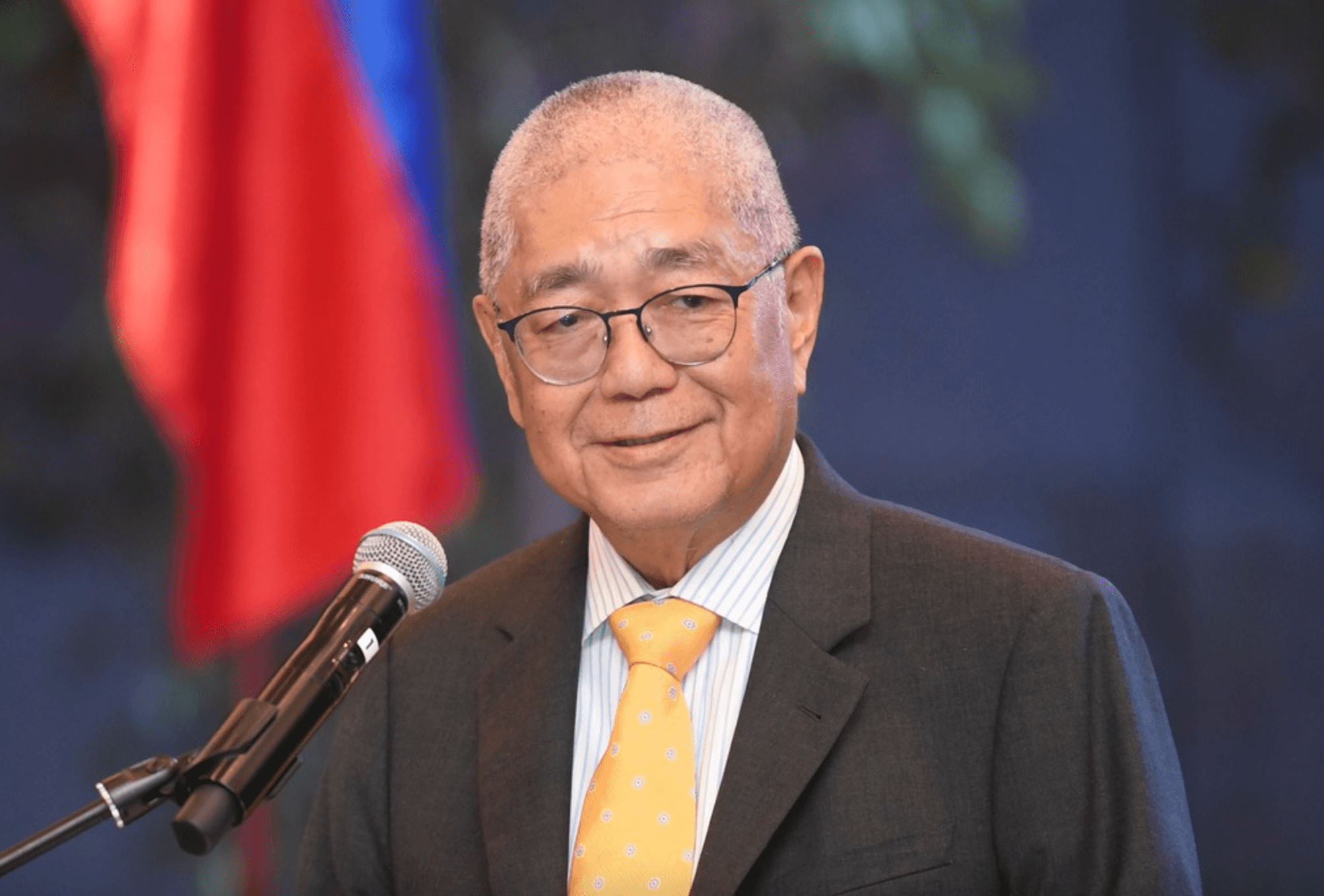

BSP Governor Eli Remolona Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. is optimistic that the resumption of monetary policy easing will help narrow the gap between the economy’s subpar output growth and its full potential. “I hope so. That’s [policy easing] our main tool. We...

With the Bangko Sentral ng Pilipinas (BSP) resuming cuts on borrowing costs, private-sector economists expect the central bank to slash the key interest rate by an additional three-quarter point by the end of 2025. This followed the Monetary Board (MB) decision to reduce the policy rate by 25 basis...

The Bangko Sentral ng Pilipinas (BSP) is expected to finally push through with its much-awaited reduction in key interest rates to protect the economy from the likelihood of a wider negative outlook gap, no thanks to United States (US) President Donald Trump's reciprocal tariffs. In an April 4...

Amid tariff war-saturated global uncertainty and rising domestic prices, the potential for an inflation surge weighs heavily on the central bank's contemplated April 10 interest rate reduction. Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. said in an interview with Bloomberg...

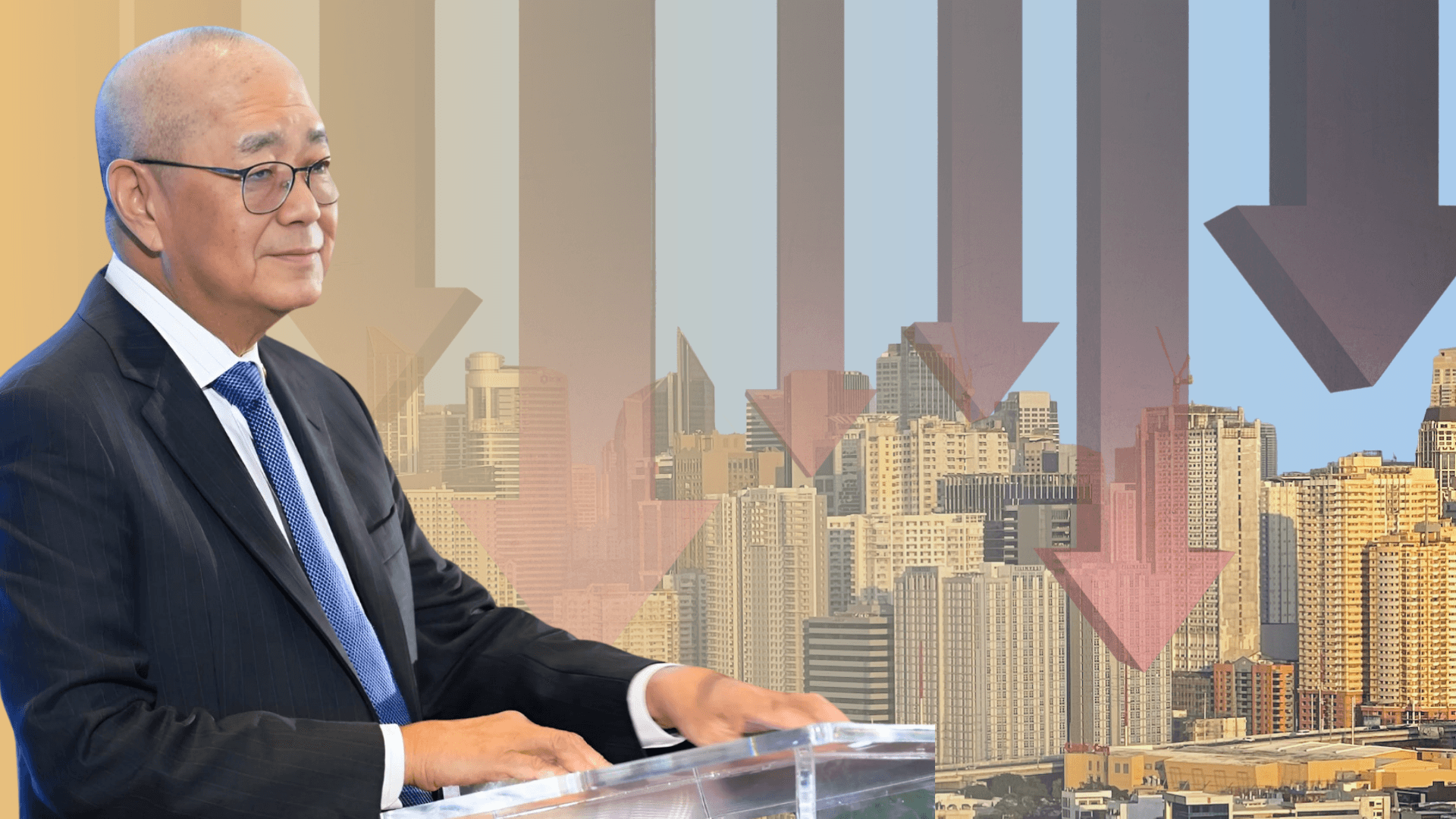

Finance Secretary Ralph G. Recto President Marcos’ chief economic manager and representative in the Monetary Board (MB) has projected a 75-basis point (bp) reduction in the central bank’s interest rates this year, anticipating this would catalyze economic growth to seven percent or...

BSP Governor Eli M. Remolona Jr. Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. has confirmed that another cut in borrowing costs is possible at the upcoming April 10 monetary policy meeting, potentially bringing the key policy rate down to 5.5 percent. “When we think...

If the Bangko Sentral ng Pilipinas (BSP) prolongs its monetary policy easing pause, it may be forced to implement steeper interest rate reductions later, as persisting economic weakness threatens growth, according to Deutsche Bank. "Delaying further rate cuts could risk the BSP having to do more in...

Singapore-based United Overseas Bank (UOB) believes the Bangko Sentral ng Pilipinas (BSP) will no longer slash reserve requirement ratios (RRRs) beyond its across-the-board cuts announced last week. “With RRR for big banks reaching a mid-single digit as envisioned by the BSP under its medium-term...

Amid heightened uncertainties wrought by US President Donald Trump’s tariffs, a cautious Bangko Sentral ng Pilipinas (BSP) is seen to resume policy easing by April at the earliest after last week’s pause. Think tank Capital Economics said in a Feb. 18 report that rising interest rates in...

By DERCO ROSAL As another Bangko Sentral ng Pilipinas (BSP) interest rate cut looms, economists and bankers are citing various factors entailing easy monetary policy, including slowing inflation and economic growth. Bank of the Philippine Islands (BPI) lead economist Emilio S. Neri Jr. also expects...

Filipinos do not need to worry about rising extra rice prices, as they are projected to fall due to better global supply, allowing the Bangko Sentral ng Pilipinas (BSP) to speed up the lowering of borrowing costs in the coming months, according to British banking giant HSBC. Aris Dacanay, chief...

Finance Secretary Ralph G. Recto said that inflation may have already reached its highest point, projecting a gradual decline in the rate of food price increases in the coming months. Recto stated that the continued moderation in inflation may lead the Bangko Sentral ng Pilipinas (BSP) to consider...