Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. said that further cuts in banks’ reserve requirement ratio (RRR) may happen next year as the central bank looks to ramp up its liquidity management and make the yield curve more reliable. “It might be for next year. We are trying to...

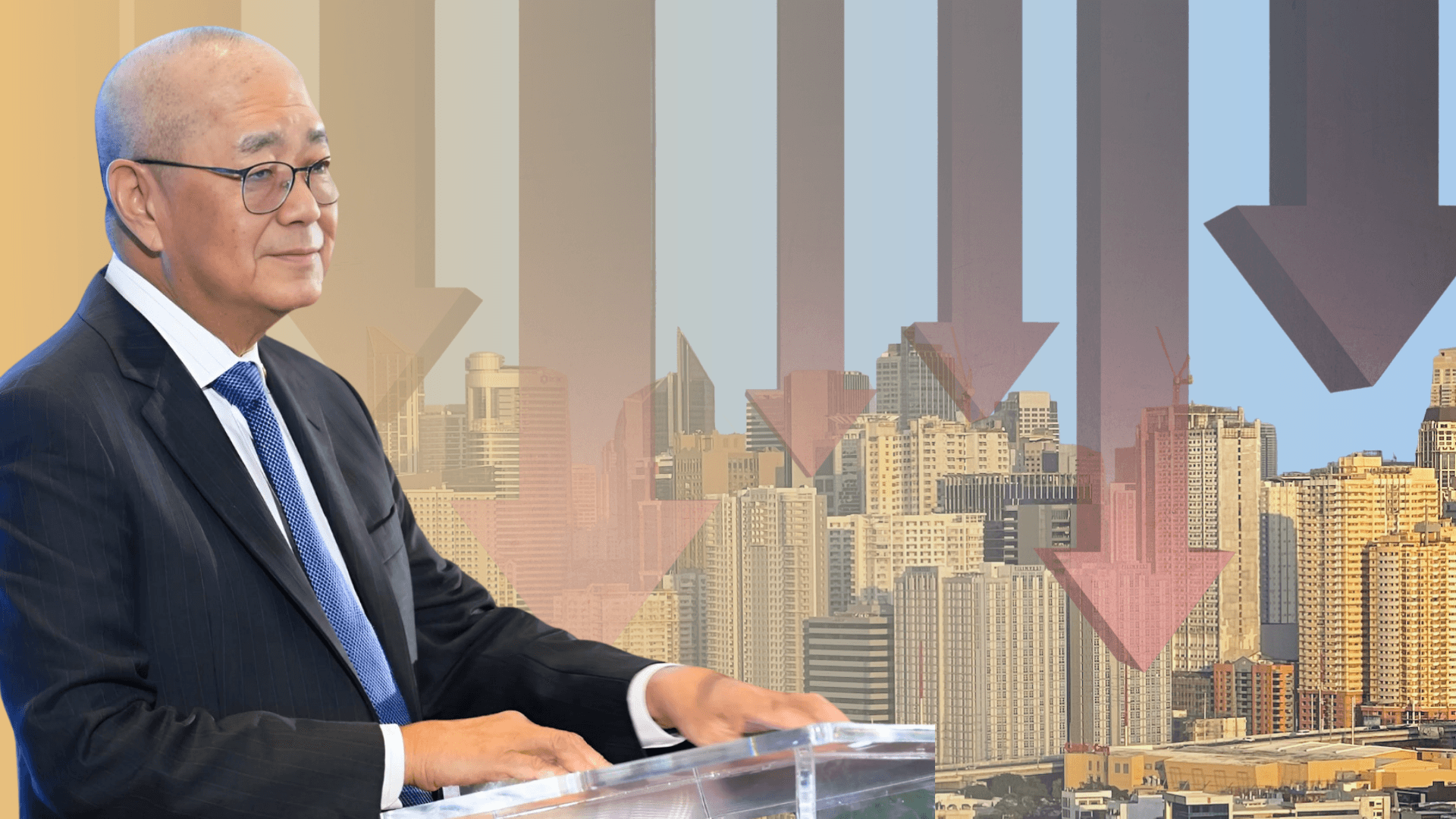

BSP Governor Eli M. Remolona Jr. Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. has confirmed that another cut in borrowing costs is possible at the upcoming April 10 monetary policy meeting, potentially bringing the key policy rate down to 5.5 percent. “When we think...

Big banks’ reserve requirements ratio (RRR) could eventually drop to zero percent by 2028 or the end of the central bank governor’s term, according to Security Bank Corp. Speaking to reporters on Wednesday, Feb. 26, Security Bank chief economist Angelo Taningco said he expects the Bangko...

Singapore-based United Overseas Bank (UOB) believes the Bangko Sentral ng Pilipinas (BSP) will no longer slash reserve requirement ratios (RRRs) beyond its across-the-board cuts announced last week. “With RRR for big banks reaching a mid-single digit as envisioned by the BSP under its medium-term...

SS Rajamouli’s RRR amazes critics worldwide SS Rajamouli's RRR is in Tollywood—not Bollywood—style. It is in Indian-Telugu language, the second most popular language in the world’s seventh largest country. SS Rajamouli RRR won best song and best foreign film at the Critics Choice Awards. It...

A scene from 'RRR' Here are two films on Netflix that showcase the spectrum of films that populate the streaming channel. One comes from India, unheralded but a delight. The second is heavily promoted, but fails miserably as a retelling of an Austen classic. RRR (Netflix India) - If you’re...

Bangko Sentral ng Pilipinas (BSP) Governor Benjamin E. Diokno is not ruling out more cuts to banks’ reserve requirement ratio (RRR) this year that would flood more money supply or liquidity sloshing around the financial system. “Further cuts on the RRR remain on the table but it could depend on...

To comply with the reserve requirement, banks have released P14.9 billion more loans to micro, small and medium enterprises (MSME) for the month of September alone, based on Bangko Sentral ng Pilipinas (BSP) data. MB file photo. This brings the average daily balance of bank loans to MSMEs to P120.9...

The central bank will continue to count loans to micro, small, and medium enterprises (MSMEs) as well as qualified large enterprises as part of compliance with the reserve requirements until end-2022 to extend relief measures to banks and non-banks and to provide funding to businesses hit by the...