Senator Juan Miguel “Migz” Zubiri lauded the signing of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act on Monday, Nov. 11, as it is expected to cut the bureaucratic red tape that has hampered the growth of the...

The work-from-home (WFH) model is on track to become a permanent component of the Philippine business landscape as the CREATE MORE bill—officially known as the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy—nears its final...

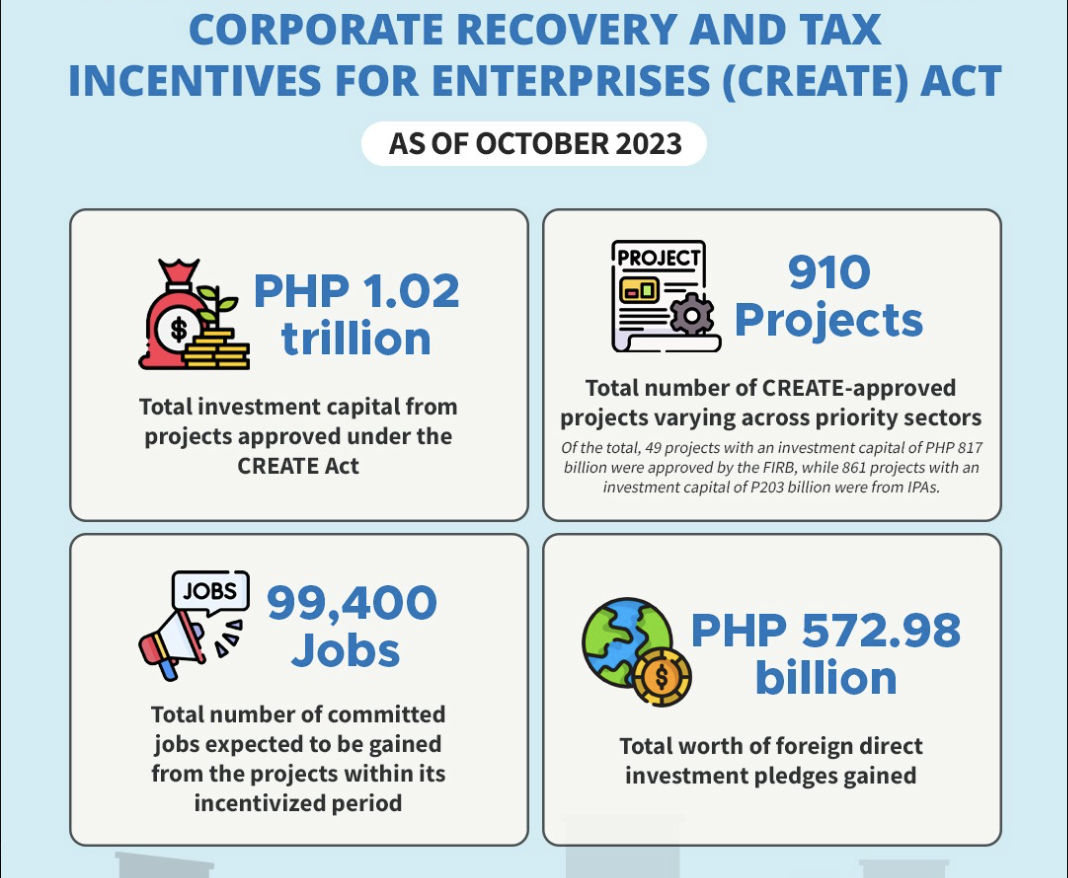

The Department of Finance (DOF) has reported that the law providing tax relief for eligible companies has resulted in the creation of over 100,000 jobs for Filipinos since its implementation two years ago. Data from the DOF showed that total approved investments under the Corporate Recovery and Tax...

The Department of Finance (DOF) announced that the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act has already attracted over a trillion pesos in investment capital. According to a Facebook post by the DOF, projects approved under the CREATE Act, which aims to address...

The Department of Finance (DOF) has reported that the government’s recent changes to its corporate tax system have attracted $16.7 billion in investments. At the Philippine Economic Briefing in Dubai, Finance Secretary Benjamin E. Diokno said these investments include 45 major projects and 740...

The Department of Finance (DOF) has reported that the implementation of the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Law has spurred investment worth over P720 billion. Under the CREATE law, the government has provided tax incentives to major projects amounting to a total...

The Department of Finance (DOF) said the government will finalize within this month the Strategic Investment Priority Plan (SIPP) of the Corporate Recovery and Tax Incentives for Enterprises (CREATE) law. In a statement, Finance Secretary Carlos G. Dominguez III said on Wednesday, Jan. 12, that the...

The Department of Finance (DOF) said President Duterte has now accomplished eight tenths of his economic reform program that provided income tax cuts for individuals and corporations. In a statement, Finance Secretary Carlos G. Dominguez III said Wednesday, July 28, that 85 percent of the Duterte...

The government incurred hefty foregone revenues due to fiscal incentives enjoyed by favored enterprises one year before the landmark congressional approval of the corporate recovery and tax incentives for enterprises (CREATE) law. According to the report submitted by the Department of Finance -...

The finance and trade departments signed the implementing rules and regulations (IRR) of the corporate recovery and tax Incentives for enterprises (CREATE) law, the government’s largest fiscal stimulus package for businesses in the country’s history. Ahead of the July 10, 2021 deadline, Finance...

BETTER DAYS Senator Sonny Angara Last March, President Duterte enacted into law Republic Act 11534, more widely known as the Corporate Recovery and Tax Incentives for Enterprises or CREATE Act. Certified at the time as urgent by Malacañang, the law was touted as one of the government’s critical...

The Fiscal Incentives Review Board (FIRB) has adopted the framework for the grant of incentives to qualified industries under the government’s Strategic Investment Priorities Plan (SIPP). As provided in the newly enacted Corporate Recovery and Tax Incentives for Enterprises (CREATE) Law that...