Camanava LGUs announce tax payment schedules, early payment discounts for 2026

By Hannah Nicol

The local government units of Caloocan, Malabon, Navotas, and Valenzuela Cities released their tax payment schedules and early payment discounts for 2026 to encourage timely compliance among taxpayers and business owners.

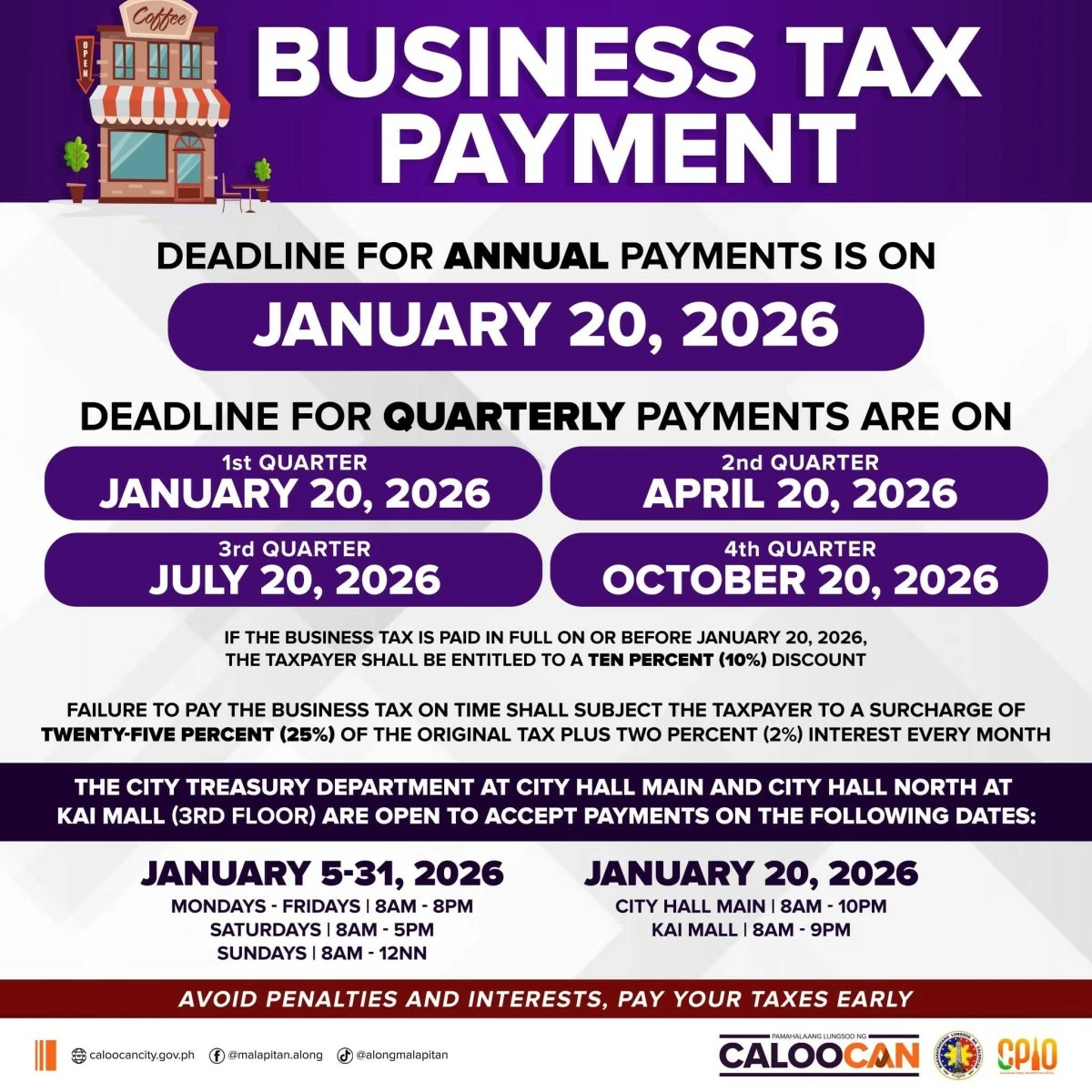

In Caloocan, the city government announced that payment of business tax and real property tax will start on Jan. 5.

(Photo from Caloocan City LGU)

Business owners who pay their business tax in full on or before Jan. 20 may avail of a 10 percent discount.

For real property tax, a 15 percent discount will be given if paid in full on or before Jan. 31, a 10 percent discount if paid by Feb. 28, and a 5 percent discount if paid by March 31.

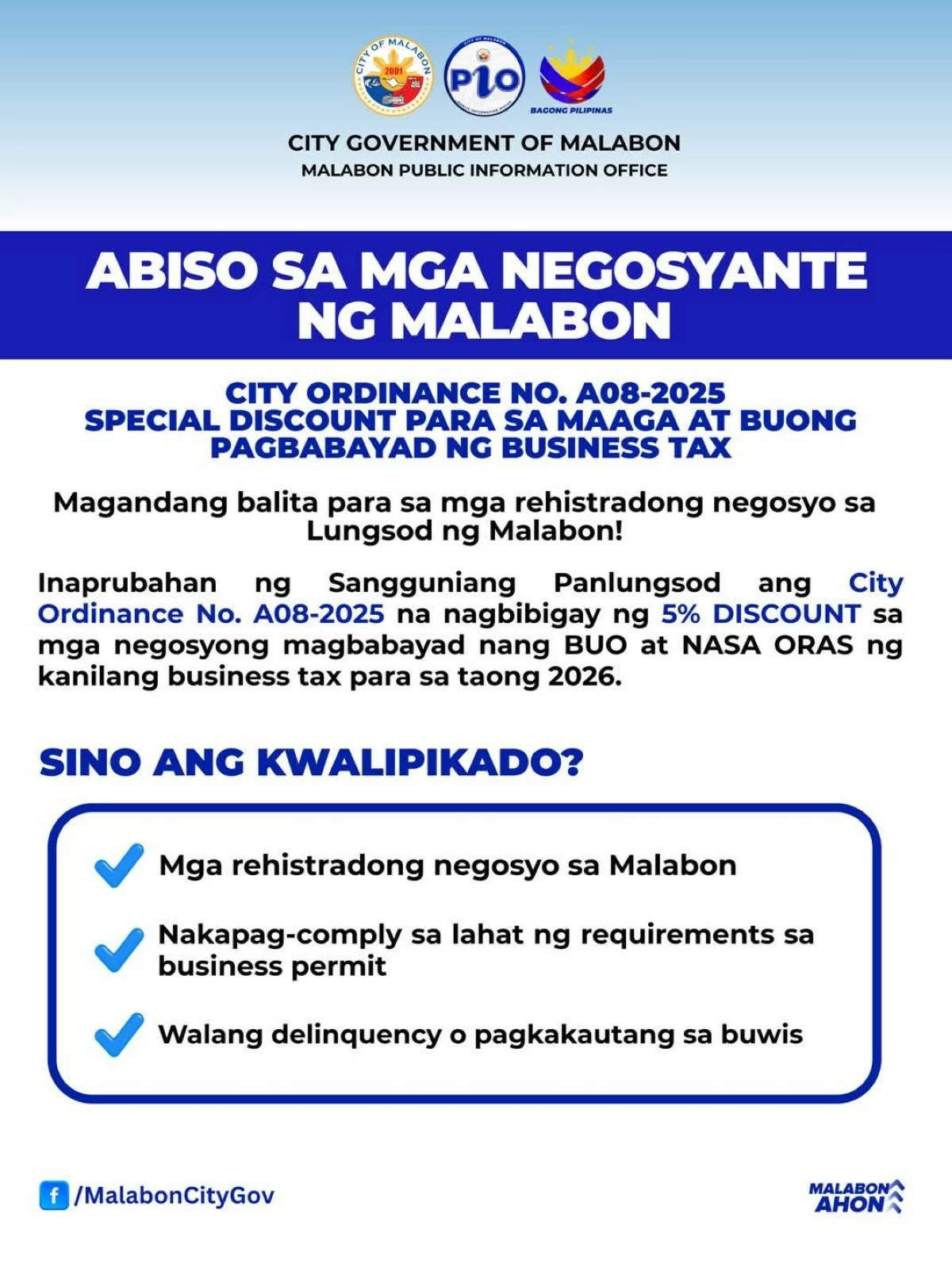

The Malabon City government announced the approval of City Ordinance No. A08-2025, which grants a 5 percent discount to registered businesses that pay their business tax in full and on time for 2026 and 2027.

(Photo from Malabon City LGU)

The discount applies to registered businesses in Malabon that have complied with all business permit requirements and have no delinquent tax obligations.

To avail of the incentive, businesses must pay their business tax in full on or before January 20 of the applicable year, with the 5 percent discount automatically applied.

The city government also reminded business owners that business tax accrues every Jan. 1.

Payment may be made in full within the first 20 days of Jan. or on a quarterly basis during the first 20 days of Jan., April, July, and Oct.

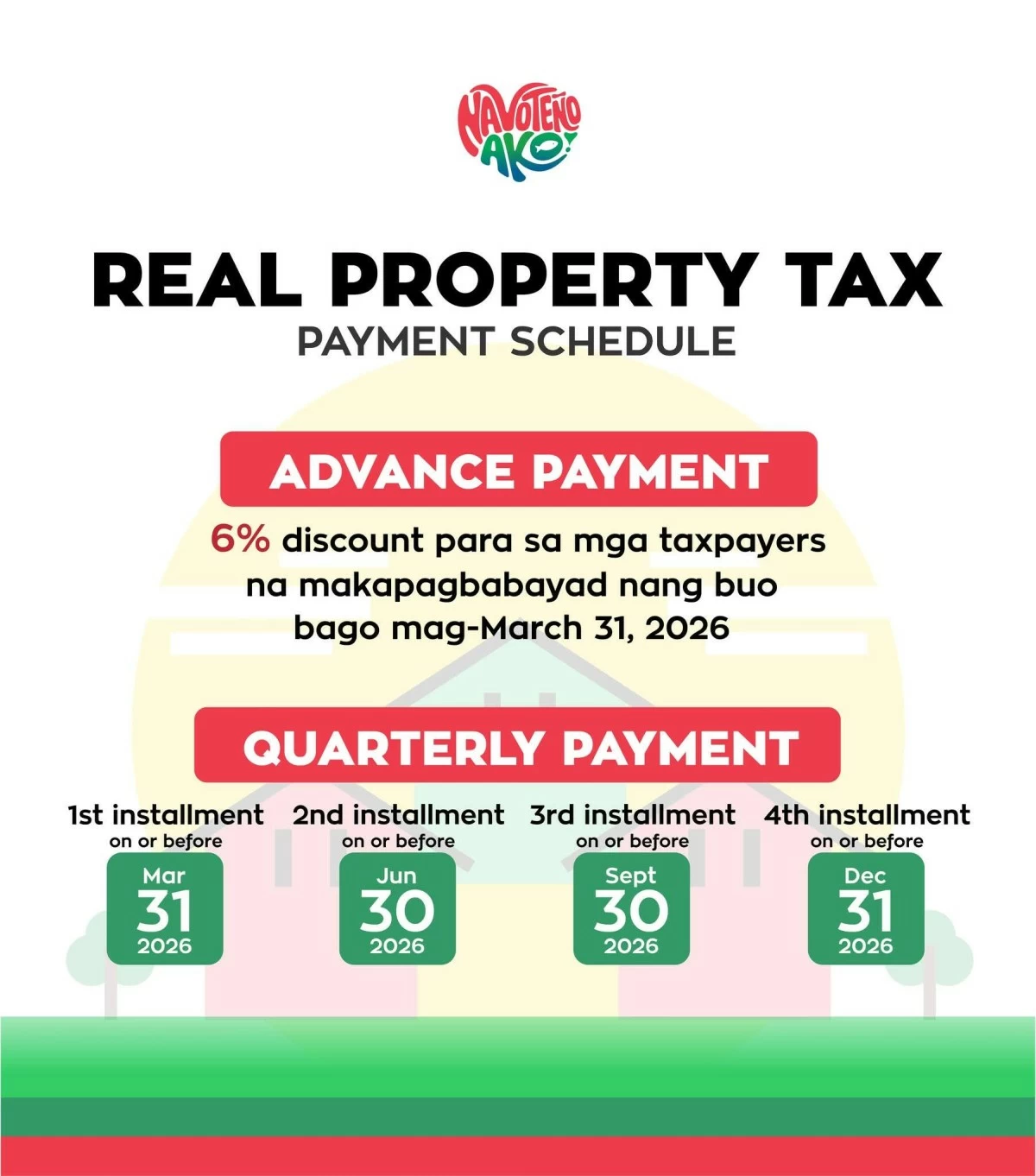

In Navotas, taxpayers paying real property tax or amilyar may receive a 6 percent discount if payment is made in full on or before March 31, 2026.

(Photo from Navotas City LGU)

Payments may be made at the City Treasurer’s Office on the second floor of Navotas City Hall.

The city reminded taxpayers to pay early to avoid penalties.

Meanwhile, the Valenzuela City government reminded business owners that the first-quarter deadline for business tax payment is January 20, 2026.

(Photo from Valenzuela City LGU)

The city also encouraged taxpayers to use its Paspas Permit system, which allows faster and more convenient online business permit renewal.

The Camanava local governments urged taxpayers to follow the announced schedules and take advantage of the available discounts to avoid penalties and support local development.