Jollibee posts strong growth in 2024, sets ambitious 2025 targets amid regional challenges

Jollibee Foods Corporation, one of the largest Asian food service companies, is allotting ₱18 billion to ₱21 billion for capital expenditures this year as it reported a 17.7 percent growth in attributable net income to ₱10.3 billion last year from ₱8.77 billion in 2023 despite a drop in fourth quarter earnings.

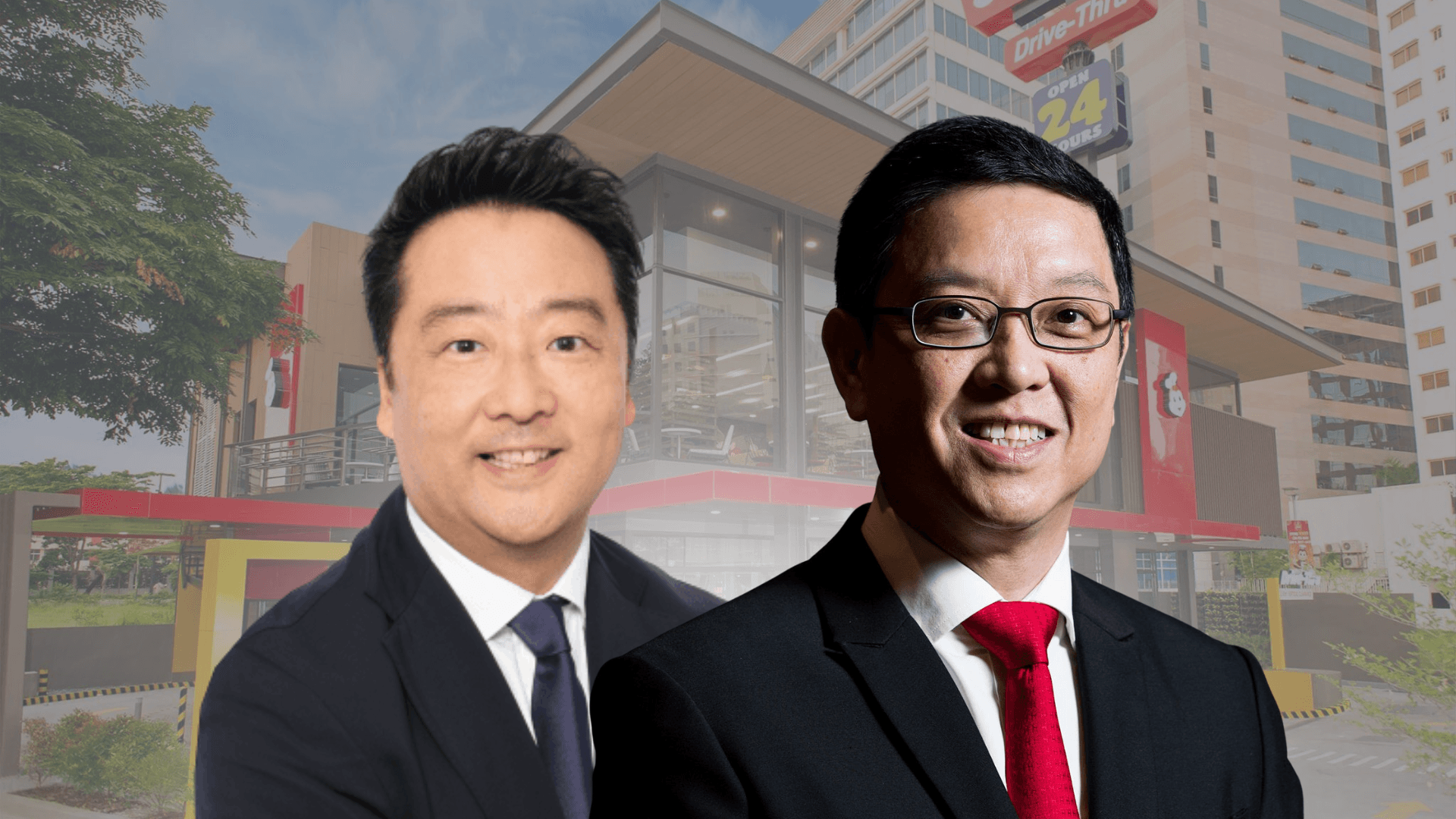

In a disclosure to the Philippine Stock Exchange, Jollibee Group Chief Financial and Risk Officer, Richard Shin said the Jollibee Group plans to open 700-800 stores (gross) across brands and regions.

“We expect to deliver an eight percent to 12 percent growth in system wide sales in 2025, with four percent to six percent growth in same store sales and store network growth of four percent to eight percent. Operating profit growth will be in the range of 10 percent to 15 percent,” he added.

At the end of December 2024, the Jollibee Group’s store network increased by 41.8 percent to 9,766 compared to a year ago: Philippines (3,382) and International (6,384) - 580 in China, 369 in North America, 388 in EMEA, 850 with Highlands Coffee mainly in Vietnam, 1,232 with CBTL, 336 with Milksha and 2,629 with Compose Coffee in South Korea.

JFC said its net income for the fourth quarter declined by 4.8 percent to ₱1.85 billion from ₱1.94 billion mainly due to the Jollibee Group’s share in net losses of certain joint ventures.

Additionally, other income for the quarter decreased by ₱341.1 million primarily due to the mark-to-market gain on financial assets which declined by about 10 times. This decline resulted from the redemption of a significant portion of the investment in bond funds of Jollibee Worldwide Pte. Ltd. to help finance the Compose Coffee acquisition.

Jollibee Group Chief Executive Officer Ernesto Tanmantiong said “The Jollibee Group achieved ₱390.3 billion of system wide sales (SWS), a 13 percent year-over-year (YoY) growth, in line with guidance.”

“I am particularly pleased with the continued consistent execution of the Jollibee brand, which grew SWS by 14 percent globally. The Jollibee Philippine business grew by 11.4 percent driven by a 7.9 percent same store sales growth.

“Jollibee International delivered a 22 percent YoY growth, with strong same store sales growth across markets – Vietnam 16.8 percent, EMEA ex-Vietnam 11.6 percent, North America 8.1 percent, and China (Hong Kong and Macau) 13.2 percent,” he added.

Tanmantiong noted that, “These results demonstrate the strength of the Jollibee brand and how well positioned it is to win with global consumers.”

Jollibeee also made significant progress in executing its strategy for its coffee and tea business. After completing the acquisition of Compose Coffee in August 2024, this segment has become even bigger with over 5,000 stores with about 78 percent of stores franchised.

It opened 361 stores during the year and grew SWS by 37.0 percent, with Compose Coffee contributing 22.6 percent to the growth.

“Our results for 2024 keep us on track to deliver our 2028 ambitions of tripling our Net Income Attributable to Equity Holders of the Parent Company and growing ROIC (return on invested capital) to 20 percent. We head into 2025 with full confidence in our ability to further drive growth and deliver value to our shareholders,” Tanmantiong said.

Jollibee’s consolidated revenues grew by 10.6 percent to ₱269.94 billion last year as system wide sales, a measure of all sales to consumers, both from company owned and franchised stores grew by 13 percent for the entire year of 2024.

Same store sales growth (SSSG) of the Philippine business for 2024 was 7.5 percent from a volume growth of 7.2 percent and a 0.3 percent increase in average check.

The international business grew by 2.8 percent, with Europe, Middle East and other parts of Asia (EMEAA) increasing by 12.8 percent, The Coffee Bean & Tea Leaf (CBTL) by 7.1 percent, Milksha by 5.4 percent, and North America by 3.2 percent. China and Highlands Coffee SSS declined by 11.2 percent and 3.7 percent, respectively.

The Jollibee Group increased its footprint by 41.8 percent to 9,766, with Compose Coffee adding 2,629 stores. A total of 674 stores were opened during the year, partly offset by 348 stores that were closed.

Shin said “The Jollibee Group demonstrated strong performance in 2024, delivering double-digit growth in revenues, operating and net income and improving margins despite challenges in certain regions and categories.

“As anticipated, our China business experienced strong headwinds putting pressures in both top line and bottom line. The performance of our better burger category was also below expectations.”