PSEi slips 0.35% as investors lock in gains to end the week

Local stocks edged lower Friday, Jan. 17, as investors locked in gains from a recent rally, pressured by weakening peso and seasonal dip in money sent home by Filipinos working abroad.

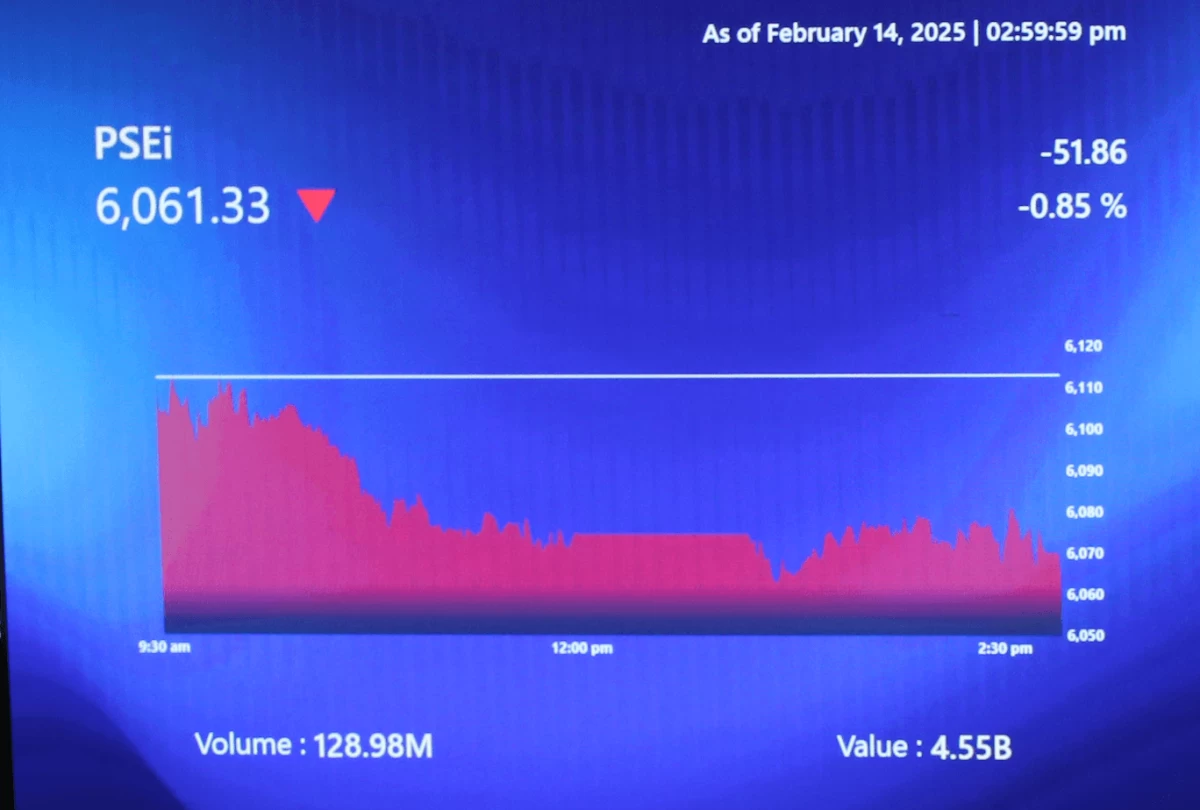

The Philippine Stock Exchange index (PSEi) slipped 22.86 points, or 0.35 percent, to settle at 6,464.67. While the headline index retreated, sectoral performance remained fragmented amid lack of clear direction as the trading week drew to a close.

Trading remained active with 1.83 billion shares changing hands, valued at ₱7.25 billion. Market breadth turned negative, with 99 decliners outpacing 93 gainers, while 77 issues remained unchanged.

The local currency’s struggles against the greenback weighed heavily on investor sentiment. The peso’s persistent depreciation has raised concerns regarding imported inflation and the potential for a tighter monetary stance from the central bank.

Luis Limlingan, managing director at Regina Capital Development Corporation, noted that the downward move was a natural reaction to the sharp gains recorded in the previous session. He added that the market felt additional pressure from data showing that personal remittances fell to their lowest level in six months during November.

The seasonal ebb in remittances, a critical pillar of the Philippine economy and a major source of foreign exchange, provided a catalyst for the afternoon sell-off.

Japhet Tantiangco, research manager at Philstocks Financial, said the decline on the final trading day of the week was primarily driven by profit-taking as market participants sought to protect margins earned during the preceding rally.

Despite the daily dip, the medium-term trajectory for Philippine equities remains upward. Michael Ricafort, chief economist at Rizal Commercial Banking Corp., noted that the index has now posted gains for four consecutive weeks. On a weekly basis, the PSEi rose 116.53 points, or 1.8 percent, marking its fifth weekly advance in the last six weeks.

Furthermore, offshore investors appear to be looking past the immediate currency volatility. Ricafort pointed out that the market has maintained a streak of net foreign buying for all 11 trading days since the start of 2026. This sustained interest from international funds suggests a degree of underlying confidence in local valuations even as the peso fluctuates against the US dollar.