Only 6 PSEi stocks survived the 2025 slump—Is your portfolio on the list?

The stock market ended a volatile 2025 in the red, with heavy foreign selling and domestic growth concerns sealing a year-long slide for the nation’s primary benchmarks.

The Philippine Stock Exchange Index, the barometer for the nation’s equity value, closed the year with a loss of 7.29 percent, while the broader All Shares Index tracked closely behind with a decline of 7.34 percent.

The downturn was punctuated by sharp contraction in late 2025, as the benchmark index touched three-year lows amid cooling economy and domestic corruption probes that dampened investor confidence.

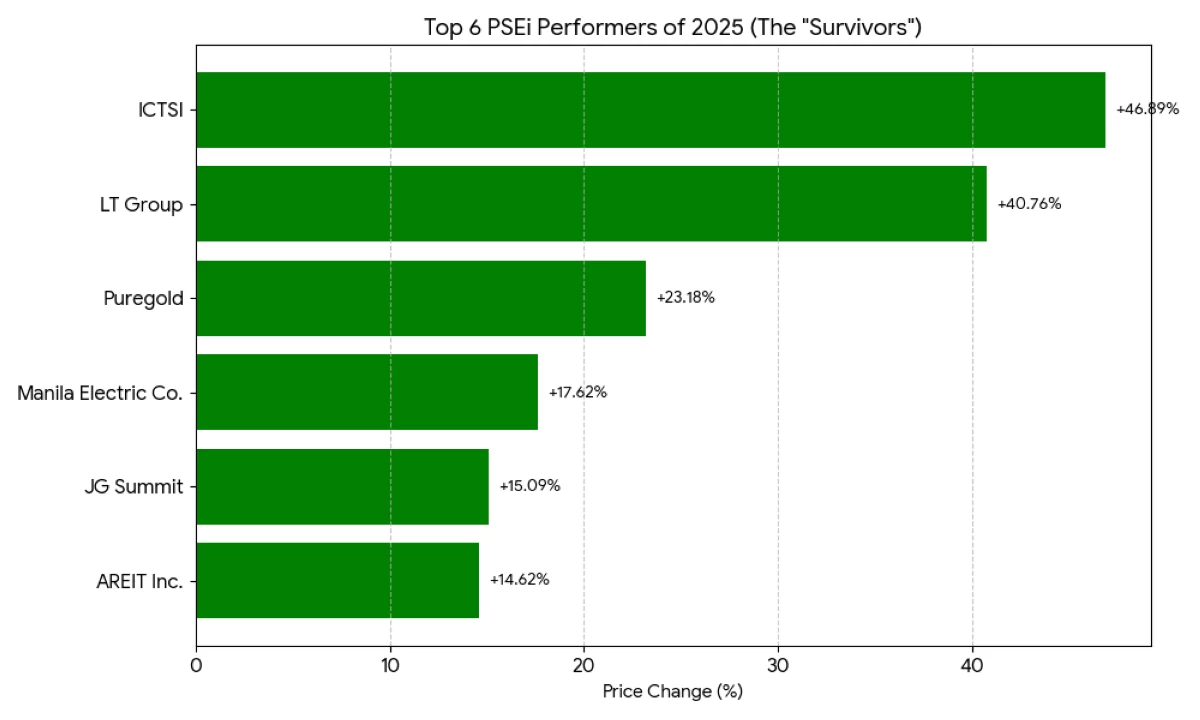

According to exchange data covering common shares from Dec. 31, 2024, to Dec. 31, 2025, the 30-member PSEi saw only six of its constituents finish in positive territory. International Container Terminal Services Inc. (ICTSI) emerged as the blue-chip leader, surging 46.89 percent as the global logistics giant benefited from sustained trade volumes and strategic port expansions.

Other notable gainers within the main index included LT Group Inc., which climbed 40.76 percent, and Puregold Price Club Inc., gaining 23.18 percent. Utility heavyweight Manila Electric Co. rose 17.62 percent, followed by JG Summit Holdings Inc. at 15.09 percent and AREIT Inc. at 14.62 percent.

However, these gains were insufficient to offset the heavy concentration of losses among other index heavyweights.

DigiPlus Interactive Corp. led the retreat with a 40.33 percent plunge, followed by Jollibee Foods Corp., which fell 33.09 percent as rising input costs and lukewarm consumer demand weighed on the fast-food giant.

Other major laggards included Monde Nissin Corp., down 32.56 percent, renewable energy firm ACEN Corp., which shed 32 percent, and telecommunications provider Globe Telecom Inc., dropping 27.46 percent.

Despite the gloom overhanging the main index, the Mining and Oil sector staged a decoupling from the broader market that bordered on the spectacular. The sectoral index nearly doubled, posting a 92.34 percent gain for the year. This surge was driven by the rally in precious metals, with gold prices hitting new heights amid global geopolitical uncertainty and softening dollar.

Philex Mining Corp. was the primary beneficiary of this trend, seeing its share price skyrocket by 260.58 percent. Apex Mining Co. Inc. followed with a 254.84 percent advance. The speculative fervor extended to the broader resource list, with Lepanto Consolidated Mining Co.’s A and B shares jumping 179.1 percent and 176.12 percent, respectively. Manila Mining Corp. also saw triple-digit gains, with its A shares rising 143.33 percent and B shares up 140 percent.

But the resource rally was not universal. Atok-Big Wedge Co. collapsed 62.13 percent, while ENEX Energy Corp. fell 33.20 percent. Other laggards in the sector included NiHAP Mineral Resources International, down 18.18 percent, PXP Energy Corp., which lost 17.07 percent, and GEOGRACE Resources Philippines Inc., sliding 16.35 percent.

The Services index was the only other major counter to finish the year in the green, advancing 14.26 percent. Performance in this sector was highly polarized, driven by individual corporate narratives rather than a broad industry trend.

PhilWeb Corp. was the standout performer, surging 342.86 percent, while Asian Terminals Inc. doubled its value with a 102.94 percent gain. Paxys Inc. rose 53.53 percent, joined by the aforementioned ICTSI and Easycall Communications Philippines Inc., which climbed 42.08 percent.

Conversely, the bottom of the services counter reflected a sharp contraction in consumer-facing and gaming-related ventures. AllDay Marts Inc. led the declines with a 76.69 percent drop, followed by PH Resorts Group Holdings Inc., which fell 75.37 percent as tourist arrivals failed to meet post-pandemic expectations.

DFNN Inc. also retreated 71.93 percent, while AllHome Corp. and DITO CME Holdings Corp. fell 62.97 percent and 58.54 percent, respectively.

Market analysts noted that while gainers in the service sector were rewarded for aggressive expansion and robust cash flows, losers were primarily victims of an inflationary environment that squeezed disposable income.

On the other hand, the Property sector remained under pressure, declining 4.25 percent as high interest rates for much of the year dampened demand in the affordable and middle-income housing segments. The sector saw clear divide between traditional developers and defensive assets such as Real Estate Investment Trusts.

A Brown Co. led the property gainers with a 66.07 percent rise, followed by Century Properties Group Inc. at 64.29 percent. RL Commercial REIT Inc. proved the resilience of the office leasing model with a 37.09 percent gain. Crown Equities Inc. and Philippine Estates Corp. rounded out the leaders, rising 28.57 percent and 25.49 percent.

On the downside, Golden MV Holdings Inc. plunged 55.56 percent and Premiere Island Power REIT Corp. fell 53.85 percent. Other major losers included Omico Corp., Vista Land & Lifescapes Inc., and Primex Corp., which dropped 33.99 percent, 29.73 percent, and 29.28 percent, respectively.

In the Financials sector, the index dipped 5.06 percent as the market adjusted to a falling interest rate environment. Despite the sectoral decline, several banking institutions posted outsized returns.

Philippine National Bank was the sector’s top performer, nearly doubling with a 96.39 percent gain. Bank of Commerce rose 36.30 percent, followed by Citystate Savings Bank at 36.26 percent and Asia United Bank at 27.48 percent. The PSE’s own shares rose 25.24 percent. However, these gains were offset by weakness at Bright Kindle Resources & Investments Inc., which fell 34.34 percent, and Union Bank of the Philippines, which dropped 26.11 percent. Security Bank Corp. and Philippine Business Bank also faced selling pressure, declining 24.54 percent and 20.62 percent, respectively.

The Industrials counter slid 7.39 percent, reflecting a bifurcated landscape where power and specialized manufacturing firms thrived while consumer-exposed companies struggled. Supercity Realty Development Corp. posted a dramatic 1,037.5 percent increase, while Top Line Business Development Corp. rose 433.33 percent. Integrated Micro-electronics Inc. and Panasonic Manufacturing Philippines Corp. also saw strong gains of 132.89 percent and 97.08 percent.

In contrast, Jolliville Holdings Corp. led the industrial decliners with a 54.64 percent drop, followed by Cirtek Holdings Philippines Corp. at 52.27 percent and D&L Industries Inc. at 36.78 percent, the latter suffering from higher raw material costs and weakened consumer confidence.

Lastly, the Holding Firms index registered the deepest losses among the major sectors, falling 15.12 percent due to exodus of foreign capital from the country’s largest conglomerates, which often serve as a proxy for the broader economy. This occurred despite many of these firms reporting improved year-on-year earnings.

Among the few bright spots were Anglo Philippine Holdings Corp., which gained 55.56 percent, and LT Group, up 40.76 percent. Lopez Holdings Corp. rose 37.78 percent, while House of Investments and Cosco Capital Inc. gained 36.09 percent and 29.93 percent. The sector's laggards were led by Abacore Capital Holdings Inc., which fell 50.94 percent, and Prime Media Holdings Inc., down 38.97 percent.