RL Commercial REIT replaces Alliance Global in PSEi reshuffle

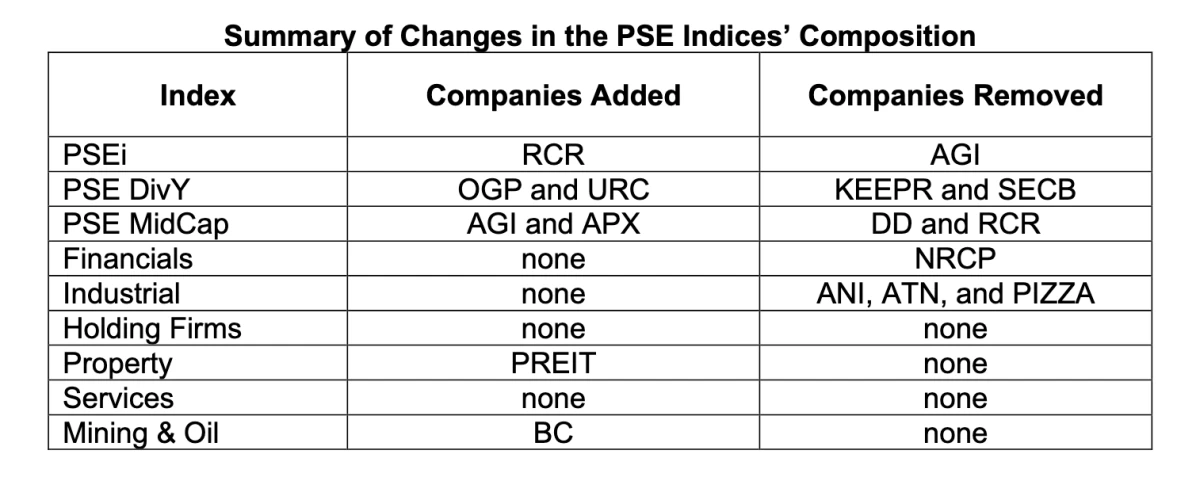

RL Commercial REIT Inc. will join the Philippine Stock Exchange index (PSEi), the nation’s 30-company benchmark, replacing Alliance Global Group Inc. as part of a semi-annual reshuffle of the local equity market’s gauges.

The Philippine Stock Exchange announced the changes following review of trading activity for the full year of 2025. The adjustment, scheduled to take effect on Feb. 2, 2026, is part of the exchange’s periodic assessment of liquidity, float, and market capitalization across its indices to ensure they accurately reflect the current market state.

Alliance Global, the holding company of billionaire Andrew Tan, will move to the PSE MidCap Index. Joining Alliance Global in the MidCap category is Apex Mining Co. Inc., while DoubleDragon Corp. and RL Commercial REIT will exit that specific gauge.

In the PSE Dividend Yield Index, which tracks companies with high and consistent dividend payouts, the bourse added gold and copper producer OceanaGold Philippines Inc. and food giant Universal Robina Corp. They replace The Keepers Holdings Inc. and Security Bank Corp., which were removed from the 20-member list.

The sectoral indices also underwent revisions, with Premiere Island Power REIT Corp. added to the Property Index and Benguet Corp. added to the Mining & Oil Index. No companies were removed from either gauge during this cycle. However, the Financials Index will shrink as the National Reinsurance Corporation of the Philippines was removed with no replacement named.

The Industrial Index saw the most aggressive contraction, with three firms—AgriNurture Inc., ATN Holdings Inc., and Shakey’s Pizza Asia Ventures Inc.—removed from the list. The exchange did not add any new constituents to the Industrial sector for this period. Meanwhile, the Holding Firms and Services indices remained unchanged.

The PSE’s index management policy requires companies to meet specific criteria, including a free float level of at least 20 percent and high liquidity based on median daily turnover. These rebalancings often trigger significant trading volume as institutional investors and exchange-traded funds adjust their portfolios to mirror the updated compositions.