Yearender: GagaOOLala founder Jay Lin says popularity of BL, GL dramas increased in 2025

Jay Lin, the founder and CEO of GagaOOLala, said the popularity of boys’ love (BL) and girls’ love (GL) dramas has increased in 2025.

“The popularity of both BL and GL dramas has increased significantly in 2025 compared to 2024, confirming they are currently more popular than last year,” Lin told Manila Bulletin.

He added, “This immense growth is highlighted by the explosive surge in GL content, which grew by 750 percent in 2025 and quickly established GL series as a major export item.”

Lin said that “the enduring appeal of BL dramas continues to escalate, building upon their overall 400 percent growth since 2015.”

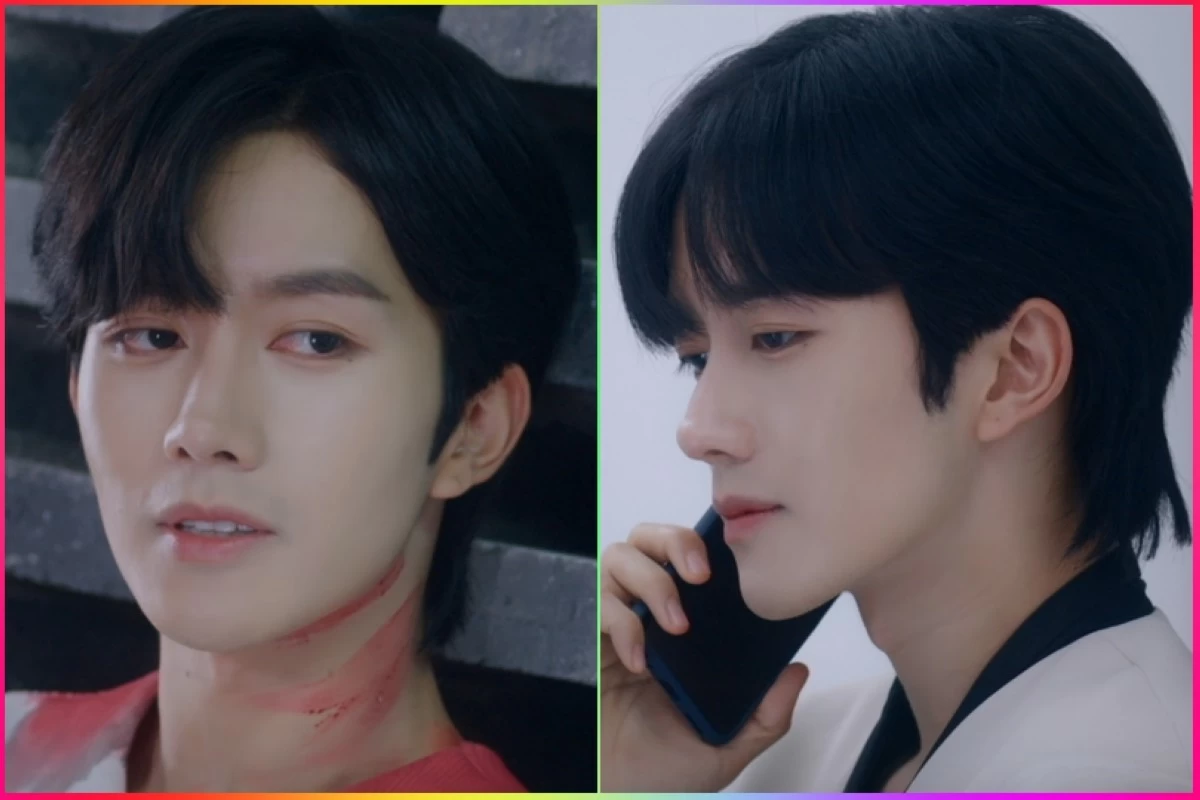

He said in 2025, “the hit drama ‘Revenged Love’ set a new record by claiming the top viewing spot in 93 countries upon release, and the subsequent drama ‘Desire’ demonstrated sustained high demand by showing a 143 percent increase in viewings after only three weeks, proving their continuously expanding influence on the global market and driving GagaOOLala's total membership to over 5 million in 2025.”

GagaOOLala is Asia’s largest LGBTQ+ streaming platform offering global service.

Dominant producer

GagaOOLala sources BL and GL dramas from many markets including Taiwan, Thailand, Japan and South Korea.

Lin says Thailand is currently the No. 1 producer of BL and GL dramas.

“The most aggressive and dominant market in producing BL and GL dramas is unequivocally Thailand, which has elevated the genre to a matter of national strategic importance, backed by government support to boost soft power through audiovisual exports,” he said.

He added, “This strategic emphasis, coupled with immense commercial momentum, has resulted in a market projected to reach 4.9 billion THB (approximately $138 million) by 2025 with an annual growth rate of 17 percent. While GagaOOLala sources high-quality content and crucial IP from markets like Japan, Taiwan, and South Korea each contributing unique localized styles, Thailand's output is characterized by sheer volume and genre diversity, incorporating everything from history to sci-fi, making it the clear global leader in aggressive scale, investment, and overall market dominance.”

Competition

Other streaming and online sites have emerged offering BL and GL dramas, competing with GagaOOLala.

Lin said GagaOOLala continued to grow amid the competition.

“GagaOOLala's success in the competitive streaming landscape stems from a strategic and highly focused niche approach, proudly positioning us as the 'Asian Gay Netflix,' the largest LGBTQ+-focused streaming service operating across nearly 250 regions worldwide. Our strength lies in mastering the 'end-to-end' value chain, resulting in a content library where over 85 percent is exclusive Asian original programming, which is our key differentiator,” he said.

He added, “This highly focused content has driven explosive operational efficiency; notably, the integration of automated digital journeys surged user registration completion by 179%, while viewing retention for our VIP members increased by 137%. Having broken the 5 million member milestone this year, we continue to attract new audiences by strategically expanding into adjacent popular genres like BL and GL, utilizing our data and proprietary content to prove that a niche market can achieve widespread popularity and powerful operational leverage.”

Last August, GagaOOLala hosted the “GOL SUMMIT: Global LGBTQ+, BL & GL Platform Data and Partnership Exchange” at the GIS NTU Convention Center in Taipei.

The summit showcased three major commercial cooperation models, demonstrating the immense growth potential and cross-sector value of original Asian LGBTQ+ content in the global market.

GagaOOLala’s performance in 2025

Lin said GagaOOLala has experienced “exceptionally strong growth across all key metrics in 2025 compared to 2024, driven by technological enhancements and a focused content strategy. We successfully surpassed the 5 million total membership mark this year, supported by 1.8 million Monthly Active Users (MAU), with an internal CEO target to double total membership within the next two years.

“This performance is largely attributable to the automated digital journey tool introduced in 2024, which has significantly propelled our KPIs [key performance indicators]: we've seen a 52 percent growth in paid VIP memberships, a substantial 137 percent increase in content viewing retention, and a staggering 179 percent surge in general user registration completion rates,” he said.

GagaOOLala’s library has “1,600 titles, with our production focus remaining on proprietary and localized content, having released 67 original works and currently hosting 240 Taiwanese titles.”

For GagaOOLala to stay competitive in the OTT market, Lin said “GagaOOLala’s plan to sustain leadership relies on the twin pillars of deepening our Niche Market strategy and maximizing Data and Ecosystem control.”

“We strictly uphold our core brand positioning by focusing on producing top-tier, exclusively Asian original queer content, which successfully shields us from direct competition; crucially, we fully capitalize on the BL/GL content craze to attract wider audiences, such as fujoshi fans, thereby broadening our market share,” he said.

The CEO explained that “our competitiveness is further driven by precise, data-driven decision-making, leveraging AI and analytics to guide our content procurement, marketing, and localization efforts across different territories.”

“Finally, we are committed to building a robust queer content ecosystem supporting creators through GOL STUDIOS and GPS Pitching Sessions and establishing strategic alliances with smaller Asian OTT platforms for global rights distribution, allowing us to promote content, translated into 11 languages, to nearly 250 countries and ensure continued membership growth,’ he said.

Plans in 2026

Lin unveiled GagaOOLala’s plans for 2026, including offering vertical and short-form dramas.

“The strategic plan for 2026 is focused on scaling our global leadership and achieving rapid growth, building directly on the success of recently hitting the 5 million member milestone. Our main goal is clear: we plan to double our membership within the next two years, and we will drive this ambitious expansion by relying heavily on AI data analysis to inform content acquisition, marketing, and user retention strategies across all markets,” he said.

Vertical and short-form dramas will be launched on GagaOOLala in the first quarter of 2026.

Lin said they “are eager to integrate new formats and recognize that vertical and short-form video is a significant industry trend that will greatly enhance audience engagement; therefore, we are targeting a launch focus in the first quarter of 2026 for our new vertical and short-form titles, ensuring we are consistently delivering the most desirable and market-relevant shows for our niche LGBTQ+ audience.”