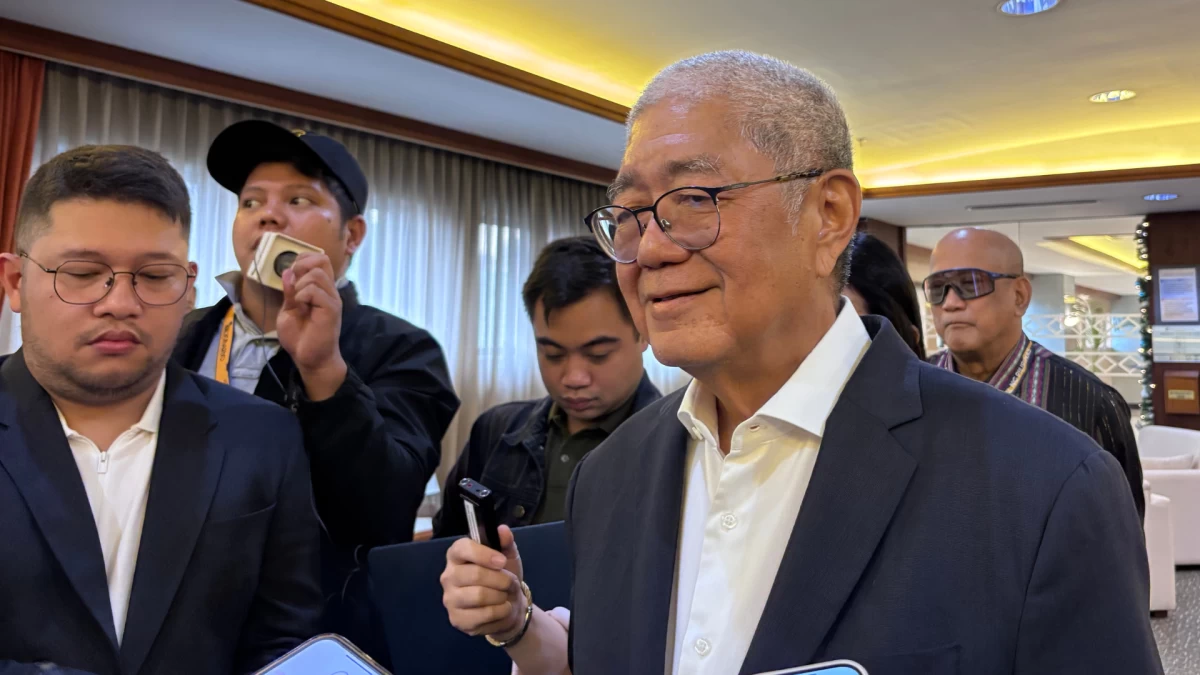

BSP Governor Eli M. Remolona Jr.

The Bangko Sentral ng Pilipinas (BSP) now expects the Philippine economy to expand below five percent this year, citing the erosion of investor confidence stemming from concerns over the governance of the government's flood control fund.

BSP Governor Eli M. Remolona Jr. told reporters on the sidelines of a central bank event on Wednesday, Dec. 3, that the local gross domestic product (GDP) growth could accelerate to four percent to five percent this year.

Growth averaged five percent in the first three quarters of 2025, significantly missing the government’s goal of at least 5.5 percent.

Remolona attributed the expected moderation primarily to a “loss of confidence among investors.” He added that a further drag on growth this year was the government’s tighter spending, part of an effort to review existing and allegedly anomalous flood control projects.

Despite the lackluster economic outlook, Remolona cautioned that it does not assure a reduction in key borrowing costs.

The central bank has already brought the benchmark rate down by a cumulative 1.75 percentage points (ppt), from 6.5 percent before the easing cycle started in August 2024 to the current 4.75 percent.

The government is targeting GDP to expand by 5.5 percent to 6.5 percent this year and six to seven percent next year.

While the near-term outlook is dimmer than at the start of the year, Remolona believes the economy should “begin twisting the throttle” by mid-2026, bringing the expansion pace “back on track” by 2027.

Remolona also maintained that a cut in the Reserve Requirement Ratio (RRR) is on the table, but he suggested it would not provide a major boost to the economy.

“It’s already very low, so a further cut won’t do much. It’s already at five percent, so going from five percent to, say, two percent, isn’t a lot when it comes to the reserve requirement. But still, it might help,” he explained.

He declined to commit to the timing of a plan to bring the ratio for commercial and universal banks to zero because the financial system still has “too much liquidity.”

A further RRR cut, he noted, would add to that. He reiterated that while RRR easing is being considered, it is not urgent given the current five percent level. The timing will depend on the success of monetary authorities in managing systemic liquidity.

Meanwhile, Remolona confirmed that the new Finance Secretary, Frederick Go, will replace Executive Secretary Ralph G. Recto as a member of the powerful Monetary Board (MB).

“I think it’s already decided. Frederick Go will occupy it starting in January,” said Remolona.