Marcos grants property tax relief to Independent Power Producers under contracts with GOCCs

President Marcos has authorized the reduction and condonation of real property taxes and penalties on power generation facilities of Independent Power Producers (IPPs) under build-operate-transfer contracts with Government-Owned-or-Controlled Corporations (GOCCs).

Through Executive Order No. 83 dated Feb. 13, all liabilities for real property tax for 2024 , including any special levies accruing to the Special Education Fund on property, machinery, and equipment actually and directly used by IPPs for the production of electricity will be reduced and condoned.

Under the Order, the liabilities will be reduced to an amount equivalent to the tax due if computed based on an assessment level of 15 percent of the fair market value of said property, machinery and equipment depreciated at the rate of two percent per annum, less any amount already paid by the IPPs.

All interests and/or penalties on such real property tax deficiency liabilities will also be condoned and the concerned IPPs will be relieved from payment.

All real property tax payments made by the IPPs over and above the reduced amount shall be applied to their real property tax liabilities for succeeding years.

The Department of Finance (DOF) and various local government units (LGUs) have taken the position that IPPs operating within their territories are not entitled to exemptions and privileges enjoyed by GOCCs, and have threatened enforcement action against IPPs, including the levy and sale of affected properties at public auction.

While IPPs are the taxable entities liable to pay real property tax, a substantial portion of the tax being charged has been contractually assumed by the National Power Corporation (Napocor)/Power Sector Assets and Liabilities Management (PSALM) Corporation under a Build-Operate-Transfer scheme and similar contracts, and therefore carry the full faith and credit of the national government.

It was emphasized that the collection of the tax, which were assessed by concerned LGUs at the maximum assessment level of 80 percent pursuant to Section 218 of RA No. 7160, "will trigger massive direct liabilities on the part of Napocor/PSALM, thereby threatening their financial stability, the government's fiscal consolidation efforts, stability of energy prices, and may even trigger further cross-defaults and significant economic losses across all sectors."

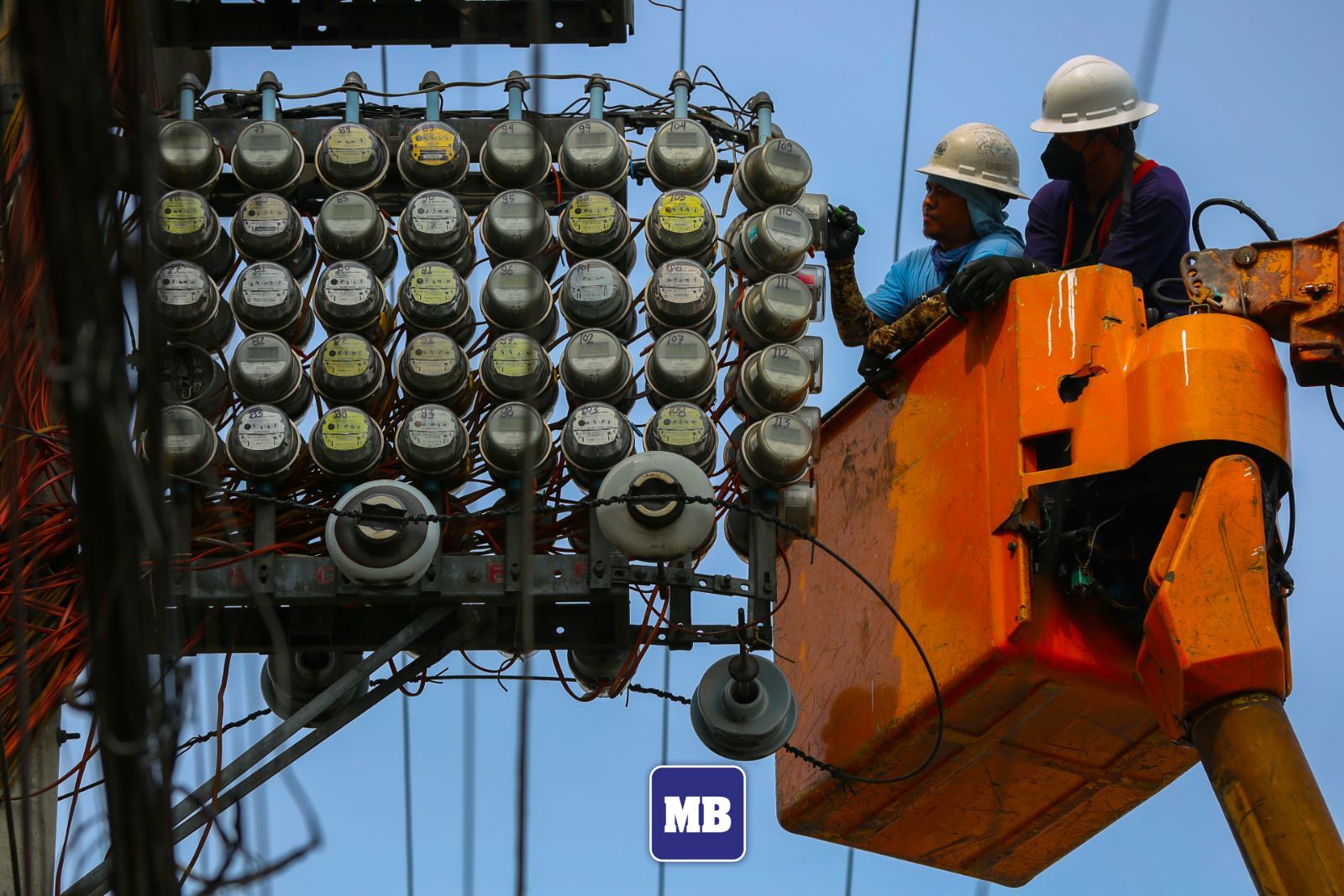

It was also stressed that the affected IPPs provide an estimated grid capacity of 3,100 megawatts. Thus, the closure or non-operation of these IPPs will entail substantial losses to the government and force the public to resort to more costly electric power source alternatives or rotating power outages.