Department of Finance (DOF) Secretary Ralph G. Recto said that key borrowing costs are unlikely to drop to pre-pandemic level amid expectations that the US Federal Reserve (Fed) will slow down its policy rate reduction. According to the finance chief, the market expectation for 2025 is for...

President Marcos' chief economic manager expects further appreciation of the peso against the US dollar, driven by increased remittance inflows during the upcoming holiday season. In a briefing on Tuesday, Sept. 24, Finance Secretary Ralph G. Recto explained that the local currency typically...

The Bangko Sentral ng Pilipinas' (BSP) monetary policy easing cycle is expected to extend until the first half of 2025, to slash the key interest rate to 4.75 percent, according to the think tank Capital Economics. "The central bank [BSP] cut interest rates at its August meeting. With growth set to...

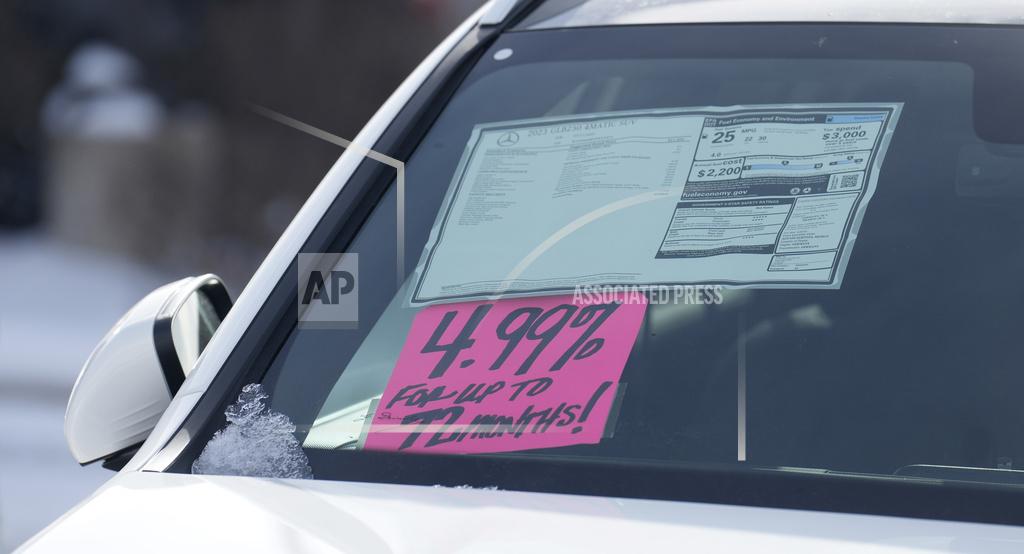

NEW YORK — Mortgage rates, credit card rates, auto loan rates, and business loans with variable rates will all likely maintain their highs, with consequences for consumer spending, after the Federal Reserve indicated Wednesday that it doesn't plan to cut interest rates until it has "greater...

WASHINGTON — The Federal Reserve on Wednesday emphasized that inflation has remained stubbornly high in recent months and said it doesn't plan to cut interest rates until it has "greater confidence" that price increases are slowing sustainably to its 2% target. The Fed issued its decision in...

Filipinos looking to take out loans for major expenses can find some relief, as the Department of Finance (DOF) expects that interest rates are likely to remain steady or even decrease in the latter half of the year. On the sidelines of the Bureau of Internal Revenue’s National Tax Campaign...