DBP seeks relief extension to recover ₱25-billion Maharlika loss

By Derco Rosal

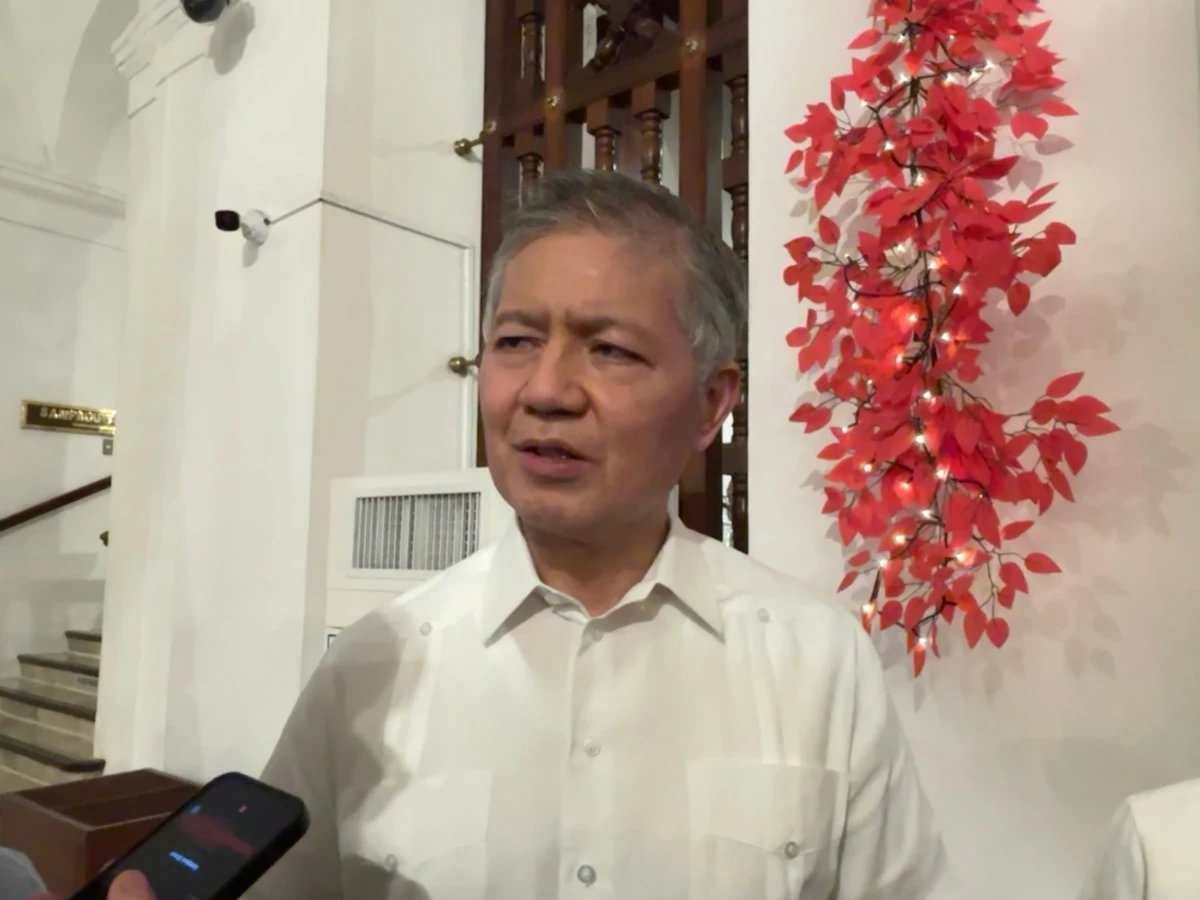

DBP President and Chief Executive Officer Michael O. de Jesus

State-run Development Bank of the Philippines (DBP) will continue to seek regulatory and dividend relief for several more years as it aims to recover the capital it infused into the Maharlika Investment Corp. (MIC).

DBP President and Chief Executive Officer Michael O. de Jesus told reporters last week that the bank, which has enjoyed dividend relief for over six years, plans to seek yearly dividend relief for another five to seven years.

The plan will be evaluated annually, according to De Jesus.

“For the dividend relief, my answer is five to seven years. As for the regulatory relief, let's see — hopefully in about two years, we may no longer need it,” he said.

Former President Rodrigo Duterte first ordered the exemption of government financial institutions (GFIs)—the Land Bank of the Philippines (Landbank) and DBP—from remitting dividends in August 2019.

“We need to strengthen our capital. Right now, our total equity is about ₱97 billion. When I joined three years ago, it was only about P80 billion or so. So we need to build up as a bank, and that's why we're asking for dividend relief,” De Jesus said.

“We also need it so we can recover. Remember, the bank lost ₱25 billion to Maharlika, so we need to rebuild our capital base,” he added.

In 2023, the DBP remitted P25 billion to the Bureau of the Treasury for its investment in the Maharlika Investment Fund (MIF).

As of end-October, government financial institutions (GFIs) had remitted ₱45.3 billion to the Treasury. These include remittances from the Bangko Sentral ng Pilipinas (BSP) at ₱18.9 billion and Landbank at P26 billion.

Overall dividends from all government-controlled and/or -owned corporations (GOCCs) totaled ₱106.5 billion in the first 10 months of the year.

DBP-Leasing Corporation (DBP-LC), the bank’s subsidiary, has remitted ₱111 million in dividends since January.

De Jesus noted that subsidiaries are “managed independently. They have their own board, and they remit directly — not to DBP — they remit directly to the national treasurer.”

Former Finance Secretary Ralph G. Recto earlier reported that GOCCs had remitted ₱177 billion in dividends as of Sept. 12.

Recto had projected the national government could rake in ₱157 billion in dividends from GOCCs by year-end, which would be 13.4 percent larger than the 2024 total of ₱138.5 billion.

GOCC dividends serve as a major source of non-tax revenues for the national government, funding the Marcos Jr. administration's priority programs without imposing new taxes.

Under Republic Act (RA) No. 7656, or the Dividend Law, GOCCs must remit at least 50 percent of their net earnings from the preceding year as dividends to the national government.

The Department of Finance last year requested GOCCs to increase this share to 75 percent to maximize non-tax revenues.