Due to the holiday season, the national government has scaled back its domestic borrowing plan for the month of December. Data from the Bureau of the Treasury showed that the Marcos administration intends to borrow just P60 billion next month, a substantial decrease from November's P225 billion....

The government's maiden borrowing in the Islamic debt market drew an overwhelming response from investors, supported by the Philippines’ robust economic fundamentals. In a statement on Thursday, Nov. 30, the Bureau of the Treasury announced that the government successfully raised $1 billion from...

The Marcos administration was able to cut the budget deficit by more than half for the year due to strong revenues, data from the Bureau of the Treasury revealed. The fiscal gap of the national government amounted to P34.4 billion last month, showing a 65 percent decrease compared to P99.1 billion...

Short-term benchmark interest rates sharply dropped anew, now below the local policy rate of 6.50 percent. At the Bureau of the Treasury auction on Tuesday, Nov. 28, the national government fully awarded its P10 billion offering. Total demand reached P72.215 billion, more than seven times higher...

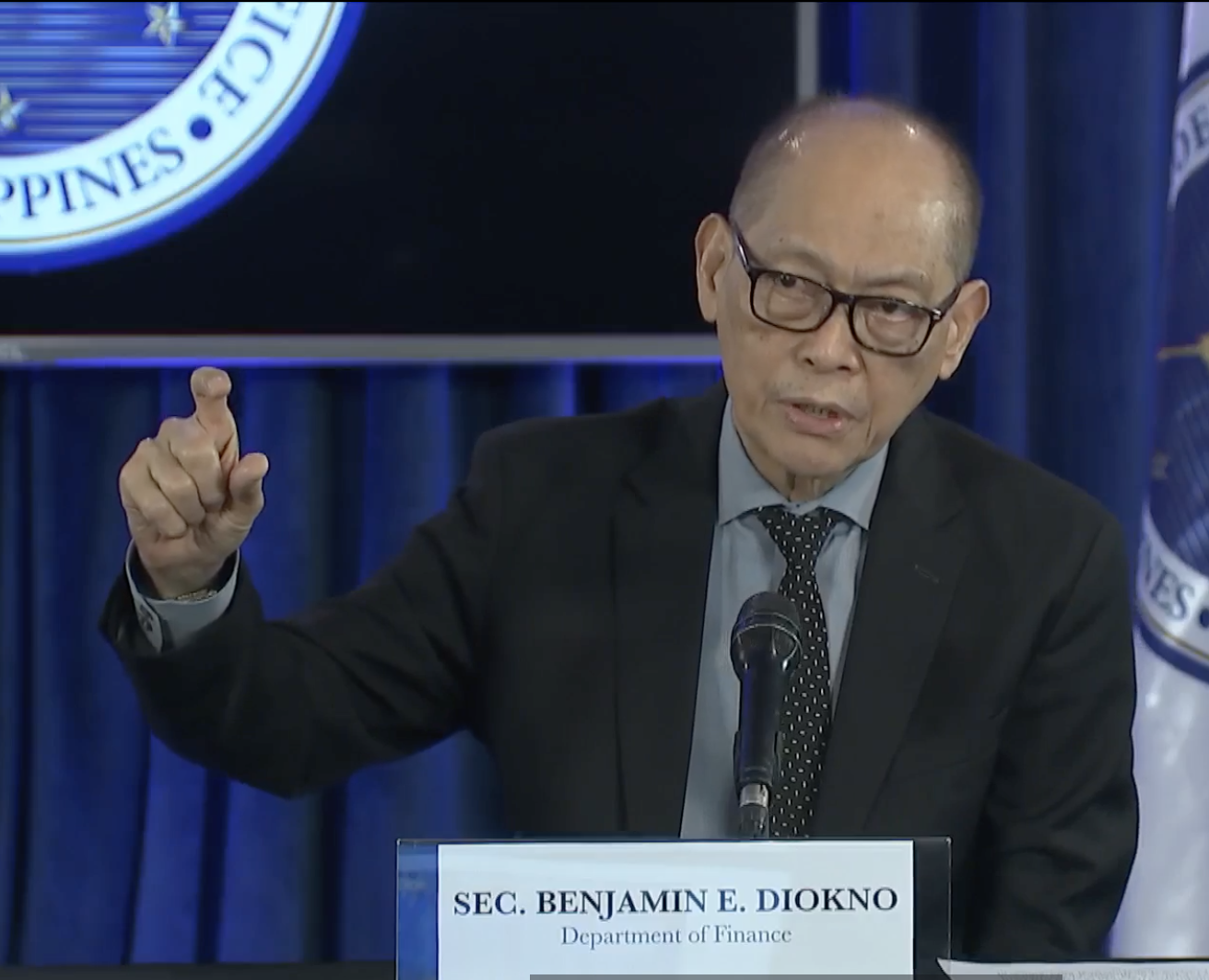

The Department of Finance (DOF) said the government’s first-ever sukuk bond offering will be settled by the middle of December this year. In a briefing on Tuesday, Nov. 28, Finance Secretary Benjamin E. Diokno said the Bureau of the Treasury has just announced the sukuk bond issuance, noting that...

Metropolitan Bank & Trust Co. (Metrobank) has been recognized by the Bureau of the Treasury (BTr) as among the 10 Top Market Maker for Government Securities Eligible Dealers (GSED) for 2024. In a statement, the bank said it brings home the title for the third consecutive year in...

The Marcos administration has mandated banks to oversee the Philippines’ first Islamic bond sale, aiming to raise at least half a billion dollars to aid in funding the government's budget shortfall. Based a document released by the Department of Finance (DOF), the national government is preparing...

The national government has fully awarded the reissued 20-year Treasury bonds (T-bonds) amid higher demands. On Tuesday, Nov. 21, the Bureau of the Treasury raised P30 billion through an auction of reissued T-bonds with a remaining life of 15 years and two months. Total tenders received were...

The country’s first-ever tokenized treasury bonds (TTBs) will promote financial inclusion and broader participation in the bond market, Department of Finance Secretary Benjamin E. Diokno said on Monday, Nov. 20. During the Bureau of the Treasury’s (BTr) 126th anniversary, Diokno commended the...

The Bureau of the Treasury has surpassed its borrowing target with the sale of the government's first tokenized bonds. Deputy National Treasurer Erwin D. Sta. Ana reported that the government's sale of one-year tokenized Treasury bonds reached P15 billion, surpassing the initially planned amount of...

The Bureau of the Treasury has decided to cancel its short-term borrowing plan for next week to give way for the government's maiden offering of blockchain-backed debt instruments. In a notice signed by Deputy National Treasurer Erwin D. Sta. Ana, the bureau has announced the cancellation of...

In a move towards embracing digitalization, the Bureau of the Treasury is set to launch its maiden tokenized bond issuance, aiming to raise at least P10 billion. In a statement, the Treasury said these digital peso-denominated IOUs will be offered with a minimum denomination of P10 million, which...