Senate bill seeks 50% cut on OFW remittance fees, tax deductions to service providers

At A Glance

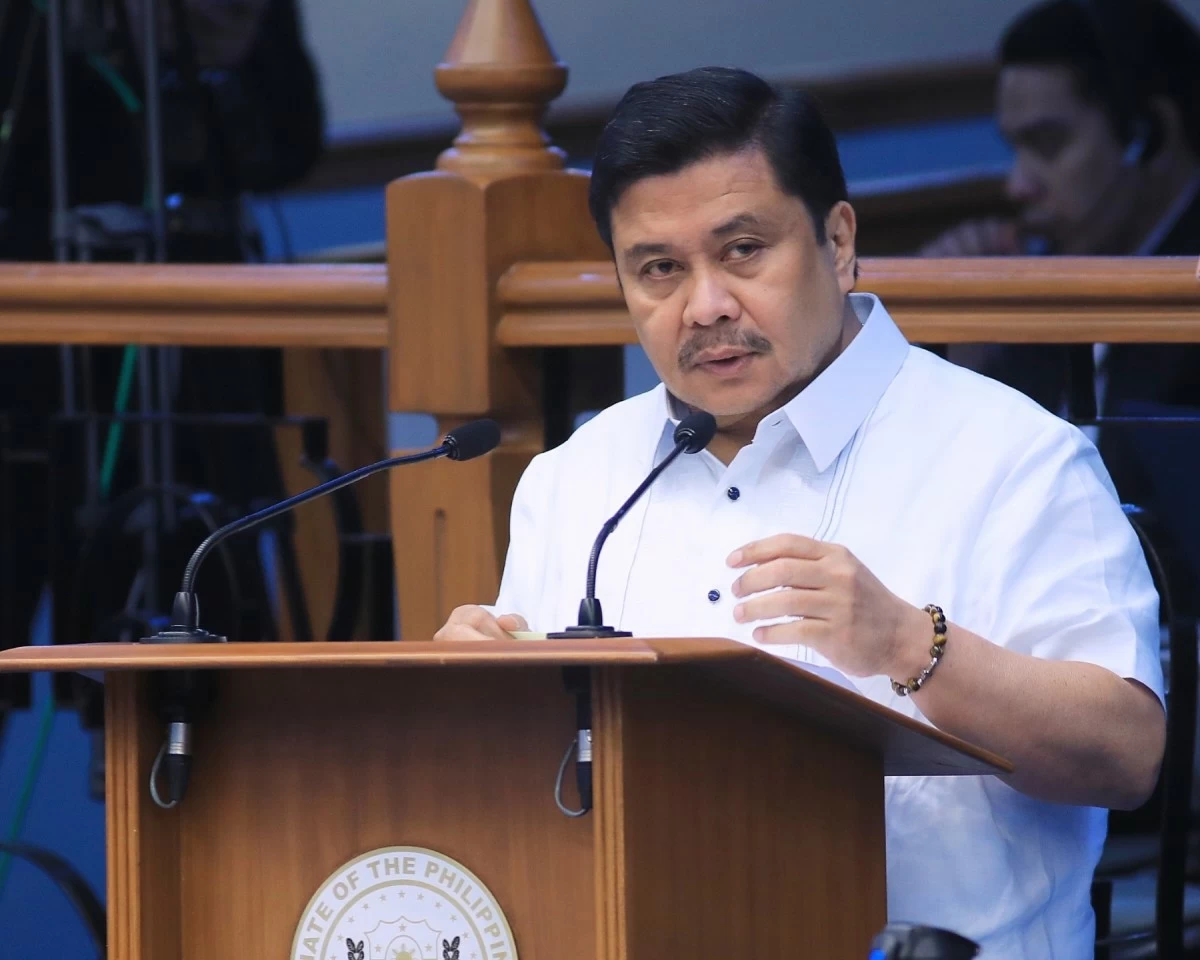

- Sen. Jinggoy Estrada said this would create a "win-win solution" for both OFWs and service providers.

Senator Jinggoy Ejercito Estrada has filed Senate Bill No. 1074 or the proposed “Overseas Filipino Workers Remittance Protection Act” that primarily seeks to slash the remittance fees for OFWs by 50 percent.

Estrada said the measure—a landmark proposal aimed at protecting the workers' hard-earned money, and considered the lifeblood of millions of Filipino families — from excessive charges, unfair practices, and financial exploitation.

Under SB No. 1074, banks and non-bank financial intermediaries that will grant the mandatory 50 percent discount on remittance fees may claim the amount as a tax deduction on their operational costs.

Estrada said this would create a “win-win solution” for both OFWs and service providers.

“This is a win-win situation for our OFWs and their families, as well as for banks and remittance centers,” Estrada said.

“For every hour our OFWs spend away from their families, they make irreplaceable sacrifices and time that no dollar can compensate for. Therefore, our law must ensure that their income is protected and utilized — income that also fuels our economy,” he said.

“The least we can do is make sure that every peso sent home reaches their loved ones with its full value intact, and not eaten up by excessive or unfair charges,” the senator stressed.

According to Estrada, study shows that OFW remittances reached a record-breaking $38.34 billion in 2024, a 3 percent increase from 2023, accounting for 8.3 percent of the country’s gross domestic product (GDP) and 7.4 percent of gross national income — underscoring the vital role that OFWs play in sustaining the Philippine economy.

The measure also mandates full transparency from banks and financial intermediaries by requiring the clear posting of peso-equivalent exchange rates in remittance centers to prevent hidden charges.

Moreover, the bill strictly prohibits the misappropriation of funds, unauthorized deductions, excessive fees, and any increase in remittance charges without prior consultation with concerned government agencies.

Under the bill, violators may face penalties of up to six years of imprisonment, fines ranging from P50,000 to P750,000, and additional sanctions under existing banking laws.

Also, institutions that deny receipt of remittances may be penalized.

Aside from fee regulation, the bill also pushes for stronger financial empowerment of OFWs and their families by directing the Department of Migrant Workers (DMW), in coordination with the Overseas Workers Welfare Administration (OWWA), Bangko Sentral ng Pilipinas (BSP), Department of Finance (DOF), and other agencies, to provide free and mandatory financial literacy programs.

Estrada said the measure goes beyond economics and is ultimately about dignity and fairness.

“OFWs are not just remitters — they are breadwinners, parents, and pillars of our economy. Protecting their money is protecting their families’ future,” he stressed.