Philippine National Bank posted a consolidated net income of ₱6.1 billion in the first three months of 2025, up by 15 percent against the same period last year due to the increase in its loan portfolio and treasury assets.

In a disclosure to the Philippine Stock Exchange, the bank said its core income for the first quarter of 2025 amounted to ₱14.1 billion, increasing by 10 percent from the same period last year. The net interest margin grew by nine percent year-on-year to ₱12.7 billion.

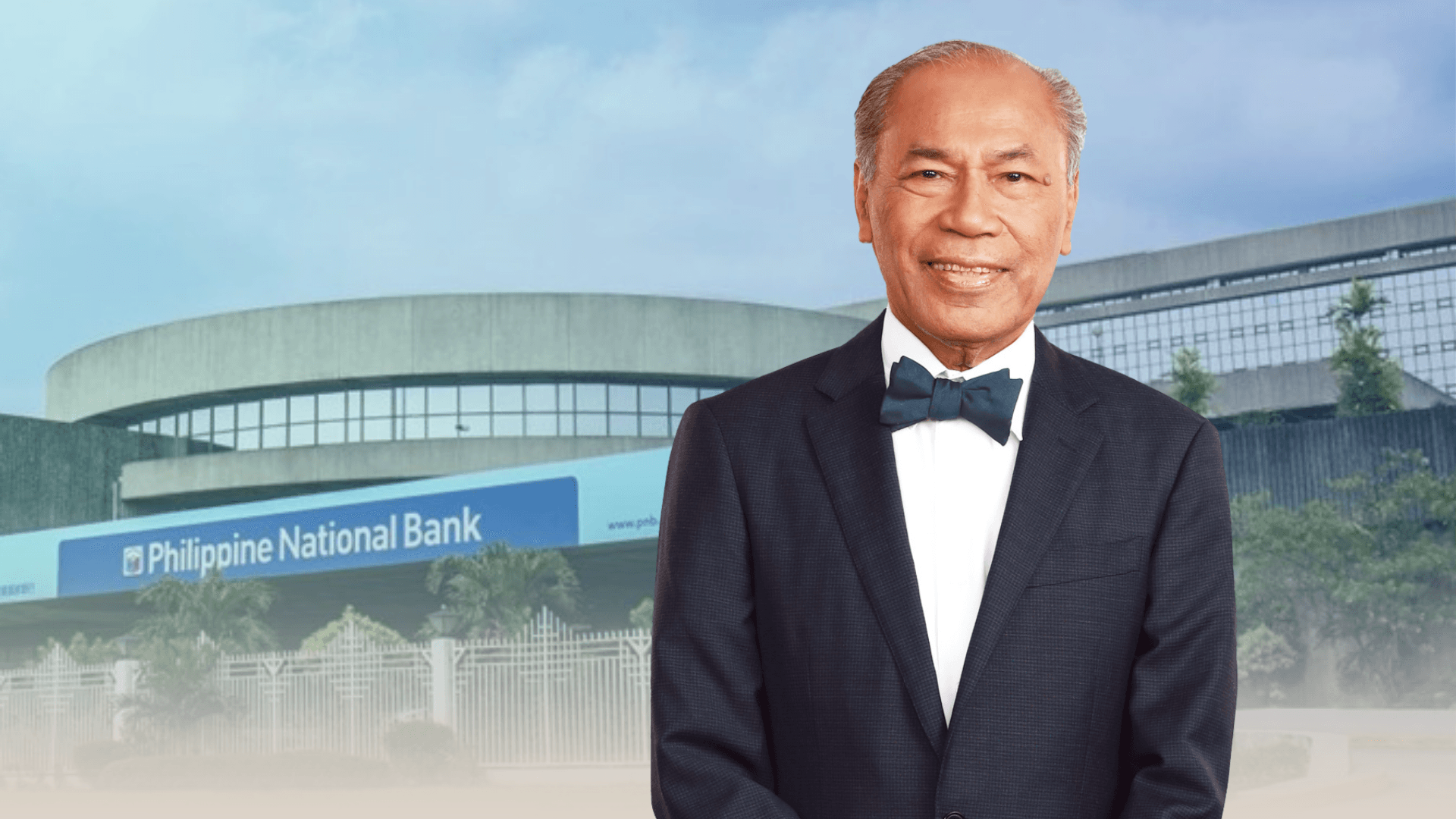

“The first quarter financial results this year reflect the strength of PNB’s franchise in its wholesale and retail businesses. Excluding the impact of non-recurring gains from the sale of foreclosed assets, the growth in the Bank’s core income continued to drive the Bank’s earning momentum,” PNB President Florido Casuela said.

He added that, “We expect that the quality of the Bank’s earnings will further improve since we have already put in place the necessary foundation for the Bank’s sustained stability and accelerated growth.”

Other income increased to ₱1.9 billion in the first quarter of 2025 from year-ago level of ₱1.2 billion, mainly boosted by gains from trading and foreign exchange transactions as well as the sale of foreclosed properties.

Operating expenses were 10 percent higher at ₱8.1 billion as the Bank continued to pursue its strategy to grow its consumer business segment. Similarly, taxes and licenses went up as a consequence of the Bank’s increased business volume.

Provision for impairment losses is at ₱277 million, 55 percent lower than the year-ago level, reflecting the continued improvement in the Bank’s loan portfolio quality through enhanced credit underwriting and sound management practices.

Total assets as of March 31, 2025, amounted to ₱1.28 trillion, two percent higher than the December 31, 2024, level. Net loans and receivables increased to ₱655.9 billion, and deposit liabilities at ₱988.3 billion.

Moody’s recently upgraded PNB’s credit rating to Baa2, one notch above investment grade, from Baa3 last year and changed its rating outlook to Stable from Positive.

The Moody’s rating action reflected PNB’s continued improvement in core profitability driven by NIM expansion and lower credit costs, robust capital and solid liquidity, which will provide sufficient buffers against the Bank’s modest asset quality.