Local stocks snap winning streak as investors await Fed cues

The Philippine benchmark index retreated on Thursday, Dec. 18, as investors locked in gains while awaiting crucial United States (US) inflation data for cues on the Federal Reserve’s interest rate path.

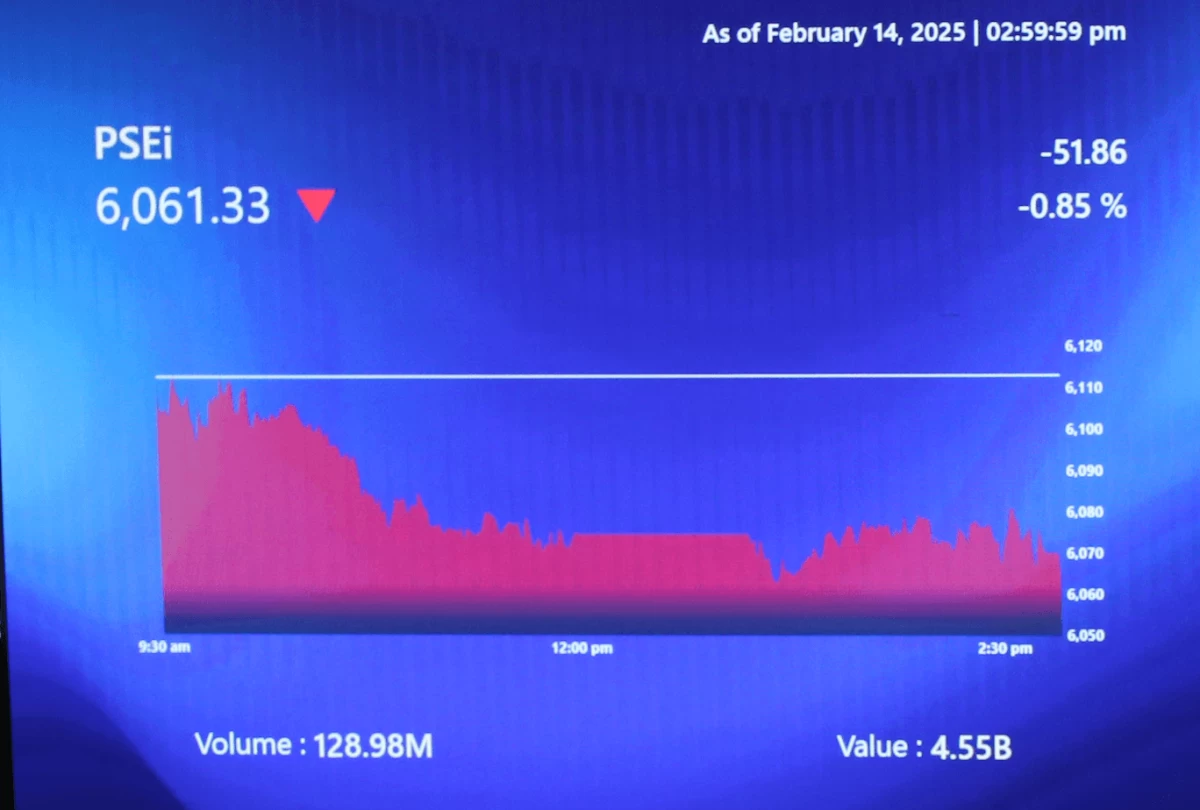

The Philippine Stock Exchange Index dropped 47.54 points, or 0.78 percent, to close at 6,031.48. Property stocks led the decline among sub-sectors. Trading activity saw 1.34 billion shares change hands with a total value of ₱12.81 billion.

Decliners outnumbered advancers 95 to 91, while 66 issues remained unchanged.

Market participants opted for safety following a streak of recent advances and a weak lead from Wall Street, which saw its fourth consecutive day of declines.

Regina Capital Development Corp. Managing Director Luis Limlingan said the local market ended lower as investors engaged in profit-taking despite a stable peso.

He noted that a lack of fresh domestic catalysts kept buying interest muted, resulting in a cautious session.

The pullback tracked overnight losses in US equities, where high-flying technology and artificial intelligence shares faced selling pressure after hitting record highs.

Philstocks Financial Research Manager Japhet Tantiangco said the market is currently bracing for the U.S. November inflation report, which is expected to provide clarity on the Fed's policy outlook.

Rizal Commercial Banking Corp. Chief Economist Michael Ricafort described the dip as a healthy correction.

He noted that the PSEi was ripe for profit-taking after recording gains through most of the previous week.