More Filipinos are exposed to fraudsters’ schemes and suffer financial loss worse than in other countries globally, as the Philippines ranks second among countries with high suspected digital fraud rates.

According to data from TransUnion’s global intelligence network released April 29, over 13 percent of digital transactions involving Filipino consumers were suspected of fraud in 2024.

This ranked the Philippines second highest among the markets studied, behind India’s 19 percent and ahead of the Dominican Republic’s 10.9 percent.

“More Filipinos reported being targeted by fraud and suffering financial loss than global counterparts,” TransUnion said in a statement.

For the first half of 2025, TransUnion’s report also showed that the suspected digital fraud rate in the country was more than double the global average of 5.4 percent.

This likewise marked the fifth year the country’s fraud rate stayed above the global level.

Yogesh Daware, chief commercial officer at TransUnion Philippines, stressed that Filipinos reported an average fraud loss of $768 or over ₱44,700 last year.

“Considering average monthly wages in the Philippines, the losses constitute at least two months of salary for most Filipino households.”

This amount is lower compared to the global median of $1,747 (about ₱101,700). Despite this, “the impact of falling victim to fraud remains significant,” Daware said.

Specifically, seven in 10 Filipinos, or 70 percent, said they were targeted by fraud attempts through email, phone calls, or text messages in the past three months, notably higher than the 53 percent average across all markets surveyed.

Additionally, 34 percent of Filipinos reported losing money to fraud attempts between November 2023 and December 2024, higher than the global average of 29 percent.

“These trends showed that Filipinos are facing greater risks from fraud, highlighting the need for stronger safeguards to prevent financial losses,” it asserted.

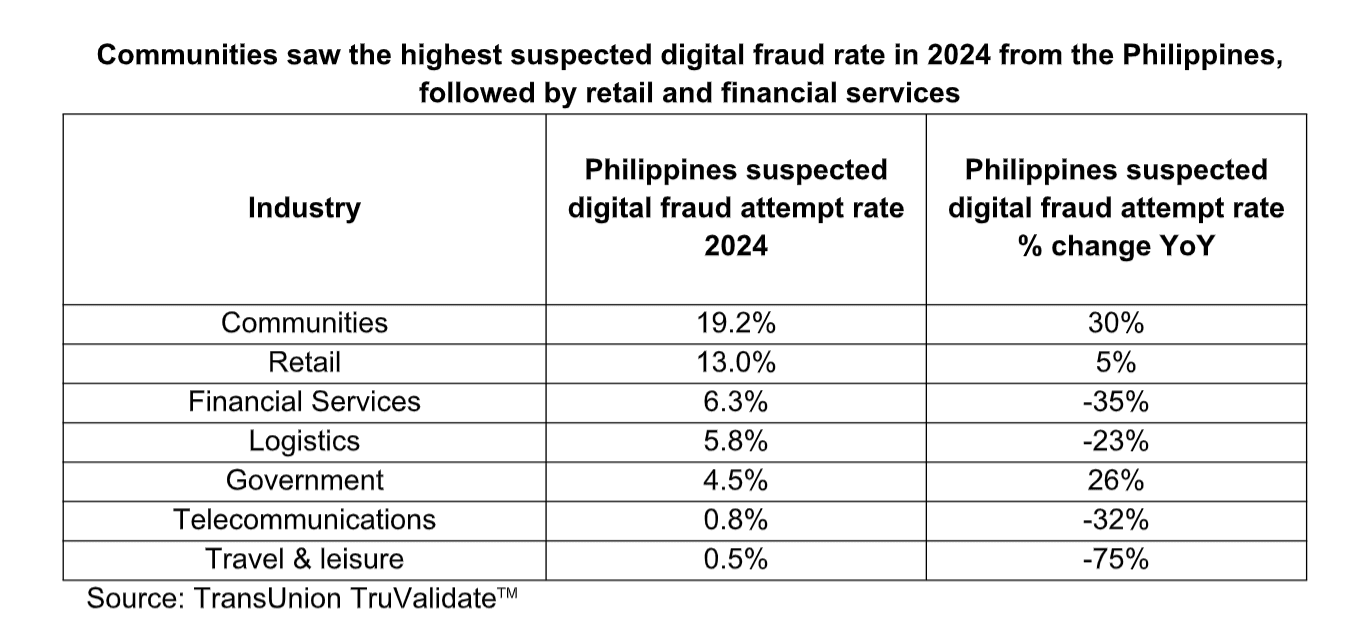

Broken down, the communities sector, which covers online dating, social media sites, and forums, recorded the highest suspected digital fraud rate among local industries at 19.2 percent in 2024. This trend was also seen globally, where the sector posted the highest fraud rate at 11.6 percent.

“The number of social media users in the Philippines amounts to 78 percent of the country’s population. The high volume of users interacting online opens doors for fraudsters to take advantage of unsuspecting victims,” Daware said.

“Despite a decrease in digital transactions in communities globally and from the Philippines last year, our analysis showed a growth in the number of transactions suspected to be digital fraud. This tells us that fraudsters are ramping up their attacks by targeting more victims and diversifying their tactics,” he argued.

Following communities, the retail industry had the second-highest suspected digital fraud rate at 13 percent, higher than the global average of 7.6 percent.

Financial services remained among the top three most targeted industries, with a 6.3 percent suspected fraud rate. However, this rate dropped by 35 percent year-on-year, even as digital transactions in the sector grew by 17 percent.

TransUnion said that the improvement is likely due to more substantial anti-fraud efforts by both the government and the private sector. It noted that the government has stepped up its campaign against scams and required financial institutions to enhance cooperation.