How to spot fake BSP documents: Central bank flags illegal use of name in scams

The Bangko Sentral ng Pilipinas (BSP) is intensifying its warnings to the public regarding a sophisticated fraudulent activities that misappropriate the central bank’s name, logo, and the signatures of its top officials to legitimize illegal financial schemes.

In an advisory released on Tuesday, Dec. 23, the BSP detailed how scammers are deploying increasingly realistic falsified documents to deceive victims into revealing sensitive personal data or transferring funds under the guise of official regulatory requirements.

The central bank observed that perpetrators typically produce unauthorized financial products and services, claiming they are endorsed or guaranteed by the central bank.

To establish a veneer of credibility, these documents often feature the forged names and signatures of high-ranking BSP officials.

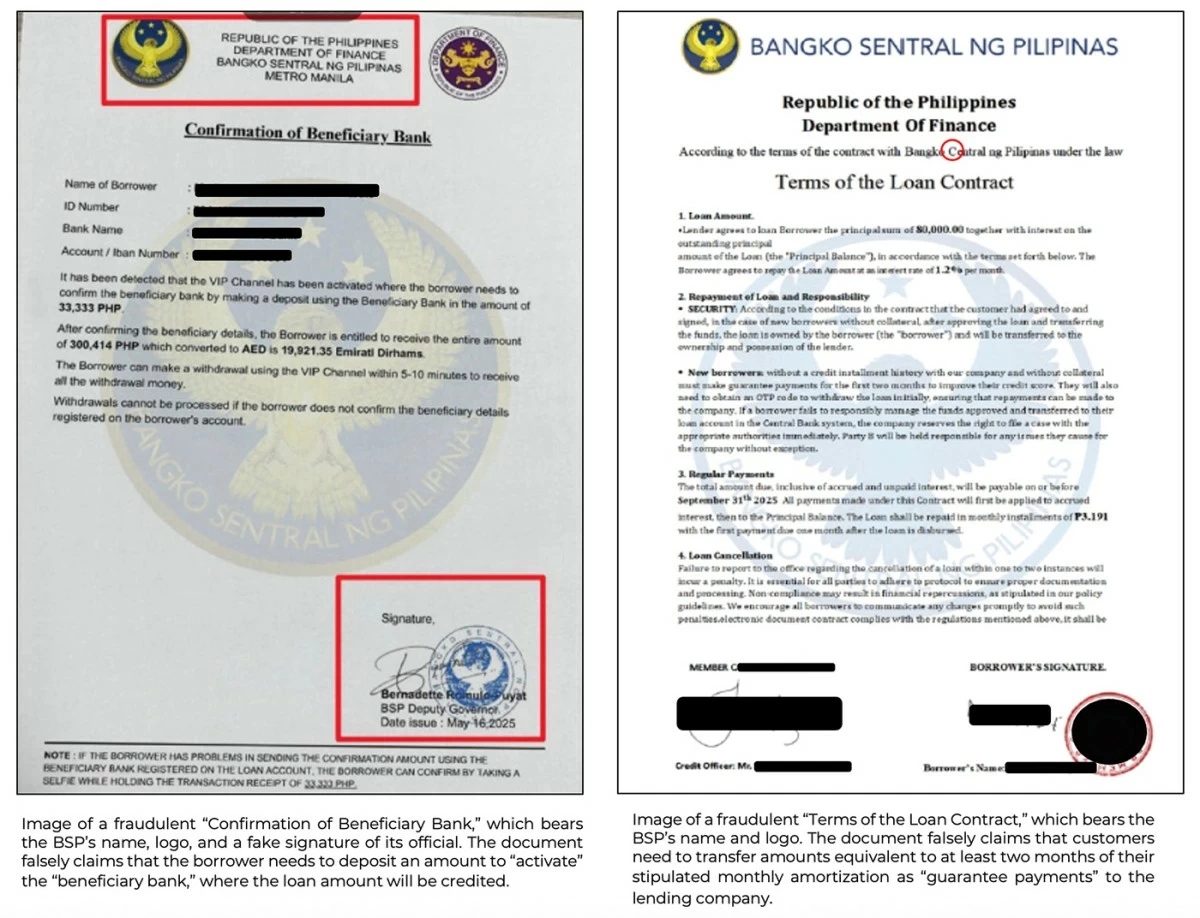

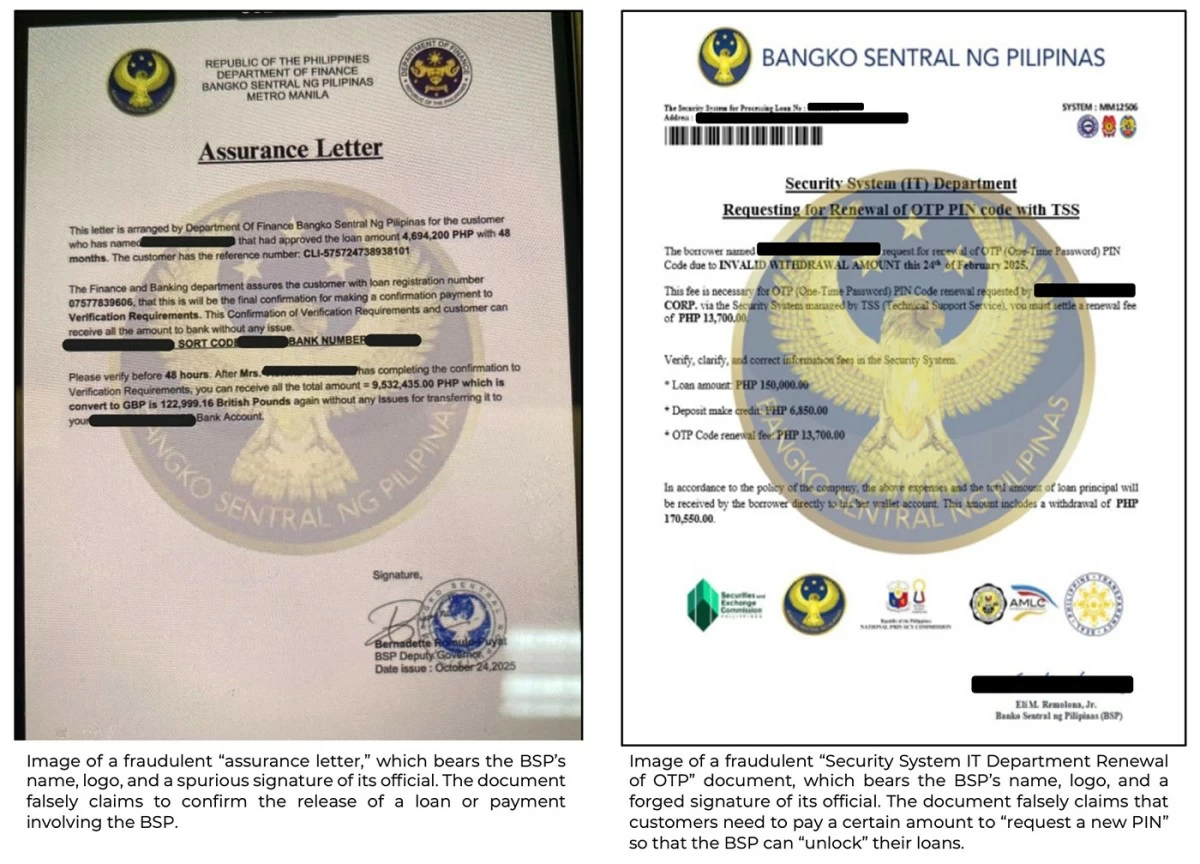

Among the specific falsified papers identified by the central bank are “assurance letters,” “Terms of Loan Contract,” and various unauthorized certifications for loans, deposits, and fund transfers.

Other more technical fabrications include “Confirmation of Beneficiary Bank” forms and “Security System IT Department Renewal Requests” specifically designed to harvest One-Time Password (OTP) PIN codes.

The BSP said that its operational mandate does not involve authorizing individuals or private firms to collect fees for anti-money laundering clearances, taxes, or other administrative charges.

The central bank clarified that legitimate financial regulators and law enforcement agencies will never solicit sensitive information, such as bank account passwords or security codes, through unsolicited phone calls, emails, or text messages.

These schemes often rely on creating an artificial sense of urgency, pressuring victims to make advance payments or provide data before they have time to verify the request's authenticity.

Public vigilance remains the primary line of defense against such misrepresentation. The central bank advised consumers to be particularly wary of offers for low-interest loans that claim to be "guaranteed" by the regulator.

Common indicators of fraud include poor grammar, spelling errors, and the use of outdated or incorrect agency logos. The BSP reiterated that it does not provide guarantees for private commercial loans or individual investment returns.

For those who encounter suspicious communications, the central bank’s directive is to ignore the sender entirely and refrain from disclosing any financial details. Such incidents should be reported to the BSP’s consumer protection department via email at [email protected] or through its official telephone line at (+632) 8811-1277.

If a bank account or digital wallet has already been compromised, the BSP urges immediate contact with the relevant financial institution or e-money issuer.

Furthermore, victims are encouraged to file formal complaints with the Philippine National Police or the National Bureau of Investigation to assist in the tracking and prosecution of these cybercriminals.