in October this year, higher by 25 percent compared...

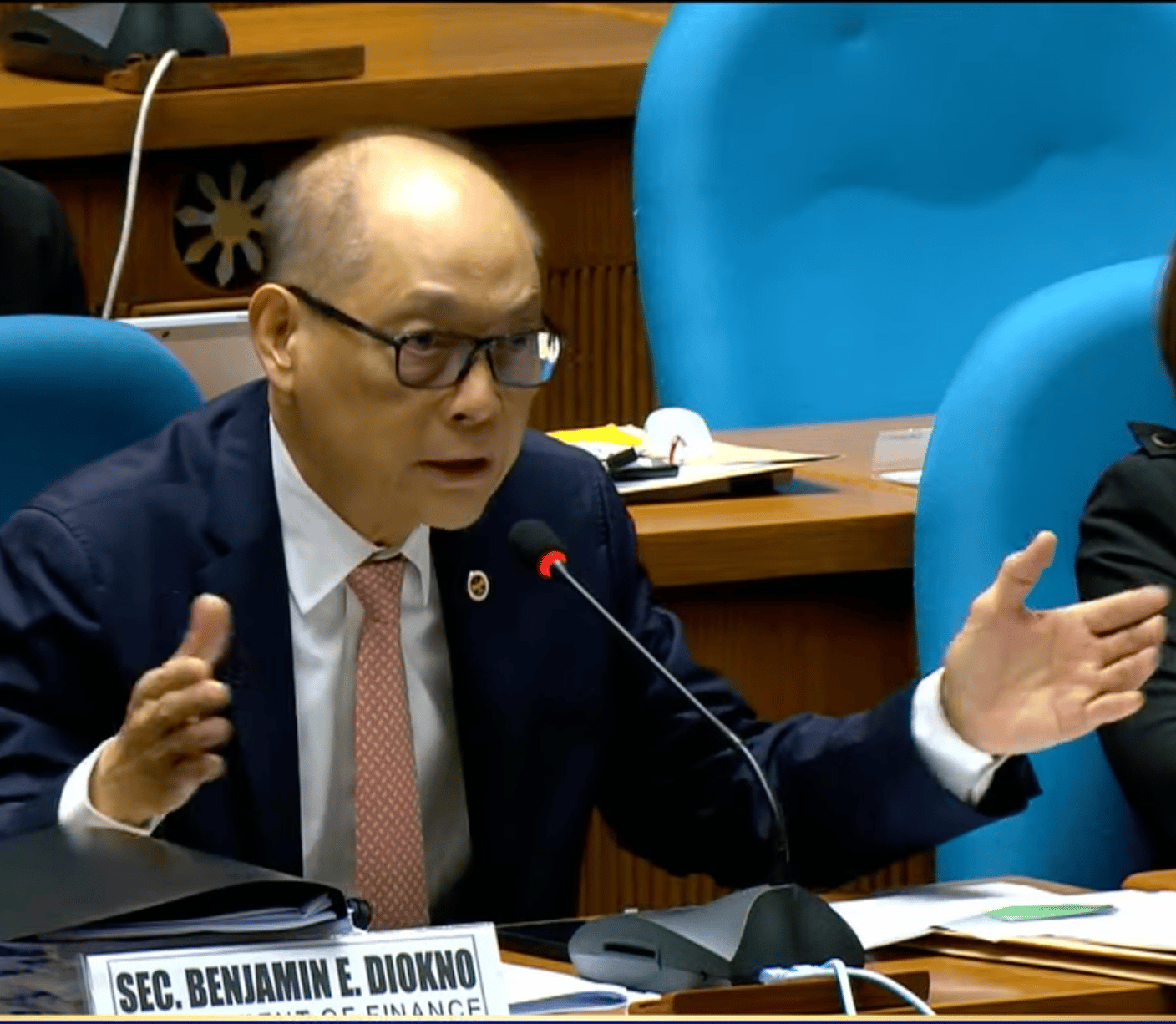

The Marcos administration plans to borrow more in US dollars as the Department of Finance (DOF) said the government is looking at tapping the hard-earned savings of overseas Filipino workers (OFWs). During a Kapihan sa Manila Bay Forum on Wednesday, Nov. 30, DOF Secretary Benjamin E. Diokno said...

Benchmark yields for short-term loans moved sideways, prompting the Bureau of the Treasury to partially borrow. At Monday's auction of Treasury bills on Nov. 28, the bellwether 91-day Treasury bill rate dropped to 4.205 percent from 4.375 percent last week. This, however, is higher than the...

The Department of Finance (DOF) remained confident that the national government’s debt ratio would decline during the Marcos administration despite its recent uptick in the third-quarter. Finance Secretary Benjamin E. Diokno said the government’s ability to pay its debts continues to improve...

Domestic borrowing program of the Marcos administration for December dropped due to fewer workweeks during holiday season. Based on the Treasury advisory on Thursday, Nov. 24, the December financing plan of the Bureau of the Treasury declined by 32 percent to P135 billion from P215 billion in the...

Benchmark yields for short-term loans moved sideways, prompting the Bureau of the Treasury to partially borrow. At Monday's auction of Treasury bills on Nov. 21, the bellwether 91-day Treasury bill rate, which banks use in pricing their loans, dropped to 4.375 percent from 4.464 percent last week....