Expect more hotels and resorts in 2026

With an expanding and balanced hotel pipeline across urban and resort markets, the country's hospitality sector's outlook remains optimistic in 2026, says Leechiu Property Consultants

The tourism industry is backed by domestic travel. (DOT-Metro Manila Facebook)

Leechiu Property Consultants (LCP) enumerated several indicators that can lift the tourism industry despite the modest dip in foreign arrivals in 2025. The real estate consultant firm listed ongoing hotel development, strong domestic travel, improving flight connectivity, and enhanced promotional work as contributing factors to a more supportive operating environment.

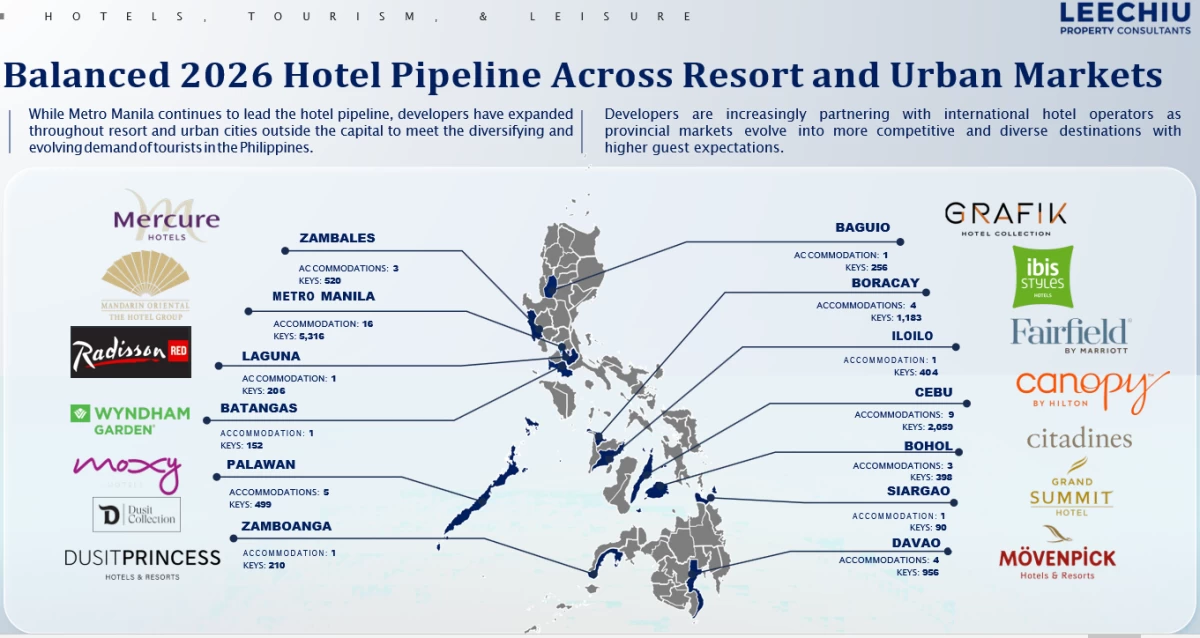

In its fourth-quarter Philippine market report, LCP disclosed that in 2026, the hospitality industry is expected to expand with the addition of 12,249 hotel keys across 50 projects, producing a more balanced hospitality sector. Metro Manila will lead the growth, followed by Cebu, Palawan, Baguio, Boracay, and Davao, continuing the trend of building developments outside of the capital region.

The report also underscored increasing partnership between developers and international hotel operators as provincial markets become more competitive and diverse with higher guest expectations. Local developers have partnered with international hotel firms such as Mercure Hotels, Mandarin Oriental Hotel Group, Radisson Hotels, Wyndham Hotels and Resorts, Dusit Hotels and Resorts, Grafik Hotel Collection, Ibis Styles Hotels, Fairfield by Marriott, Canopy by Hilton, The Ascott Limited, Grand Summit Hotels, and Movepick Hotels and Resorts.

This year, more accommodations will soon be available in Metro Manila and in the provinces.

LCP also noted that upper midscale hotels are gaining developer interest due to lower construction costs and faster returns on investment. At the same time, upscale and luxury segments remain active, supported by rising demand for premium, branded stays.

Local hotel brands are steadily expanding, as developers aim to differentiate their portfolios and establish homegrown standards of service excellence that cater more closely to the evolving preferences of Filipino travelers.

For 2025, domestic tourism served as the industry’s anchor, delivering business travel and MICE activities. At the end of the previous year, the average hotel occupancy was projected at 60.17 percent, a figure slightly higher than the 59.62 percent recorded in 2024, reflecting consistent room demand.

This year, rising disposable incomes and greater regional mobility are expected to reinforce domestic travel. Key travel events include the hosting of the ASEAN Tourism Forum 2026 in Cebu and the opening of the SMX Convention Center Seaside Cebu in the last quarter of the year.

Foreign tourist arrivals are expected to pick up in 2026.

LCP also disclosed that foreign arrivals slightly contracted to 5.8 million, the projected total by the end of 2025, compared to the 5.9 million arrivals from last year. The firm also forecasted that the tourism sector will gain new momentum in the coming year, based on the following initiatives: expanded flight routes, streamlined visa systems, and more diversified tourism destinations. In addition, the restoration of the ₱1 billion in government funding for tourism promotions is anticipated to bring in more arrivals from high-impact global marketing campaigns.

“We expect inbound foreign arrivals to grow steadily in 2026. The rollout of e-visas for Chinese travelers, the expansion of flight routes, and a more diversified tourist mix are all supporting the recovery. A softer peso is also making the Philippines more competitive, and with private investors now taking a larger role in airport operations, connectivity is set to improve. Growth will be modest, but the trajectory is unmistakably upward,” said Alfred Lay, Director for Hotels, Tourism, and Leisure at LPC.

For 2026, the Department of Tourism has earmarked a ₱ 1 billion promotional budget to strengthen the country’s visibility in the international tourism market. The enhanced marketing budget will support broader global marketing initiatives that can be further amplified through private-sector collaboration.

This year, the firm estimated a 6.3 million increase in foreign tourist arrivals.