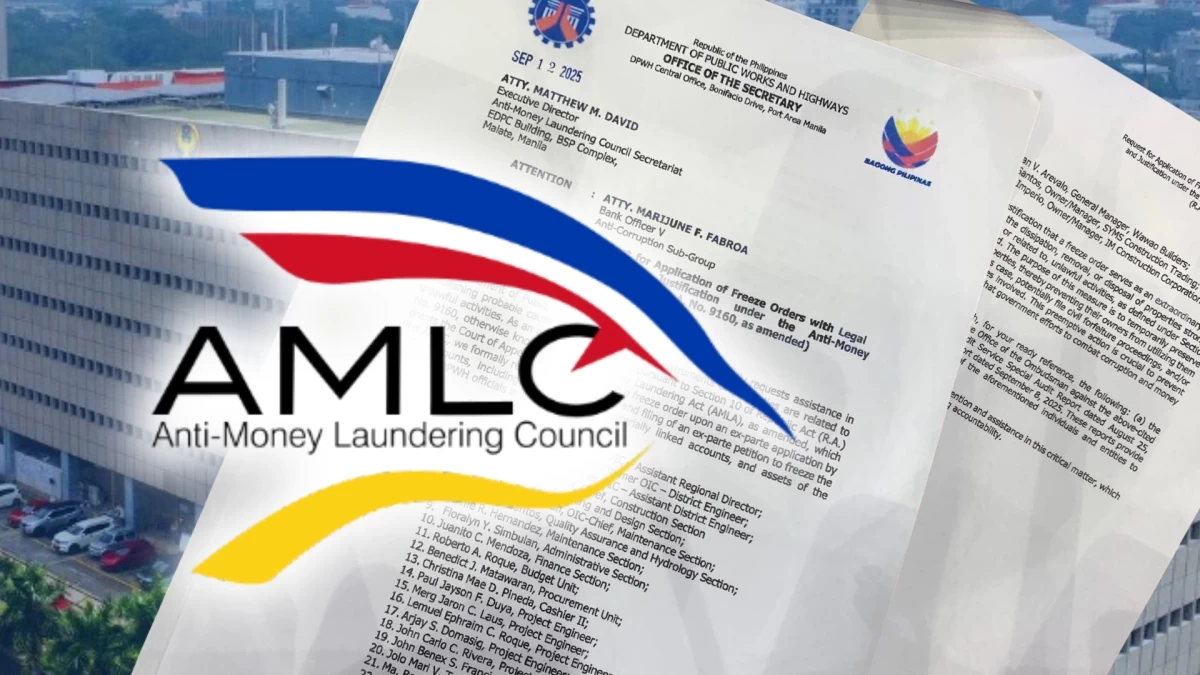

Philippines remains at 'high' risk for money laundering—AMLC

By Derco Rosal

The Philippines remains at “high” risk for money laundering as criminal networks exploit wide range of illicit activities including drug trafficking, fraud, and environmental crimes.

According to the National Risk Assessment released by the Anti-Money Laundering Council on Dec. 15, the threat persists despite intensified government efforts to secure the financial system.

The AMLC noted that criminal schemes are evolving rapidly through the misuse of digital platforms, cryptocurrency-based transfers, and casino junket operators.

Cross-border laundering via offshore entities and remittance networks also remains a primary concern for the financial intelligence unit.

While the inherent threat level is elevated, the interagency body rated the country’s overall vulnerability as “medium.” This assessment reflects what the council described as improved institutional capacity, stronger regulatory frameworks, and more effective coordination among domestic agencies.

Casinos, real estate firms, and virtual asset service providers are among the sectors identified as most vulnerable to illicit flows. These industries are characterized by high cash intensity and varying levels of maturity in their anti-money laundering controls. In contrast, the banking, securities, and trust sectors are deemed to have medium vulnerability, while the insurance industry is rated low to medium-low.

Risks associated with terrorism financing have eased compared to previous assessments, with the overall threat now rated as medium. The AMLC attributed this improvement to sustained security operations and strengthened oversight of non-profit organizations. Nevertheless, the council warned that residual risks persist in conflict-affected areas of Mindanao and through potential misuse of cross-border transfers.

The report also separately assessed proliferation financing, which involves the funding of activities connected to weapons of mass destruction. The country faces a medium risk in this category as low external threats are offset by vulnerabilities in sanctions enforcement and gaps in trade monitoring. The AMLC emphasized that these findings reinforce the need for continued strengthening of compliance measures across the private sector.