The National Home Mortgage Finance Corporation is set to issue its 7th securitization offering called the NHMFC Bonds 2024 valued at ₱1.3 billion. The offering is backed by 1,658 long-term secured residential loans characterized by low delinquency. It is the second largest amount ever issued by NHMFC since its maiden issuance in 2009.

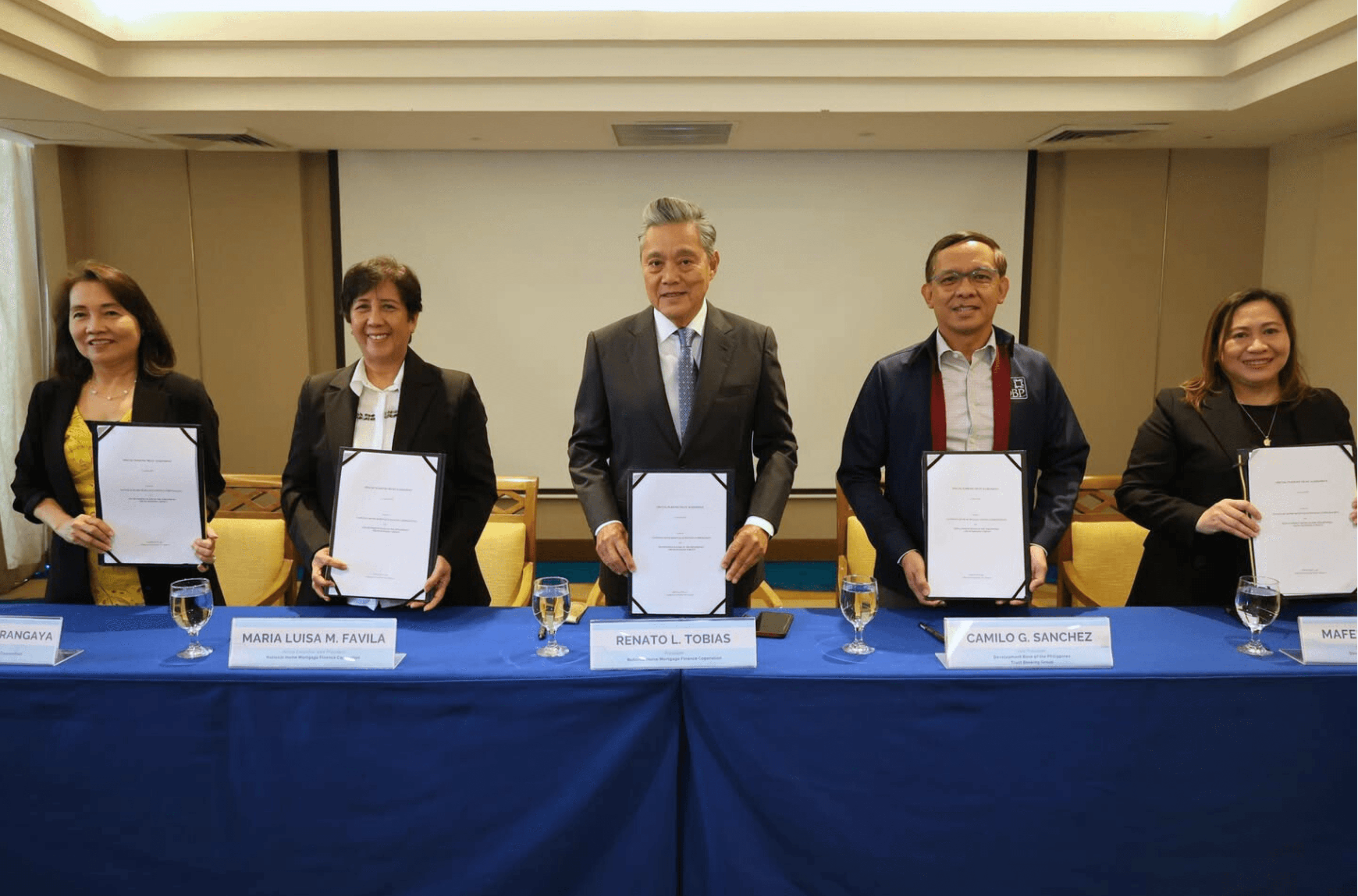

At the signing ceremony held on Friday (March 21, 2025) between NHMFC and the Development Bank of the Philippines-Trust Banking Group (DBP-TBG) for the NHMFC Bonds 2024 Special Purpose Trust Agreement and Securitization Plan, NHMFC President Renato L. Tobias said that this bond issuance serves as a crucial source of funding for housing, creating opportunities in the capital market.

Third party partners of NHMFC for this securitization are the DBP-TBG as Special Purpose Trust Administrator, Land Bank of the Philippines-Investment Banking Group (LBG-IBG) as arranger/underwriter, Philippine National Bank-TBG as trustee/registrar/paying agent, MOSVELDTT Law Offices as transaction counsel & tax advisor, MOORE Roxas Tabamo and Co. as portfolio auditor and Philippine Rating Services Corporation (Philratings) as credit rating agency.

“This partnership marks a significant step forward to fulfilling NHMFC’s mandate of being the sole secondary mortgage institution. It also advances NHMFC’s mission to strengthen investment opportunities in the capital market, addresses the financing needs of the housing originators and promotes sustainable growth in the housing sector,” President Tobias remarked.

President Tobias further said that “by signing the NHMFC Bonds 2024 Special Purpose Trust Agreement, we underline our commitment to fostering our partnerships built on trust and mutual benefit. Furthermore, through our diversified financial strategies in the Securitization Plan, we are not only enhancing our operational efficiency but we are also creating new opportunities for investment and development in the capital market, benefitting our communities and stakeholders alike.”

On the other hand, Mr. Camilo G. Sanchez, Trust Officer and Vice President of DBP-TBG said that they are humbled and honored for the continuing trust and confidence of NHMFC to be its partner in the pursuit of its mandate.

“The NHMFC Bonds 2024 as the 7th securitization program of NHMFC, is a clear indication of NHMFC as the premier secondary mortgage institution in the country,” VP Sanchez said.

He also assured that as NHMFC exerts all efforts to uphold its mission of sustaining the liquidity and affordability in the housing market through its securitization program, DBP Trust Banking Group is once again on its steady feet to render the services mandated as SPT Administrator.

Also present at the event were LBP-IBG Vice President Guin Angelo S. Dumalagan, MOSVELDTT’s Senior Partner Atty. Jerry Coloma, and other key officials from NHMFC.