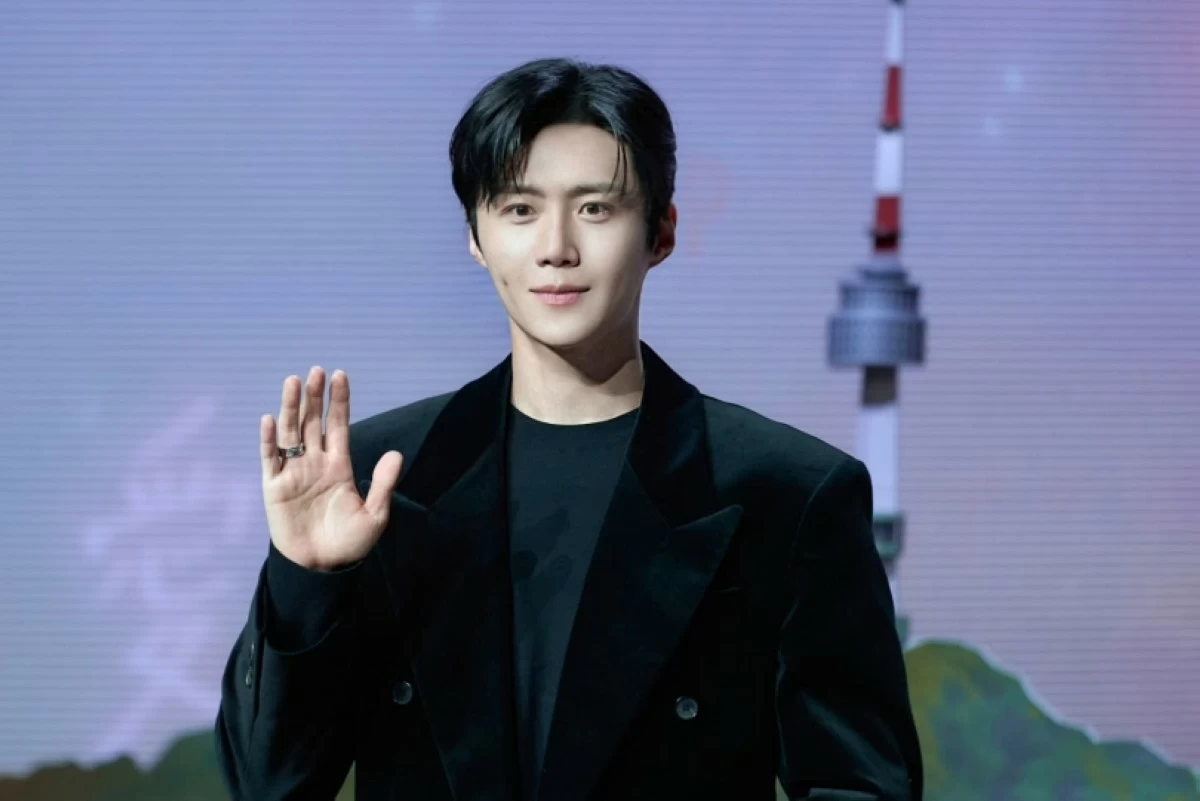

Kim Seon-ho sorry for establishing one-person company, pays additional personal income tax

Korean actor Kim Seon-ho expressed his apology for establishing a one-person company and revealed that he paid additional income tax.

His one-person company, he established in January 2024, became the subject of tax evasion accusations.

On Feb. 4, his agency, Fantagio, released a new statement about Kim Seon-ho.

“Kim Seon-ho deeply reflects on establishing and maintaining the corporation for about a year without fully understanding how to properly operate it. He bows his head in apology,” the agency said, SBS Star media outlet reported.

Fantagio said Kim Seon-ho paid additional personal income tax in addition to the corporate tax that was already paid.

“As a proactive step to correct his past, uninformed management of the corporation, Kim returned all corporate card expenses, family salaries, and the company vehicle. For amounts previously settled through the corporation, he completed paying additional personal income tax on top of the corporate tax that had already been paid. The corporation is currently going through closure procedures, and the administrative steps will be finalized soon,” the agency added.

Fantagio revealed that Kim Seon-ho established the “corporation in January 2024 for acting activities and theater production.”

“After the corporation was set up in January 2024 and until before his new contract with Fantagio began in February 2025, payments for his activities were settled to that corporation,” it said.

It added, “After realizing the company’s operation could cause misunderstandings, he stopped operating it, and no activities have actually been carried out through the corporation for over a year.”

Fantagio clarified that “from the start of Kim Seon-ho’s exclusive contract in February 2025 to now, all settlements have been paid directly to him as an individual. There is no connection whatsoever between Fantagio and that corporation regarding our contract process or his activities.”

“We also apologize for causing confusion and concern, and we will take every measure to manage all aspects of our artist’s activities more thoroughly going forward,” it said.

Cha Eun-woo, who is facing a 20-billion won (about $13.6 million) tax surcharge, and Kim Seon-ho both belong to Fantagio.

Kim Seon-ho is currently starring in Netflix’s “Can This Love Be Translated?”