A dynamic property market is seen in 2026

Colliers Philippines reveals real estate trends that are shaping the office, residential, and office markets

Power Plant Mall in Pampanga, the first Rockwell Center outside of Makati City

In 2026, the Metro Manila real estate and emerging regional hubs remain an active market marked by office recovery, retail resilience, industrial expansion, and residential opportunities, as reported by Colliers Philippines. Based on their property market outlook, Colliers Philippines Research Director Joey Bondoc describes the property market as dynamic, dominated by shifting demand, evolving consumer behavior, and strategic investments.

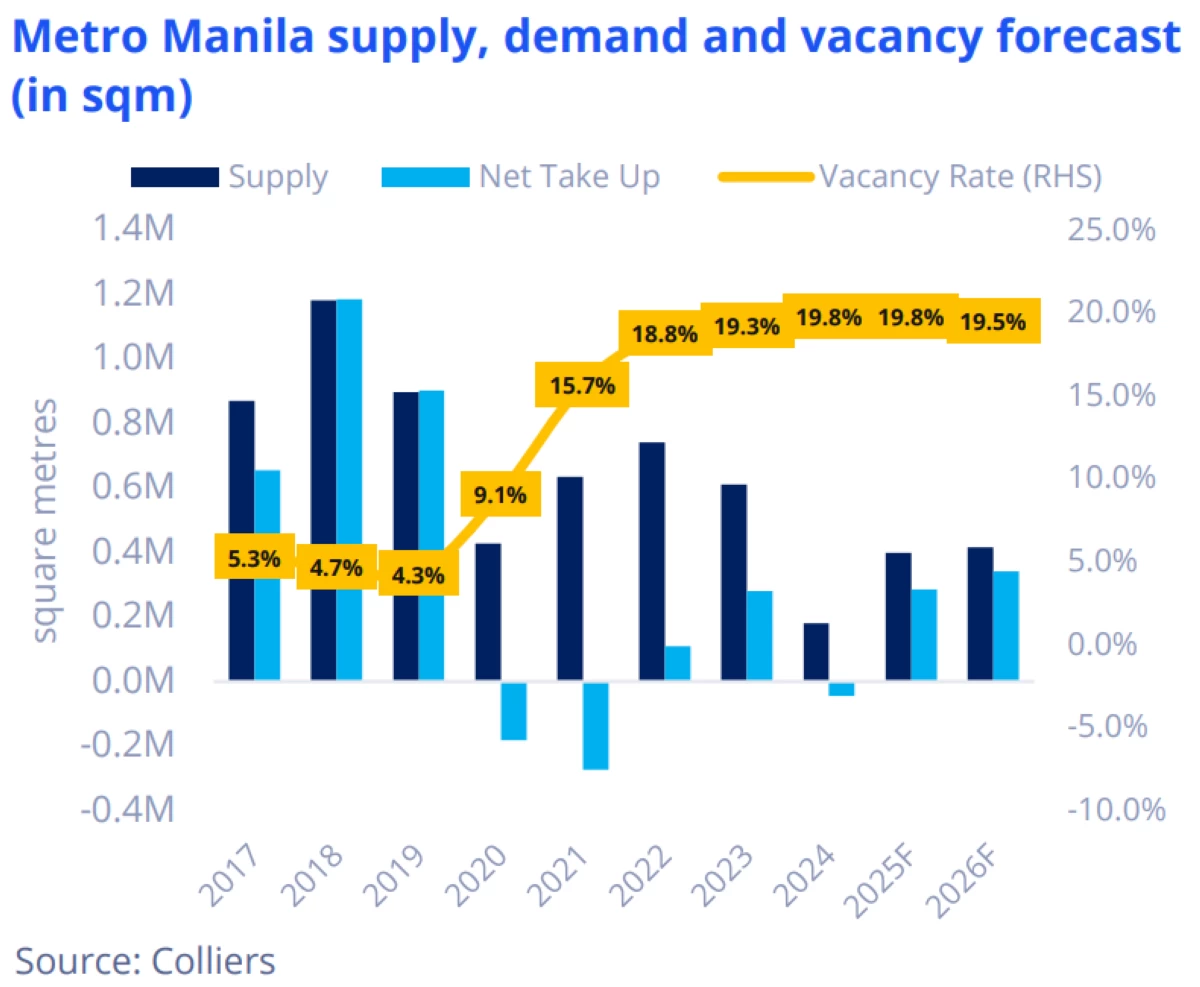

From 2026 to 2028, Colliers expects the delivery of nearly 350,000 sqm. of new office space in Metro Manila, only a third of the 1.0 million sqm completed annually from 2017 to 2019—the pre-Covid period and peak of offshore gaming demand. “We expect the Bay Area, Ortigas Fringe, and Quezon City to account for nearly 60 percent of the new supply,” says Bondoc.

The office market vacancy is forecasted at 19 percent in 2026.

Outside the National Capital Region, Cebu and Pampanga are projected to take up more than 50 percent of transactions. Bondoc also noted the increasing positioning of flexible workspace providers in emerging regional markets such as Cebu, Pampanga, Iloilo, Bacolod, and Davao, supporting the move to decentralization.

Since landlords of office buildings are competing with newer, greener, and amenity-rich structures, Colliers encourages innovation by upgrading their office assets and offering flexible lease terms, such as rent-free periods, lower base rents, or delayed rent escalations. “With a growing pipeline of high-quality, sustainable buildings, older properties risk becoming obsolete without upgrades. Landlords should consider integrating green certifications, smart building technologies, and energy-efficient systems to align with tenant expectations and environmental, social and governance goals,” underscores Bondoc.

From 2026 to 2028, Colliers expects the average annual delivery of 3,600 condominium units, a decrease from the 13,000 annual average from 2017 to 2019, a period of heightened demand due to POGO businesses.

Developers are also expected to seek opportunities in Metro Manila peripheries such as the C5 Corridor and the Quezon City – Katipunan Area, brought by the lack of developable land and soaring prices in central business districts.

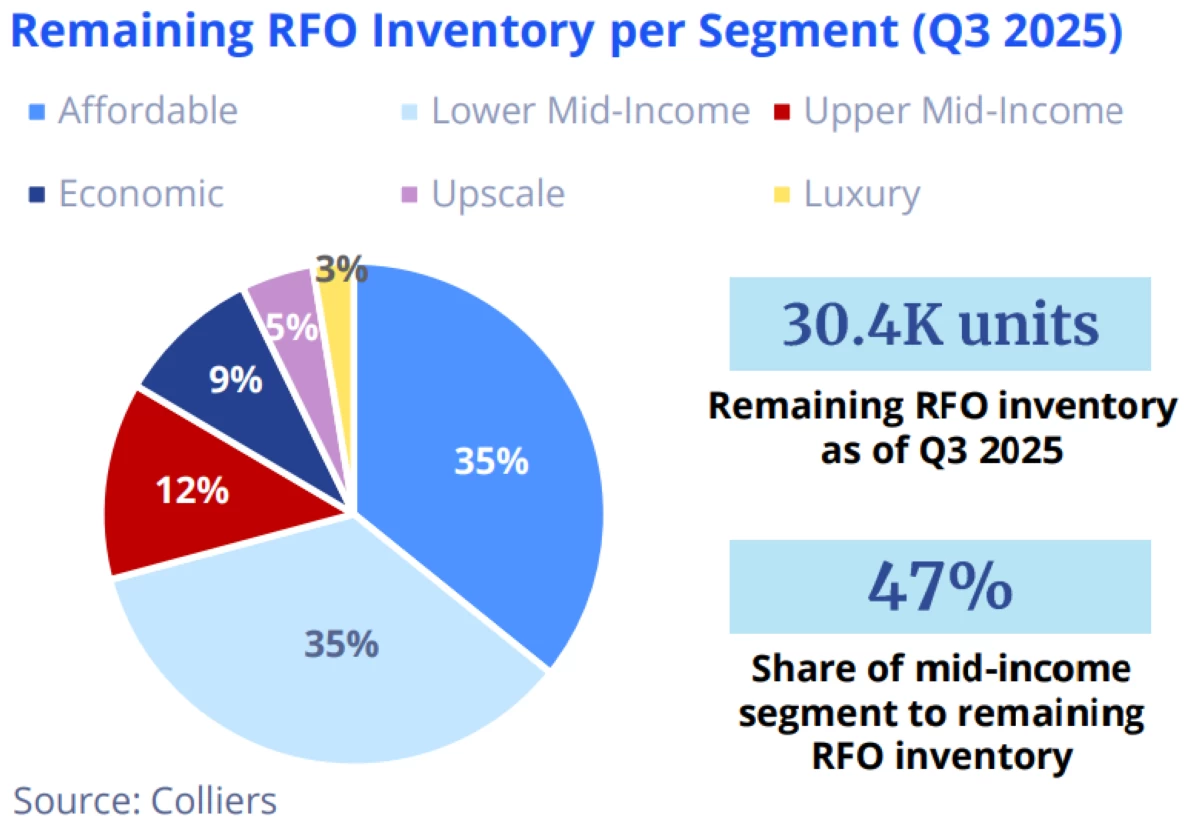

In the third quarter of 2025, the unsold RFO inventory is more than 30,000.

As of the third quarter of 2025, the unsold ready-for-occupancy (RFO) condominium inventory in Metro Manila stood at 30,400 units. To address the condominium oversupply, several developers are aggressively offering more attractive and innovative promos such as bigger discounts, lengthened payment terms, and rent-to-own schemes in some of their projects. As a result, Colliers recorded improved take-up, particularly in the mid-income residential segment.

The firm also projects a more pronounced shift to suburbia, as part of the developers’ geographic diversification strategies, resulting in a diverse property market with improved residential options for investors and end-users. The firm also sees a rise in masterplanned communities that offer integrated townships fitted with parks, sports hubs, recreational facilities, as well as golf courses.

In the third quarter of 2025, the Metro Manila retail vacancy further improved to 11.4 percent from 13.1 percent in the first quarter of 2025. Colliers forecasts that retail vacancy rates will return to pre-pandemic levels by the end of 2026. In the third quarter of 2019, just before Covid, the retail vacancy in the capital region reached 9.3 percent.

From 2026 to 2028, Colliers expects an annual average completion of 111,000 sqm. of new retail space in Metro Manila, down from 332,000 sqm delivered annually from 2017 to 2019.

Retail developers shift to suburbia in key provinces

The shift to suburbia will also be more evident in the retail sector. In 2027, Rockwell Land Corporation will launch Power Plant Malls in Angeles City and Bacolod City, while SM Malls and Ayala Malls are setting their sights on key cities, including Cebu, Davao, Iloilo, and Bacolod, where new malls will be opened and renovated between 2026 and 2028.

Colliers expects food and beverage (F&B), clothing and footwear, and beauty and wellness retailers to dominate physical mall space take-up over the next 12 months. Foreign brands are also likely to continue occupying massive physical mall space.

SM Sta. Rosa (Yulo) mall will rise in Nuvali in 2026.

Over the past few quarters, Colliers has observed that major developers are offering experiential spaces such as the football field atop the SM Mall of Asia and parks for mallgoers’ pets. Retailers are also offering sip-and-shop concepts across Metro Manila.

The Ayala Malls Abreeza expansion is scheduled for completion in 2026.

He adds that “these retail concepts will remain popular moving forward as Filipino customers become more discerning and get exposed to premium retail experience being offered abroad. These retail concepts also take up massive brick-and-mortar space, contributing to greater mall space absorption moving forward,” says Bondoc.

He also encourages developers to aggressively chase these retailers. “They are not just aggressive in opening new stores, but they also chip in faster space take-up given the humongous brick-and-mortar space that they occupy,” concludes Bondoc.