FROM THE MARGINS

I had the honor of joining the ASEAN Forum on Inclusive Financial Well-being on April 8, upon the invitation of Governor Abdul Rasheed Ghaffour of Bank Negara Malaysia (BNM). Held in Kuala Lumpur, the forum was a sideline event of the 2025 ASEAN Finance Ministers and Central Bank Governors’ Meeting (AFMGM) and highlighted the role of financial well-being in driving sustainable growth.

The forum brought together around 350 participants from ASEAN member states, the ASEAN Working Committee on Financial Inclusion, Malaysian government agencies, financial institutions, NGOs, social enterprises, and academia. Surrounded by policymakers, financial leaders, grassroots advocates, and innovators from across Southeast Asia, one thought echoed in my mind:

“Financial inclusion is not just about opening bank accounts. It is about opening doors.”

I was part of a panel discussion moderated by Ms. Aban Haq from the Alliance for Financial Inclusion. It was a privilege to join BNM Deputy Governor Adnan Zaylani, who shared BNM’s initiatives from a policymaker’s perspective; DBS Bank CEO Tan Su Shan, who highlighted efforts to support SMEs and social enterprises; and Dr. Joanne Yoong, a behavioral scientist who explored the psychological barriers to inclusion. Our discussion made clear that across ASEAN, there is growing recognition that access to financial services is not enough—financial access must lead to opportunity, security, and dignity for all.

Not one-size-fits-all

Shaped by years of work with low-income communities in the Philippines and other Southeast Asian countries, I carried with me the day-to-day realities of the marginalized: the sari-sari store owner in the province, the jeepney driver navigating rising costs without a safety net, the young worker juggling multiple jobs to support his family while paying off loans, the elderly person struggling to use a mobile wallet for the first time. These stories underscore the need to build financial systems that are not only accessible but also fair, empowering, and resilient.

At the forum, I shared that financial well-being is not a one-size-fits-all concept. It differs across communities shaped by varying economic, cultural, and social contexts. While the core elements—financial security, resilience, and opportunity—are common, the pathways to achieving them differ. From my experience in microfinance, I have seen how financial well-being is influenced by environment, cultural norms, service accessibility, gender, and community resilience. Effective financial solutions must therefore be context-based, inclusive, and aligned with local realities.

Layered challenges

Many low-income families face not just financial exclusion, but also social and digital marginalization. Barriers to education, healthcare, and secure employment often trap them in cycles of poverty. Marginalized families and communities have limited access to infrastructure, digital tools and the internet.

Our affiliated microfinance and social development organizations have spent over four decades addressing these layered challenges. From a single microfinance institution, we have grown into a network of 30 financial institutions and social enterprises—responding to our clients’ evolving needs. We learned that financial inclusion is most effective when paired with education, social services, and community engagement.

I emphasized at the forum that poverty is not just lack of access—it is lack of control. To address this, our banks, insurance firms, and clinics are either substantially or fully owned by our member-clients. To break intergenerational poverty, we pursue a triple-bottom-line approach: financial sustainability, social impact, and environmental responsibility. Our social finance model integrates financial services with health, education, livelihood, and community-building—especially for women entrepreneurs. Today, we serve almost 10 million clients—most of them poor women—and our microinsurance programs cover nearly 31 million Filipinos.

Scaling-up social finance

Although digital innovation is part of our approach—with Konek2CARD, a mobile banking app and a remittance platform—we remain mindful of the digital poor because in far-flung communities, weak infrastructure, expensive devices, and high internet costs exclude many people.

Scaling-up social finance is not easy. Microfinance institutions (MFIs) and similar organizations face regulatory barriers, infrastructure gaps, capitalization and other challenges. But MFIs with deep community trust, wide client reach, and alignment with national inclusion goals are well-positioned to lead.

Expanding into education, health, and climate finance can deepen impact and open new partnerships with corporations and social investors alike.

The conversations at the ASEAN Forum made one thing abundantly clear: financial inclusion cannot stop at access. We need policies that prioritize people, systems rooted in equity, and programs that direct resources where they are needed most. Social finance—where impact, not just profit, drives investment—offers a compelling path forward. In the Philippines and across Southeast Asia, it is time to reimagine financial ecosystems that not only include the marginalized, but empower them to shape their own economic futures.

By strengthening individual capabilities and building supportive systems, especially through social finance, we can collectively empower communities and drive transformative impact on financial well-being.

* * *

“We are in a position of financial and social power, and we could be agents of change in our society.” — Guy Laliberté

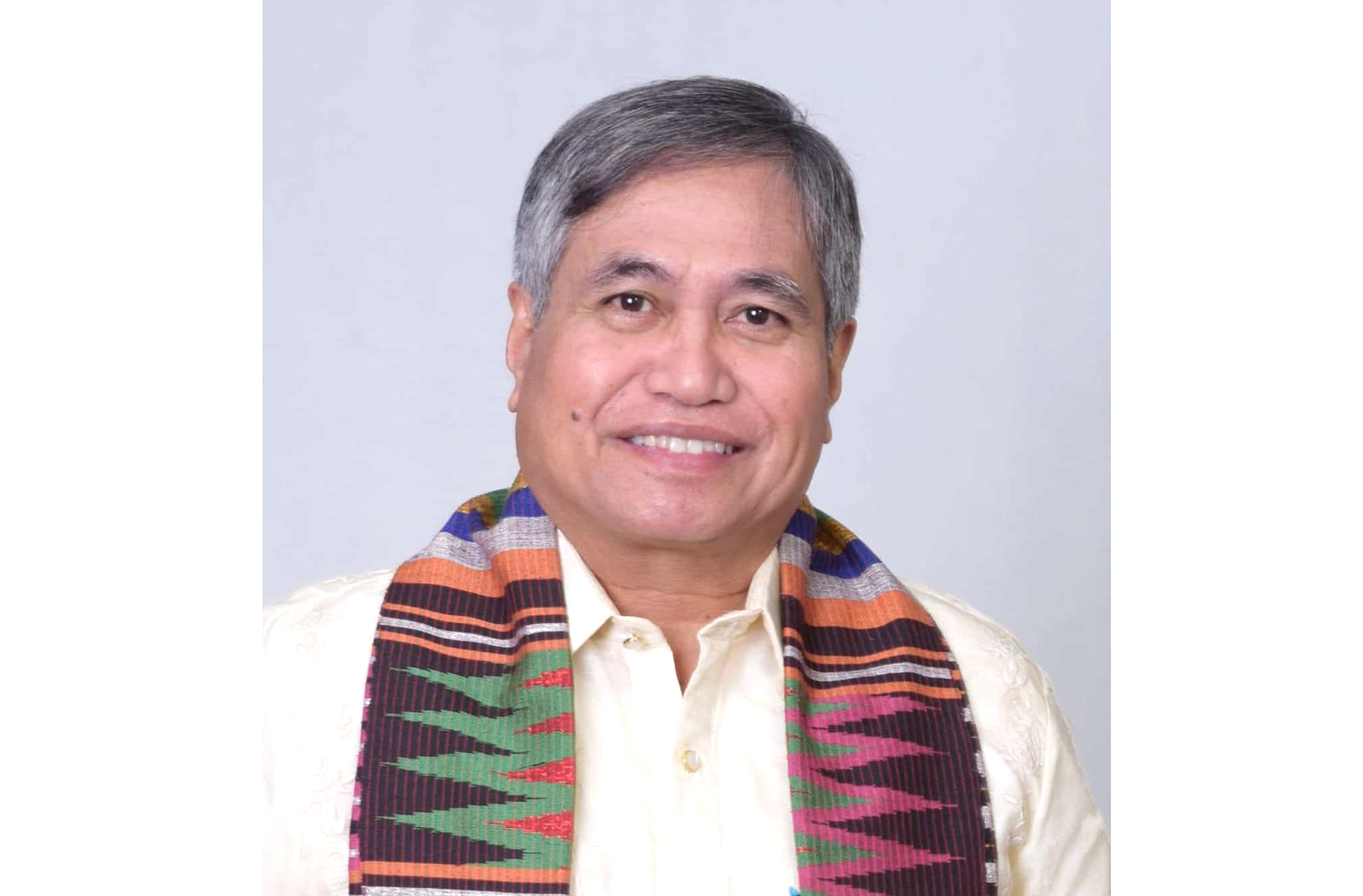

(Dr. Jaime Aristotle B. Alip is a poverty eradication advocate. He is the founder of the Center for Agriculture and Rural Development Mutually-Reinforcing Institutions (CARD MRI), a group of 23 organizations that provide social development services to eight million economically-disadvantaged Filipinos and insure more than 27 million nationwide.)