BDO chief warns of prolonged Philippine investment slowdown

By James A. Loyola and Derco Rosal

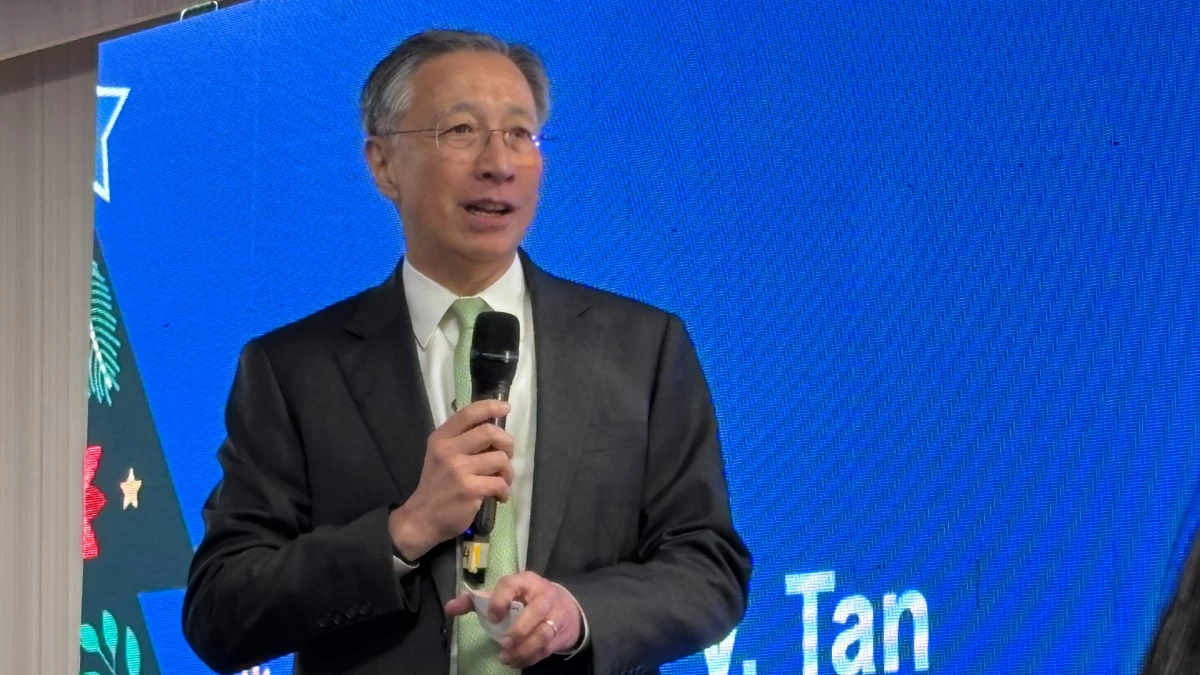

BDO President and Chief Executive Officer Nestor V. Tan

Sy-led BDO Unibank, Inc. said muted investments are likely in 2026, as business activity in the Philippines has weakened this year due to a string of headwinds—including the flood control fiasco—that have unsettled local business conditions.

BDO President and Chief Executive Officer Nestor V. Tan admitted that the country’s largest bank by assets entered the year on solid ground as the strong finish in 2024 had been carried over into 2025.

Tan noted, however, that the robust banking and business environment at the start of the year began to lose its balance when United States (US) President Donald Trump proclaimed Liberation Day on April 2—the day he first announced a sweeping tariff hike.

It can be recalled that US-bound Philippine exports were first slapped with a 17-percent tariff, then raised to 20 percent, before inching down to 19 percent on the back of negotiations between both countries.

“We started out very strong, honestly. We had a solid fourth quarter last year and that momentum was carrying over, but then Liberation Day happened, and people began to pull back,” Tan said.

He added that geopolitical risks and other onshore issues emerged at a time when business conditions “were starting to stabilize and improve,” adding that the governance concerns on flood-control fund spending entered the scene when the supply chain chaos began to normalize again.

Net inflows of brick-and-mortar foreign direct investments (FDI) in the Philippines dropped to $320 million in September—the lowest level since the $313.8 million recorded in April 2020, when the most stringent Covid-19 lockdowns were first imposed.

Economists said this slump was largely due to a mix of onshore concerns stemming from the flood-control graft scandal.

“Now the overall mood, I would say, is at best somber,” the CEO stressed, noting that the challenges will keep emerging on the back of the ongoing probe into the flood-control graft cases, a move prompted by the public uproar over government spending.

He said the current scrutiny allows the government and the public sector to address corruption issues and introduce reforms to prevent the recurrence of irregularities.

“From a business perspective, [2025] was a tough year, and we continue to think 2026 will be the same,” Tan said, adding that the bank’s outlook is uncertain given the range of possibilities the business community deems likely.

He asserted that persistent uncertainties do not necessarily arrest investments, as investors are just holding back a bit, which he anticipates will persist into the coming year.

Despite the downbeat business climate, Tan assured that “it’s not all doom and gloom because there are still pockets of opportunity outside of the environment that we see.”

Provincial expansion, he noted, continues to outpace growth in Metro Manila, and there is growing activity in sectors such as infrastructure, energy, and others.

For her part, BDO Chairperson and SM Investments Corp. (SMIC) Vice Chairperson Tessie Sy-Coson said, “The next year will not be so bad if we think more positively. We just have to do our work in spite of all the political noise. So, for us, we’re going to continue what we have planned and I think we will be able to achieve our targets next year.”