The dual-tranche P5-billion ASEAN green bonds issuance of Lopez-led Energy Development Corporation (EDC) has been rated as the “best local currency green bond” by the Triple A Awards 2021, which is part of The Asset, a financial multi-media group. In a statement to the media, EDC noted that the...

Alcantara-led Alsons Consolidated Resources Inc. (ACR) cornered a credit rating upgrade by Philippine Rating Services Corporation (PhilRatings) for its P3.0 billion commercial papers (CP) issuance. The credit rating improvement to PRS Aa minus (corp), according to PhilRatings, was largely credited...

Yuchengco-led Rizal Commercial Banking Corporation has successfully listed its P14.76 billion Series E ASEAN Sustainability Bonds due 2024 on the Philippine Dealing and Exchange Corporation. Carrying a coupon of 3.00 percent per annum, the bonds saw strong demand from investors which resulted in an...

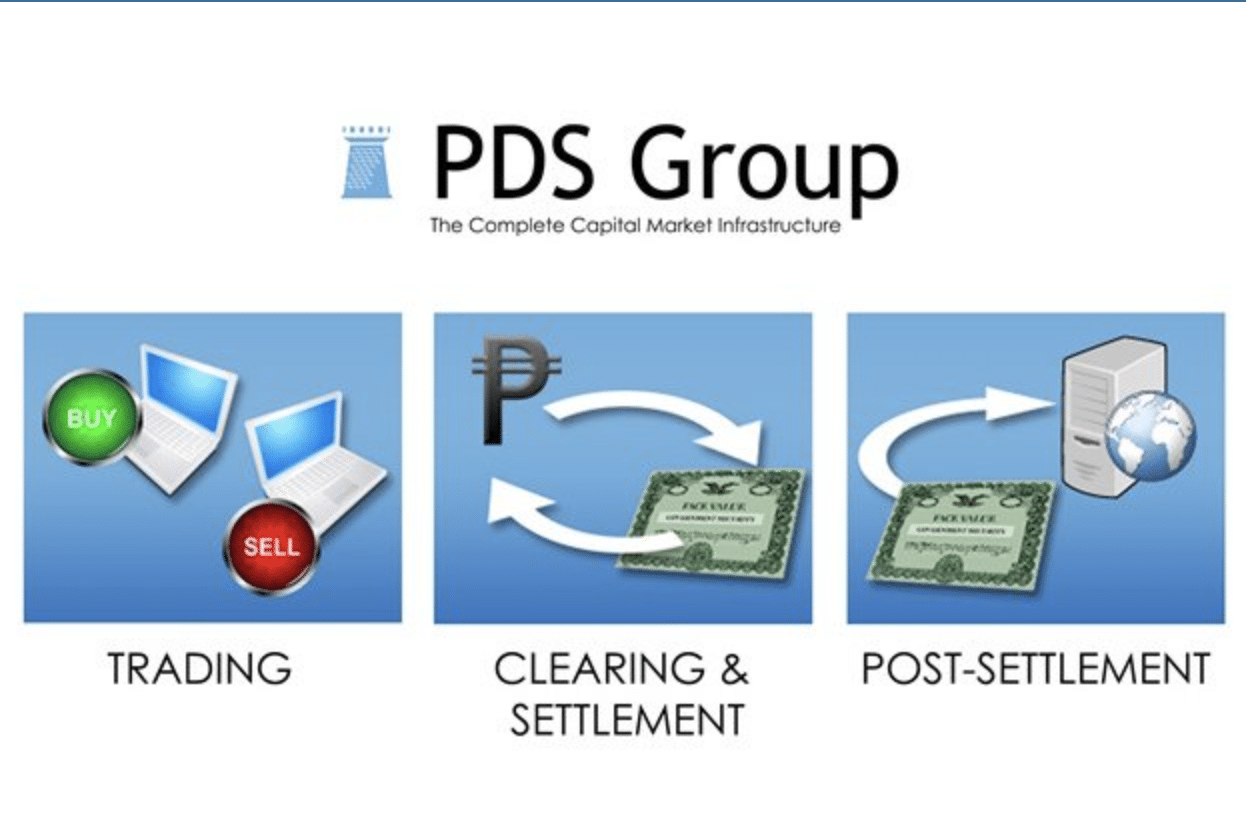

The Philippine Dealing System Holdings Corp. (PDS) plans to launch the country’s first-ever digital corporate bond next month as part of its initiatives to utilize digital technologies to deepen the domestic capital market. In a report to the Capital Market Development Council (CMDC), Antonino...

Hybrid rice seeds producer-SL Agritech Corp. (SLAC) has raised nearly P2 billion through another commercial paper issuance as the company gears for local and overseas expansion. On Wednesday, Dec. 20, SLAC formally listed its P1.86 billion worth of short-term commercial papers at the country’s...

SM Prime Holdings Inc., one of the leading integrated property developers in Southeast Asia, has successfully listing its P10 billion Retail Bond Series O at the Philippine Dealing & Exchange Corp. (PDEx). In a statement, the firm said SM Prime Chief Finance Officer John Nai Peng C. Ong and...

Alcantara-led Alsons Consolidated Resources Inc. (ACR) has listed with the Philippine Dealing and Exchange Corporation (PDEx) the P600 million second tranche of its commercial papers (CP) issuance. That portion of the CP offer is part of the P3.0 billion CP program that the company had registered...

Real estate giant Ayala Land, Inc. (ALI) has successfully listed its new P3 billion 4.0776 percent p.a. fixed rate bonds in a virtual ceremony at the Philippine Dealing and Exchange Corporation (PDEX). The 10-year bond listing due 2031 is part of ALI’s newly approved third shelf registration...

Leading oil firm Petron Corporation has accomplished on Tuesday, Oct. 12, its listing with the Philippine Dealing and Exchange Corporation (PDEx) for the P18-billion first tranche of its fixed rate peso-denominated retail bonds. That bond issue will be the initial fund-raising activity of the oil...

D&L Industries has successfully listed its maiden bond offering at the Philippine Dealing and Exchange Corporation (PDEx) after being oversubscribed by both individual and institutional investors. The firm raised ₱5 billion from the issuance of Peso-Denominated Fixed-Rate Bonds consisting of...

Alcantara-led Alsons Consolidated Resources Inc. (ACR) has listed the P1.4 billion first tranche of its commercial papers (CP) issuance with the Philippine Dealing and Exchange Corporation (PDEx), the company announced on Friday. That fraction of the issuance will be the initial part of the P3.0...

Leading oil firm Petron Corporation will be issuing P50 billion worth of peso-denominated fixed rate bonds – and the initial tranche to be offered to the public will be P18 billion. In a disclosure to the Philippine Stock Exchange (PSE), the oil company emphasized that it will slate P50 billion...