FROM THE MARGINS

A few weeks ago, I had the privilege of organizing a Baguio trip for my batchmates from Ambray Elementary School in San Pablo City. Around 35 of us, led by Batch ’69 officers, Ruel Merin and Carol De Villa-Galomo, and some family members, joined the journey. It gave us an opportunity not just to reconnect, but also to witness how microfinance is transforming people’s lives. Many of my batchmates are either center leaders or active members of a microfinance institution (MFI) in Laguna, so visiting our fellow members’ business enterprises along the way became a meaningful bonding experience filled with inspiring stories of resilience and success.

Manaoag: Encounter with clients

Our first stop was the Minor Basilica of Our Lady of the Rosary in Manaoag, Pangasinan. This gave us a moment of prayer and reflection, a chance to give thanks and seek blessings before continuing our journey.

While in Manaoag, I visited an MFI where I met two clients, Virgie Mintac and Dionisia Gamboa, whose experiences demonstrated how microfinance helps build better lives.

Sixteen years ago, Virgie Mintac struggled to make ends meet. She was a vegetable vendor in Urdaneta while her husband farmed palay, corn, and squash. When a friend introduced her to microfinance, she saw an opportunity for a brighter future. She was given access to business capital, agricultural loans, and life insurance. With educational loans, she was also able to send her children to school. Her children have graduated and all are gainfully employed. Her eldest son works as a head mason, her second son works for his brother while also assisting on the farm, and her youngest daughter, an Accountancy graduate, has been working at her MFI’s affiliate bank for six years. Seeing the benefits, two of her children also became microfinance members.

Dionisia Gamboa has been an MFI member for 18 years. At 71, she continues to manage a sari-sari store while making and selling “atsara” and peanut butter. Reminiscing about the challenges of raising 11 children, Dionisia shared how her MFI helped them through the years by providing loans for her business and children’s education. Dionisia and her husband used to be laborers in a handicraft business, but through microfinance, she was able to expand their store and purchase a tricycle for additional income. Her microinsurance, which provides her coverage up to 100 years, gives her peace of mind in her old age.

Both Virgie and Dionisia shared that more than financial support, their MFI gave them a sense of community. The weekly center meetings served as opportunities to learn and help fellow members, reinforcing the idea that progress is best achieved together.

Baguio: Exploring local enterprises

After the interviews, I rejoined my batchmates for lunch at Coastal’s Cuisine Bar and Grill, which is owned by microfinance client Filipina Fenuliar. The food was plentiful, and the hospitality made the experience more memorable. We left Manaoag and arrived in Baguio that evening, then had dinner at a restaurant owned by another MFI client.

Apart from exploring cultural and historical sites like Bell Church, Diplomat Hotel, and Our Lady of Atonement Cathedral, we visited farms and woodcraft businesses supported by microfinance. At the strawberry farm, we met farmers who turned their passion into sustainable businesses. In woodcraft workshops, artisans showcased finely crafted wooden products. Lunch was at a flower farm, while dinner was at Dong Ye Korean and Chinese Restaurant, owned by Jedidah and Josephine Boliwan. Both establishments are run by microfinance clients. We also strolled through the night market, conversing with these entrepreneurs who shared how access to small loans enabled them to expand their businesses and support their families.

Our second day in Baguio was spent visiting Burnham Park and Mines View Park, where we enjoyed local delicacies such as ube and strawberry “taho.” Lunch at Camp John Hay was catered by an MFI member, further highlighting the strong presence of microfinance-supported businesses in the city. We also visited the Baguio Market to buy local products and support small-scale entrepreneurs. We spent the evening at Agasem Grill and Restobar, owned by a microfinance client Kristopher Cris Mamaril, where we enjoyed good food, singing and dancing—a perfect way to celebrate friendships, new experiences, and the spirit of togetherness that defined our trip.

Traveling home with renewed inspiration

The journey home was long, but our conversations were filled with nostalgic reflections of our days as grade school students in Ambray and our experiences as individuals now in our advanced years.

More than the memories we created, we carried with us a deeper appreciation for the power of financial inclusion, the importance of supporting small businesses, and the value of staying connected. The trip reaffirmed that progress is possible when people come together, help one another, and embrace entrepreneurship as a path toward a better future.

* * *

“A journey is best measured in friends rather than miles.” – Tim Cahill

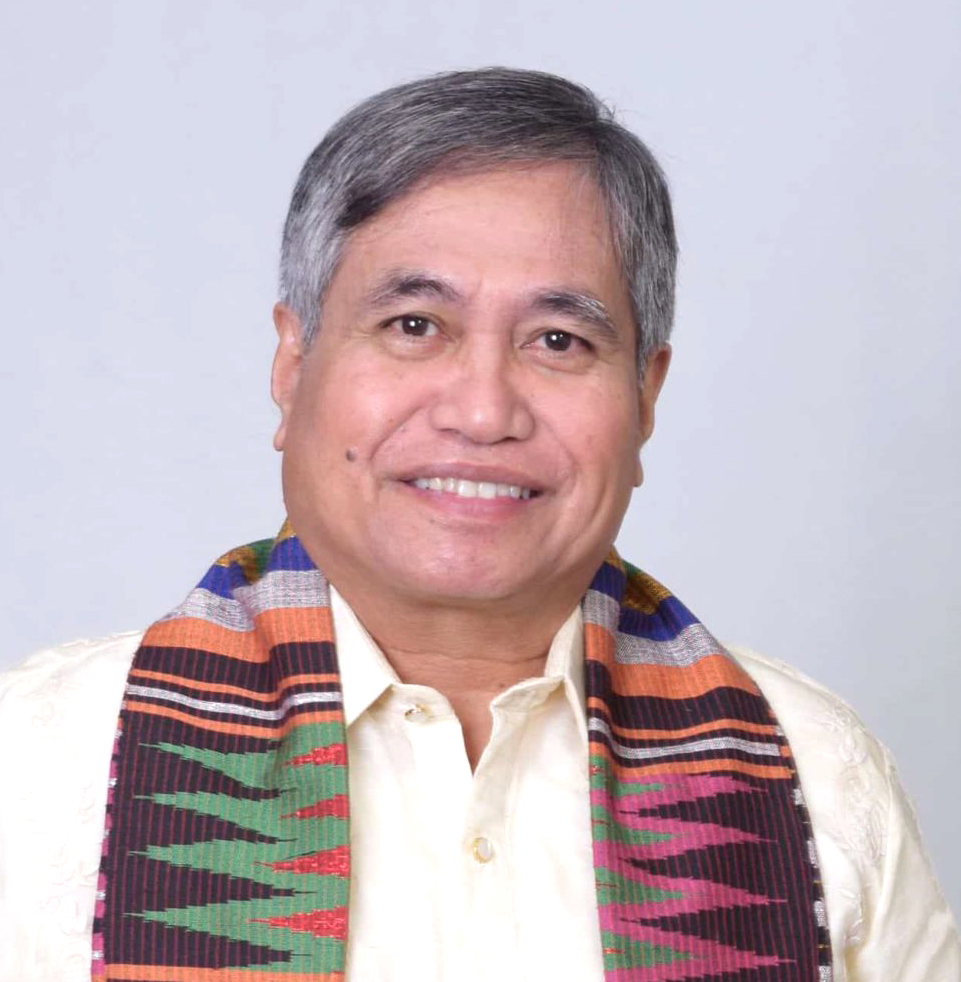

(Dr. Jaime Aristotle B. Alip is a poverty eradication advocate. He is the founder of the Center for Agriculture and Rural Development Mutually-Reinforcing Institutions (CARD MRI), a group of 23 organizations that provide social development services to eight million economically-disadvantaged Filipinos and insure more than 27 million nationwide.)