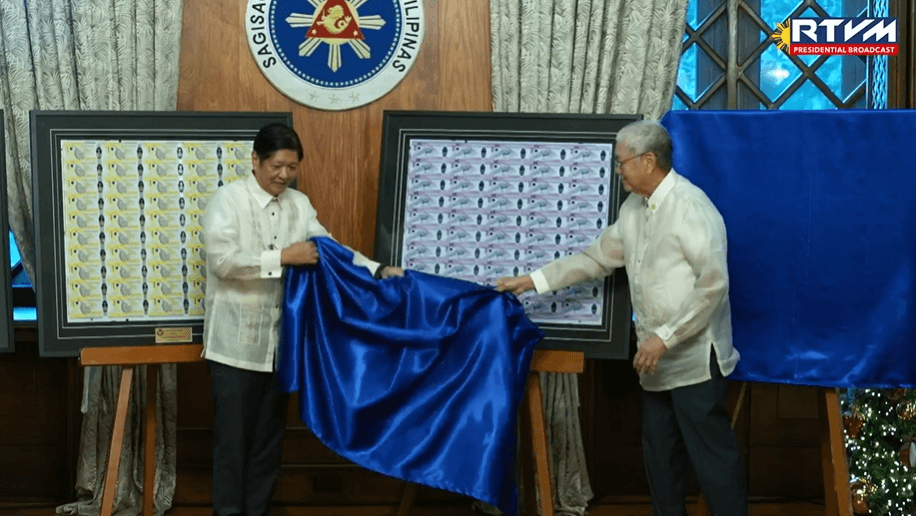

President Ferdinand R. Marcos, Jr. (left) and Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona, Jr. applaud the First Philippine Polymer Banknote Series during its launch in Malacañang on Dec. 19, 2024. The familiar crinkle of a crisp paper bill, the faded ink from countless...

Upgrading the Philippine currency ensures that every hard-earned peso, whether saved or invested, stays safe, President Marcos said. "By upgrading our currency, we are making sure that every hard-earned peso stays safe, whether it is saved, whether it is spent, or whether it is invested," Marcos...

The Bangko Sentral ng Pilipinas (BSP) has introduced the First Philippine Polymer (FPP) Banknote Series featuring enhanced security and durability, which will be available in circulation starting the first quarter of 2025. On Thursday, Dec. 19, President Ferdinand R. Marcos Jr. led the unveiling of...

After powering the UP Fighting Maroons to a sweet victory in UAAP Season 87, Quentin Millora-Brown leaves his door open for a possible stint with Gilas Pilipinas. Quentin Millora-Brown (UAAP Media) Millora-Brown, who played for the State U in a one-and-done campaign which he dedicated to...

With inflation remaining within the government's target range and economic growth slowing, private sector economists expect that the Bangko Sentral ng Pilipinas (BSP) will further reduce its borrowing cost at its Dec. 19 meeting. According to the Bank of the Philippine Islands (BPI) and think tanks...

The Japan International Cooperation Agency (JICA) expects more small and medium enterprises (SMEs) in the Philippines to access financing more easily through its ongoing joint credit initiative with the Bangko Sentral ng Pilipinas (BSP). JICA Philippines and the BSP on Wednesday, Dec. 11, launched...

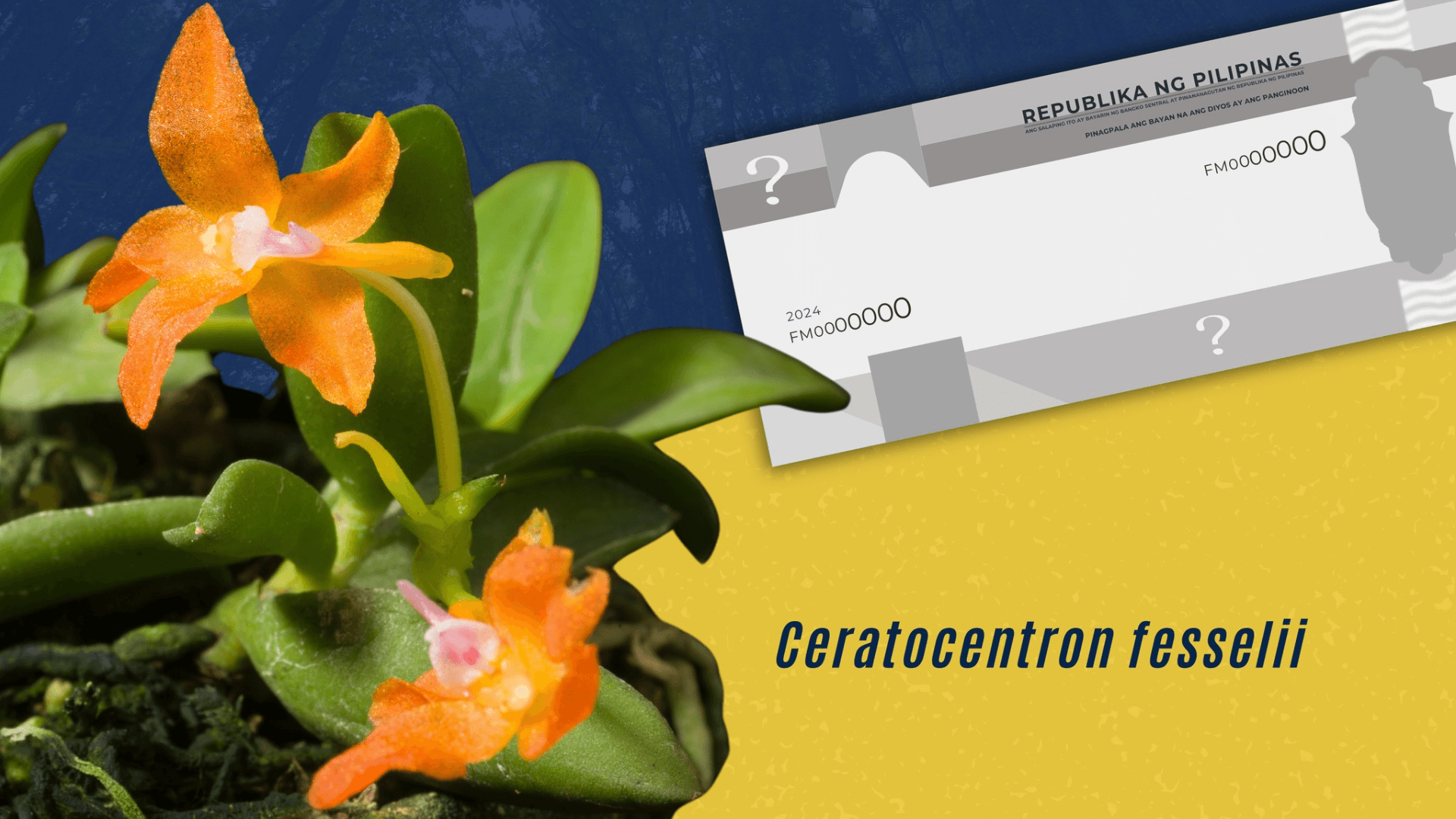

The Bangko Sentral ng Pilipinas (BSP) plans to showcase the critically endangered Ceratocentron fesselii orchid on its new polymer banknotes, an initiative that aims to improve security features and promote conservation awareness. In a Facebook post on Tuesday, Dec. 10, the BSP revealed plans to...

Singapore-based United Overseas Bank (UOB) anticipates the Philippine central bank will lower borrowing costs in December, citing manageable inflation and rising risks to economic growth. “Monetary policy is well-positioned for what lies ahead,” said Julia Goh, senior economist at executive...

The Philippines’ stock of US dollars declined to $108.465 billion at the end of November, down $2.618 billion from the previous month’s $111.083 billion after the government settled its maturing foreign currency loans. The end-November gross international reserves (GIR) level is higher than the...

With consensus expectations that inflation modestly accelerated in November, most economists polled by Manila Bulletin anticipate the Bangko Sentral ng Pilipinas (BSP) will proceed with cutting borrowing costs during its Dec. 19 policy meeting. Private-sector economists who are monitoring the...

Apple Pay and Google Pay are exploring the possibility of entering the Philippine market, but must first register with the Bangko Sentral ng Pilipinas (BSP) as operators of payment systems (OPS), a central bank official said. BSP Deputy Governor Mamerto Tangonan confirmed that both tech giants have...

The Bangko Sentral ng Pilipinas (BSP) highlighted the Philippines’ potential as an investment destination for Islamic finance, citing the country's growing economy and the government’s push for financial inclusion. In a statement on Monday, Dec. 2, BSP Governor Eli M. Remolona, Jr. said that...