COA: Taguig LGU missed revenue projections in 2024 by P2.18-B due to underperforming accounts

The Commission on Audit (COA) reported that the Taguig City government missed its overall revenue projections in 2024 by P2.18 billion or 11.74 percent due to accounts which fell short in collections.

COA issued its annual audit reports for local government units (LGUs) and government agencies for 2024.

In its observations and recommendations for Taguig, COA reported that “the City’s over-all revenue projections for the year was slightly not attained by P2.186 billion or 11.74 percent due to lack of periodic review for some accounts which fell short in collections.”

It said the comparative projected income in the 2024 annual budget of Taguig amounted to P18,613,680,832 but the actual income totaled P16,427,516,947.81, which “showed that the City slightly not attained its revenue targets by P2,186,163,884.19 or 11.74 percent.”

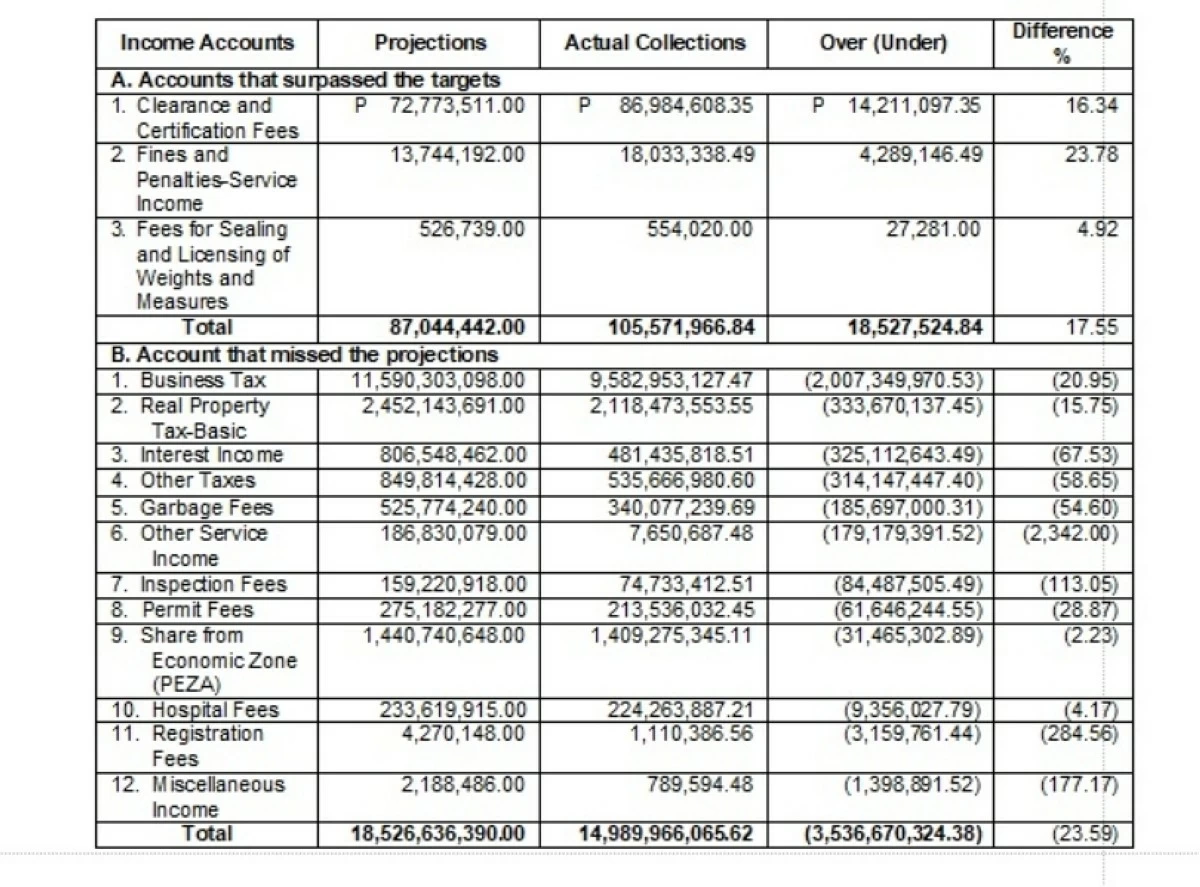

There were three accounts that realized P18,527,524.84 more than the target; 12 accounts missed the projected income by P3,536,670,324.38; and 13 accounts registered P1,331,978,915.35 collections without projections.

The three accounts that surpassed targets for 2024 were clearance and certification fees, fines and penalties-service income, and fees for sealing and licensing of weights and measures

The accounts that missed the targets were business tax, real property tax-basic, interest income, other taxes, garbage fees, other service income, inspection fees, permit fees, share from economic zone (PEZA), hospital fees, registration fees and miscellaneous income.

“Close monitoring on the periodic review of revenue performance during the year could have been missed out, defeating the requirements of Section 316 of RA No. 7160 and Local Budget Circular (LBC) No. 112 dated June 10, 2016, or the Budget Operations Manual for 2016,” the COA report noted.

It added, “The performance level of the targets set at the beginning of the year, could have been reviewed or check, had there been a required Quarterly Report of Income. The situations where projected revenues are not realized or instances where major accounts have no projections, indicate the need to improve the forecasting system of the City.”

“On the other hand, the inability to attain the projected income could result to non-implementation of certain projects which are essential in the delivery of public service or addressing the never-ending demand of public service. Thus, there is a felt need for periodic review of the performance to further improve collection efficiency,” it said.

The COA recommended to the Taguig City government through its Local Finance Committee to “consider a systematic and realistic forecasting of revenue taking into account the prior years’ experience and statistics as aids in setting targets.”

“Require the concerned officials to conduct periodic review of the Quarterly Report of Income to ascertain whether collection targets are attained, to provide assurance of improved finances for the operations of the City,” it said.

According to the COA report, in its response, the Taguig City government “assured that a systematic and realistic revenue forecasting is in place. CTO [Treasury] informed that regular meetings and collaboration with revenue generating Offices and ITO were conducted to improve the module in generating Quarterly Report of Income.”

“It was further informed that for accounts that reported under-collection like in Business Taxes and RPT [real property tax], these are affected with factors and variables beyond Management control like delinquent taxpayers, cessation of business, etc.,” according to the report.

The COA report added that Taguig recorded an increase of P3.075 billion or 18.94 percent in its general fund in 2024.