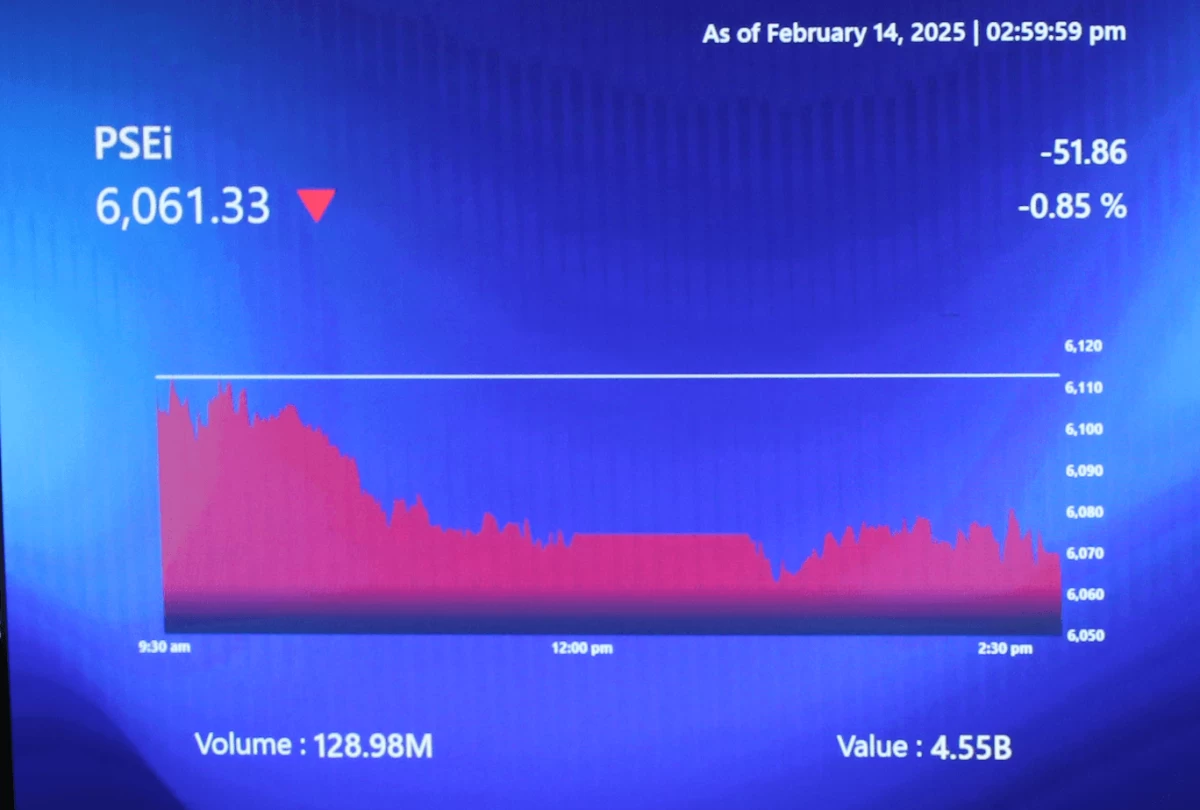

PSEi snaps win streak as manufacturing hits four-year low

The Philippine Stock Exchange Index (PSEi) corrected on Monday, Dec. 1, with investors booking gains after the country’s manufacturing index fell.

The main index dropped 32.95 points, or 0.55 percent, to close at 5,989.29. Conglomerates led the retreat, even as the Services and Mining sectors continued to advance.

Volume improved to 1.14 billion shares valued at ₱6.48 billion. Gainers still narrowly outnumbered losers, with 99 stocks advancing against 97 declining, while 65 remained unchanged.

“The local bourse closed in the red as investors locked in profits ahead of the release of key economic data on Friday,” said Luis Limlingan, Managing Director at Regina Capital Development Corp.

He noted the decline came “despite expectations of softer November inflation, supported by continued rice price deflation, which may give the BSP [Bangko Sentral ng Pilipinas] additional room to consider another rate cut.”

Rizal Commercial Banking Corp. Chief Economist Michael Ricafort attributed the PSEi’s drop to the latest S&P Global Philippines Manufacturing PMI, which declined to 47.4, indicating contraction. This figure is the lowest in more than four years, or since August 2021.

Ricafort noted the drop was “largely due to weather-related disruptions by Typhoon Tino in the first week of November 2025 and Supertyphoon Uwan in the second week of November 2025 that reduced the number of working days, thereby slowing down business activities in hard-hit areas.”