BSP readies digital marketplace for bancassurance products

By Derco Rosal

At A Glance

- DUMAGUETE CITY—A digital marketplace for the expanded bancassurance system is expected to be rolled out by the Bangko Sentral ng Pilipinas (BSP) soon, an execution of which falls under the near-final updated bancassurance guideline expected to be released in the first half of 2026.

DUMAGUETE CITY—A digital marketplace for the expanded bancassurance system is expected to be rolled out by the Bangko Sentral ng Pilipinas (BSP) soon, with its implementation falling under the near-final updated bancassurance guidelines expected to be released in the first half of 2026.

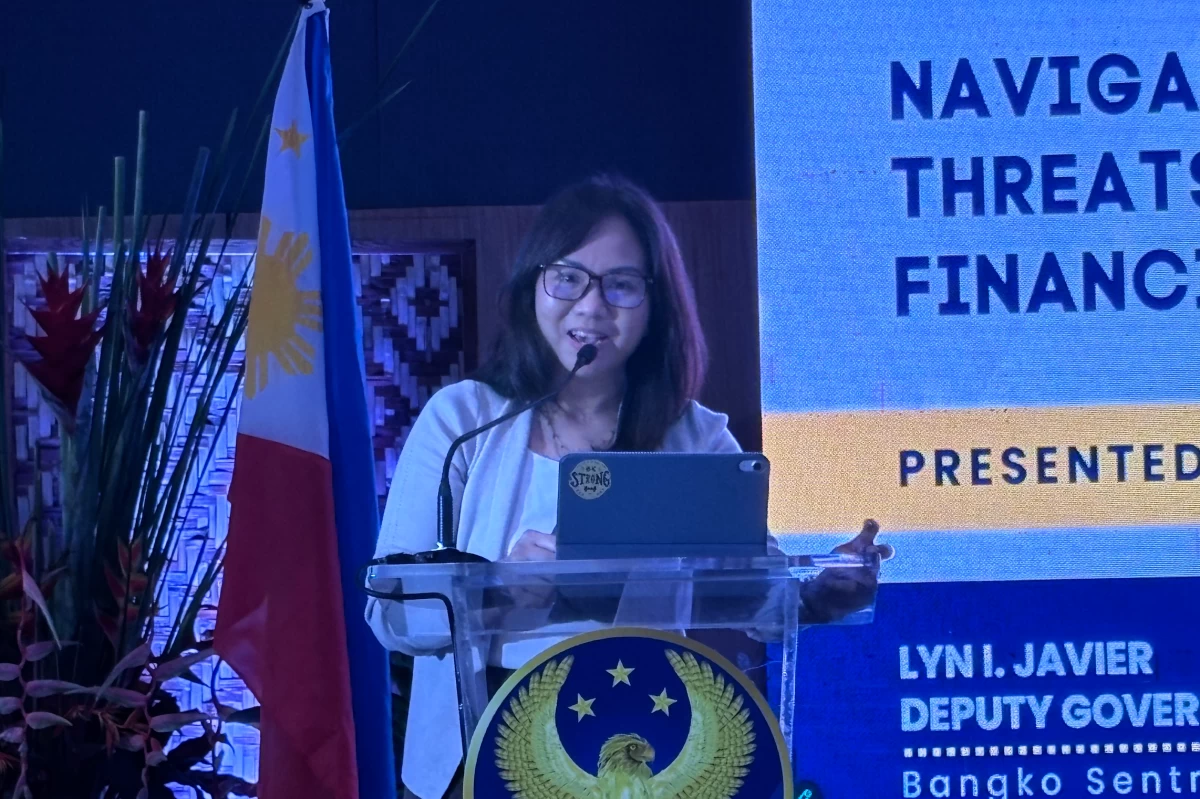

BSP Deputy Governor Lyn I. Javier told reporters during a media information session that the digital marketplace for cross-selling insurance products is “coming very soon because we’re already finalizing based on the inputs we have.”

It may be recalled that in July 2025, the BSP said it would roll out amended bancassurance guidelines allowing third-party insurers to sell their products to banks’ customers. Bancassurance is an arrangement in which an insurance firm sells its products through a partner bank, enabling it to reach more customers without expanding its own sales force.

Javier, who oversees the central bank’s financial supervision sector (FSS), noted that a key limitation under the existing rules is the exclusive distribution of insurance products within a group of related companies.

BSP Deputy Governor Bernadette Romulo-Puyat earlier said the BSP intends for bancassurance not to be limited to conglomerates but to include external players. The upcoming rules will widen financial institutions’ access to a broader pool of customers.

“Our initial approach was to limit bancassurance to physical touchpoints. Now, we are introducing a digital marketplace, open to major banks and electronic money issuers (EMIs), allowing their platforms to host other financial service providers, including insurance companies, so customers can access insurance products through digital channels,” Javier said.