BSP vows continued inflation control, growth support following Fitch's nod

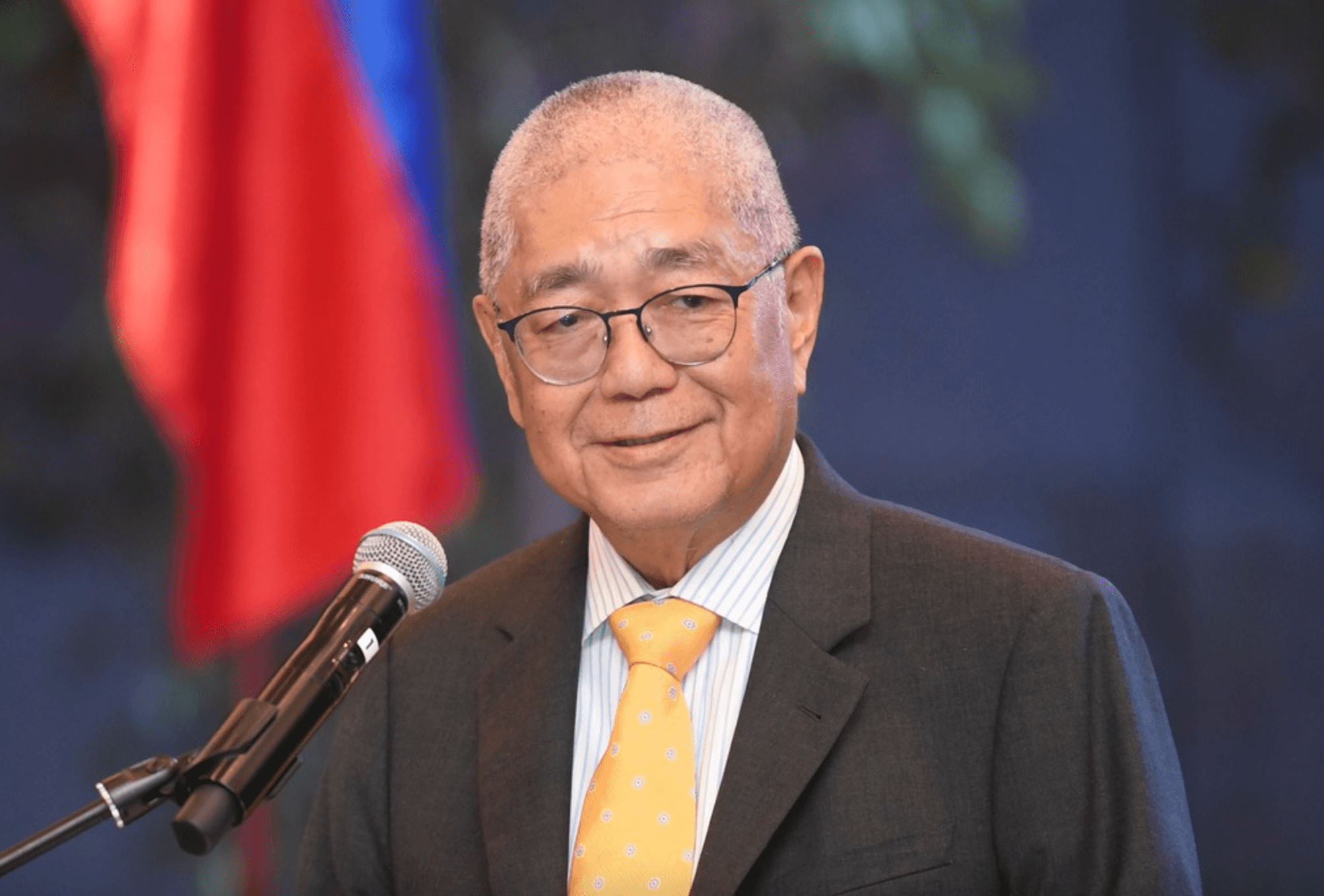

Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona Jr. vowed to continue implementing measures to keep inflation under control and support sustainable economic growth, following Fitch Ratings’ reaffirmation of the country’s BBB credit rating.

“The BSP took actions to help keep inflation manageable and promote sustainable economic growth. The BSP will continue to do so,” Remolona said in a statement released on Tuesday, April 29.

This came after the central bank governor welcomed the credit-rater’s reaffirmation of the country’s investment-grade credit rating.

Specifically, Fitch Ratings has maintained the Philippines’ BBB credit rating with a “stable” outlook, noting the country’s progress in controlling inflation and preserving overall economic stability.

For the first three months of 2025, the average inflation rate stood at 2.2 percent, falling comfortably within the government’s target band of manageable price increases conducive to economic growth.

Fitch considers the BSP’s inflation targeting framework as “credible” and expects inflation to stay around two percent in 2025 and 2026—at the lower end of the government’s two- to four-percent target range.

Fitch also noted the country’s “solid domestically driven growth.” The local economy expanded by 5.3 percent in the fourth quarter of 2024, and 5.7 percent for the full year. These fell short of the government’s downscaled six to 6.5 percent growth target. Data for the first quarter of 2025 will be released on May 7.

“Fitch expects the Philippine economy to expand by 5.6 percent in 2025, driven by infrastructure spending, services exports, and remittance-backed private consumption,” the BSP said. If realized, this growth rate would still fall short of the government’s more ambitious six-to-eight percent target for 2025 and 2026.

It likewise projected the country’s gross domestic product (GDP) to grow by six percent over the next few years.

Fitch pointed out that the Philippines’ domestic-focused economy reduces its exposure to global trade tensions. The relatively low US tariff on Philippine exports could also provide a competitive advantage over other regional countries, the BSP said.

Other credit rating agencies have also given positive updates. In November 2024, S&P Global Ratings revised the Philippines’ outlook to positive, while Japan-based Rating and Investment Information, Inc. upgraded the country to “A-” with a stable outlook in August 2024.

An investment-grade rating indicates low credit risk and easier access to affordable funding, allowing the country to invest more in social programs and development initiatives.