'Grey list' comeback: Will the Philippines stay off the global money-laundering watchlist?

By Derco Rosal

At A Glance

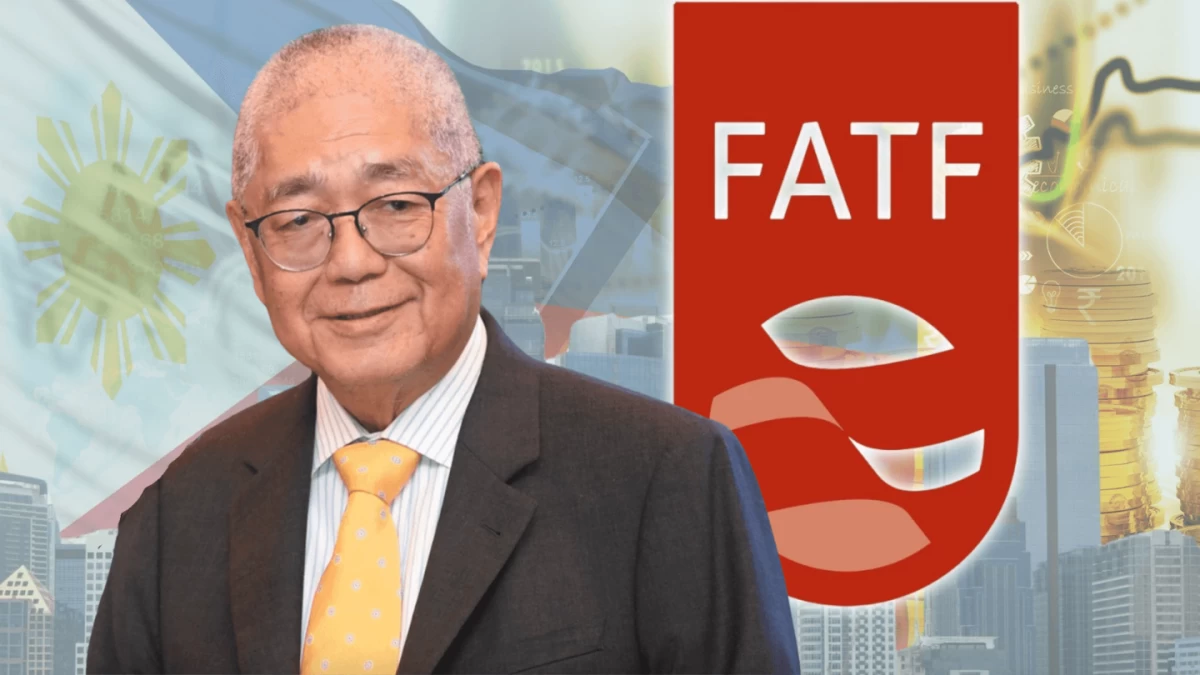

- DUMAGUETE CITY—Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. admitted the Philippines is still standing face to face with the risk of returning to the highly shunned grey list even after the country's exit in 2025.

This struck a serious note on the need to ramp up government measures against money laundering and terrorism financing, particularly given the country’s continued exposure to illicit financial flows and the fallout from the flood-control controversy.

“To be honest, we have a risk of returning to the grey list,” Remolona told reporters during a media information session last Sunday, Feb. 1. “Although we’re doing what we can to prevent that,” the governor stressed.

It bears recalling that the Philippines was removed from the watchlist of the Paris-based global money-laundering watchdog Financial Action Task Force (FATF) in early 2025, ending a difficult period that lasted nearly four years.

Being included in FATF’s grey list is “a burdensome process for banks and other financial institutions. This process discourages correspondent banking relationships and international financial flows into the country,” according to the interagency Anti-Money Laundering Council (AMLC).

Among jurisdictions placed under increased monitoring, the Philippines—which had been on the list since June 2021—was the only country removed last year.

Shortly after, the European Commission (EC) also delisted the Philippines from its roster of high-risk jurisdictions.

The removal was prompted by the Philippines’ “strengthened effectiveness” of its anti-money laundering and countering the financing of terrorism (AML/CFT) regime, as well as its commitment to fully implement action plans addressing deficiencies identified by FATF.

Key improvements cited included stricter oversight of non-financial businesses, tighter regulation of fund transfers, and enhanced measures to combat money laundering.

FATF also noted strengthened cross-border controls and improved law enforcement access to financial data.

For its part, AMLC—chaired by Remolona—said the Philippines’ exit from the grey list “may prompt foreign banks to review and resume their business relationships and transactions with Philippine financial entities,” as the move signaled improved compliance and lower regulatory risks.

However, with the country still carrying a “high-risk” label, foreign investors may remain cautious about re-entering the domestic financial system. A favorable outcome from FATF’s next evaluation in 2027 would be key to proving the country’s sustained progress.

While acknowledging the long road ahead, Remolona said he remains optimistic that the Philippines will address identified risks by the time of the FATF reassessment.

“This is going to be a long process, so we have time to do what we need to do to show the FATF that we’re doing everything we can,” Remolona said, adding that the two-year window given to AMLC is sufficient to tackle “all” existing and emerging risks.

Based on AMLC’s 2025 national risk assessment, the Philippines remains tagged as “high risk for money laundering,” as criminal networks continue to exploit illicit activities such as drug trafficking, fraud, and environmental crimes.

These risks persist even as authorities have intensified efforts to safeguard the financial system from increasingly sophisticated schemes involving digital platforms, cryptocurrency-based transfers, and casino junket operations.

Casinos, real estate firms, and virtual asset service providers were identified as the most vulnerable sectors due to high cash intensity and uneven maturity of AML controls. In contrast, the banking, securities, and trust sectors were assessed to have medium vulnerability, while the insurance industry was rated low to medium-low.

Similarly, the country’s financial intelligence unit flagged a medium risk for proliferation financing, which involves funding activities related to weapons of mass destruction.