Ayala sets two-year goal to turn emerging businesses profitable following strong 2024

Zobel-led Ayala Corporation, the country’s oldest conglomerate and among the most prestigious, is aiming to surpass its performance in 2024, its strongest year ever, by bringing its smaller and newer businesses to profitability in about two years.

During the firm’s annual stockholders meeting, the company highlighted the importance of building a more cohesive Ayala Group that creates greater shared value following its record core earnings of P45 billion in 2024.

“We want to ensure that our emerging business units have a credible path to scale and the ability to achieve good valuation levels. Currently, we're focused on helping our emerging businesses achieve profitability and scale. At the same time, we want our larger companies to retain their positions as industry leaders,” he noted.

The conglomerate’s major business units are Bank of the Philippine Islands, Ayala Land Inc., Globe Telecom, and ACEN Corporation, while its smaller units include Integrated Microelectronics Inc., AC Mobility, AC Logistics, and AC Health.

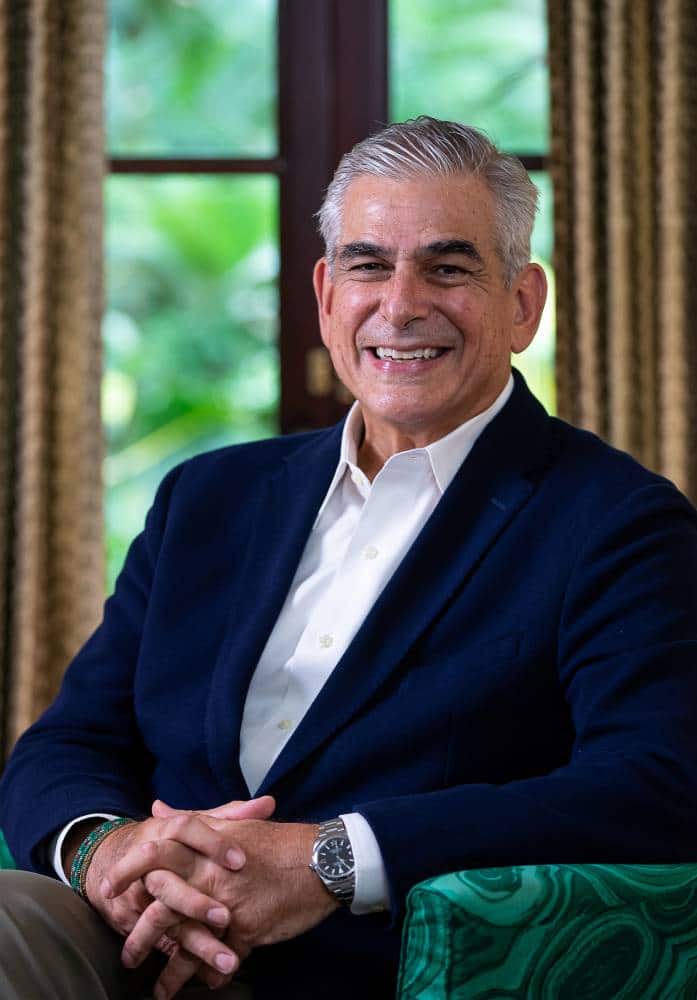

Ayala Corporation President and CEO Cezar P. Consing expressed measured optimism that strengthening the major and smaller businesses and capitalizing on the Group’s ecosystem will enable Ayala to deliver long-term value.

He noted the importance of Ayala’s rationalization initiatives as consistent with the Group’s greater focus on business activities that generate the most value.

Consing explained that, “what we've done with our smaller businesses, each of them, we have restructured them, rationalized them, repositioned them, put them in a position where they can win. And, fortunately for most of our smaller businesses, they're now at that level.”

According to Consing, “2025 could be an inflection year for our smaller businesses. Each of them undertook major rationalization initiatives last year, and we should begin to see the payoffs of such moves this year.”

For example, AC Health will further grow its provider business by expanding its hospital and multi-specialty clinic footprint.

ACMobility, meanwhile, will continue to invest in growing its new electric vehicle business, add company-owned dealerships, and expand its charging infrastructure. AC Logistics will work with global leader A.P. Møller Capital to grow its local business.

Consing said Ayala’s smaller business units registered combined equity losses of ₱1.35 billion last year but added that, “We have, however, made good headway in sharpening our portfolio... I think we will get to the point, probably in the next couple of years, where all or almost all of our businesses will be contributing positive equity earnings.”

He pointed out that, “we had our strongest year ever with not all our engines firing on all cylinders. Can you imagine what we would look like if we had a year where all our engines were firing on cylinders?

“I think the chances are there will be a year where all our engines are firing on cylinders because we're making sure that we're set up for that.”

Consing added though that, “We will still be heavily reliant on our four big listed businesses, but the rest of our portfolio companies will be able to contribute shareholder value and dividends. Our balance sheet, which is already quite strong, will become even stronger.

“It will have to, because we want to invest more in several of our businesses. Of our four major businesses, ACEN could probably use more equity capital. Two or three of our newer businesses could also use more growth capital.”

The Ayala Group is alloting ₱230 billion for capital expenditures this year to support Group businesses which have the potential to meaningfully scale. This program is timely as the next decade could be one of considerable growth for the Group.

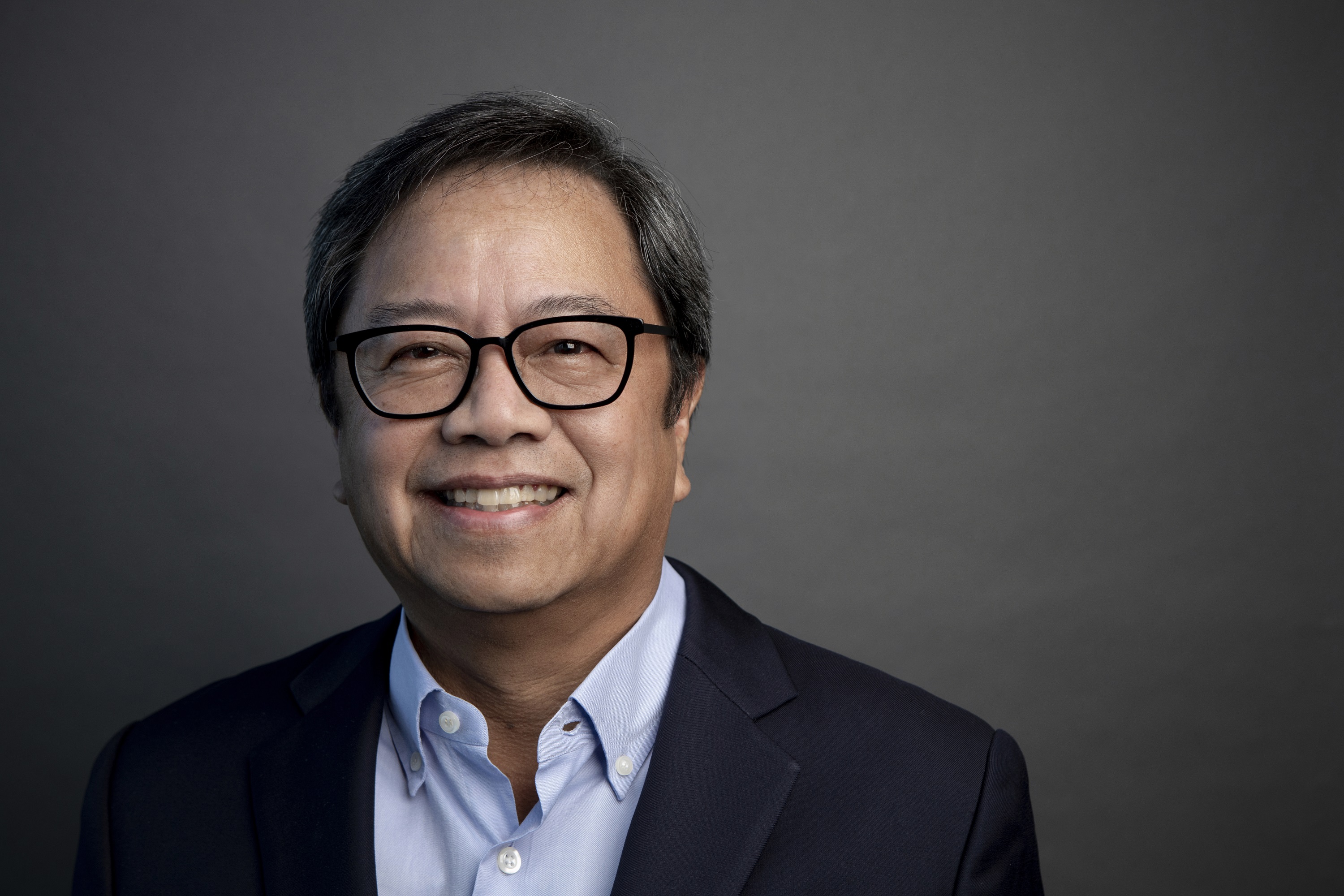

Meanwhile, Ayala Corporation welcomed to its Board of Directors Emmanuel P. Maceda, Chairman of Bain & Company, following his election during the company's annual stockholders meeting.

Bain & Company, which is headquartered in Boston, Massachusetts, is one of the world's leading management consulting firms.

Maceda replaced former Finance Secretary Cesar V. Purisima, who has served as independent director at Ayala Corporation since 2022.

Zobel thanked him for his exceptional contributions particularly in enhancing governance, financial, risk management, and sustainability practices at the company.

"We are excited to have Manny join us at Ayala Corporation. He has advised global CEOs on large-scale transformations, strategy, growth, and organizational effectiveness. His experience and expertise align with Ayala's thinking and direction for the future, covering new technologies, including artificial intelligence, and stakeholder-centric capitalism, among many others," Zobel said.