Brazil, the world’s leading meat exporter, is expected to significantly boost its export market this year due to rising demand from key trading partners, including the Philippines, which is battling the spread of animal diseases in its domestic production.

In a report, the United States Department of Agriculture-Foreign Agricultural Service (USDA-FAS) said the Philippines’ appetite for beef and pork is vital to the continued growth of the South American nation’s poultry industry.

Global beef production this year is anticipated to remain unchanged from 2024 at 61.6 million tons amid falling production in the US and the European Union (EU), which is offset by increases in Brazil, India, and Australia.

Brazil, the world’s largest beef exporter, is forecasted to ramp up its cattle production to a record 11.9 million tons or about 19 percent of the expected total volume.

USDA-FAS said global exports will likely hike by one percent this year to 13.1 million tons amid increased production from Brazil, India, and Australia.

Brazil exports, in particular, are presumed to go up three percent to reach 3.8 million tons of total imports.

The report noted that “firm demand” from trading partners such as the US, Chile, and the Philippines “is likely to drive Brazil exports to a record in 2025.”

South American countries are expected to corner nearly 30 percent of the global beef trade.

Based on data from the Bureau of Animal Industry (BAI), the Philippines imported 88.77 million kilograms (kg) from Brazil in 2024. This is 43.53 percent of the total import volume of 203.9 million kg last year.

The hike in beef imports has been attributed to the strong demand, which is outpacing the current capacity of local production.

Meanwhile, pork is another commodity that the Philippines is expected to significantly increase imports of, in a bid to temper prices which has seen increases amid limited domestic supply.

USDA-FAS estimates that global pork production will remain steady at around 116.7 million tons this year, with a forecasted total export of 10.2 million tons.

Brazil, recognized as an inexpensive supplier of pork, is positioned for continued growth given higher production and strong international demand.

“Brazil is expected to gain market share in price sensitive markets as tariffs and animal health issues shift market dynamics in 2025,” the report read.

“Additionally, African swine fever (ASF) outbreaks in Europe, the Philippines, Vietnam, and South Korea continue to impact production in these countries,” it added.

Brazil was the top supplier of pork to the country last year, exporting 210.11 million kg of pork or 28.63 percent of the total import volume of 733.73 million kg.

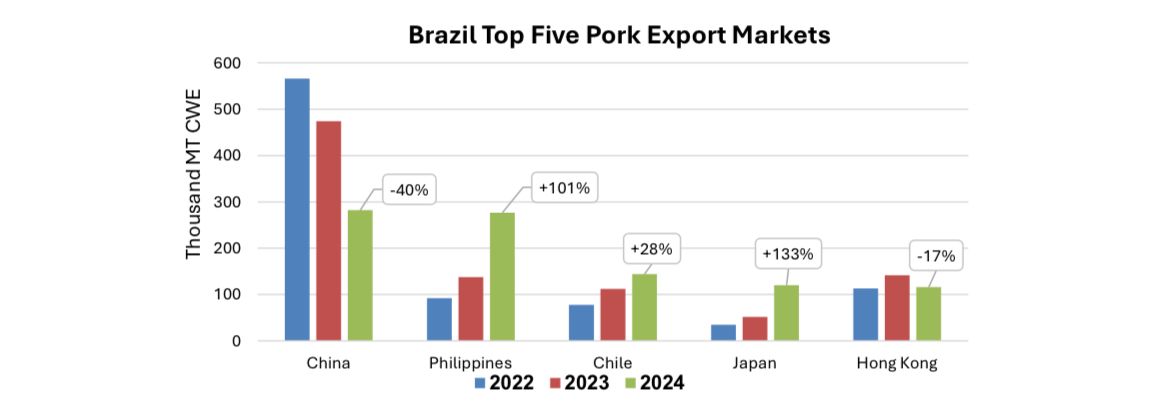

According to USDA-FAS, the Philippines will be Brazil’s second-biggest export market this year, above Chile, Japan, and Hong Kong, while China is anticipated to be its leading market.

The domestic production of pork, arguably the country’s most beloved animal meat, has seen immense decline since the first ASF outbreak in 2019.

Data from the Department of Agriculture (DA) showed that the current swine population stands at approximately eight million, which is only 60 percent of the nearly 13 million heads before the outbreak.